By Shreesh Biradar

India, the world's second-largest sugar producer after Brazil, is seeing a surge in retail sugar prices shot up 40% in the past year, reaching an all-time high of Rs 44 per kg. However, the sugar industry faces challenges such as lower production, high diversion towards ethanol manufacturing, and export quotas. The sugar industry sees cyclical changes every 3 to 4 years, and the current scenario, meant to be a boom period, is not turning out quite as expected as sugar manufacturers are turning cautious. Vivek Sarogi, Managing Director of Balrampur Chinni says,” if El Nino plays out this year, it could impact sugar production and will lead to curtailment of exports”.

The last significant shift for the industry was in 2015-16, when El Nino adversely hit sugarcane regions, leading to a surge in sugar prices and substantial growth in the value of sugar stocks. For instance, stocks like Mawana Sugars and Dwarikesh Sugars rose 7X in 2016. The current year predicts a return of the dreaded El Nino, which may further impact global sugar production. The increased use of sugarcane for ethanol blending has also tightened the commodity supply.

Despite international sugar prices reaching an 11-year high, Indian millers are unable to capitalise on this. But the Indian government’s support price for ethanol and interest subvention schemes for distillery plants have been beneficial for the industry overall.

As global factors like El Nino impact production levels and the government's support measures continue to shape the industry, the sugar sector is at a critical point, navigating the delicate balance of supply, demand, and pricing dynamics.

Sugar production drops in India

India’s sugar production dropped by 8% in the 2022-23 sugar cycle. The decrease was due to unseasonal rains and lower yields across the country. Maharashtra (32%) and Karnataka (17%), which together contribute almost half of India's sugar production, were particularly affected. Maharashtra’s production declined by 13%, and Karnataka’s by 2%. However, the increased production in Uttar Pradesh (32%) partly offset the overall drop.

Sugar consumption has seen a steady increase of 2.6% YoY over the past five years. However, increased exports and diversion towards ethanol blending are limiting the otherwise excess sugar supply.

The current year may be impacted by El Nino, even though the Indian Meteorological Department has predicted normal rainfall, with unseasonal rains interrupting the harvesting season. During the last El Nino event in 2015-16, India reported a 10% decrease in production.

Stable sugarcane FRP provides relief to mill owners

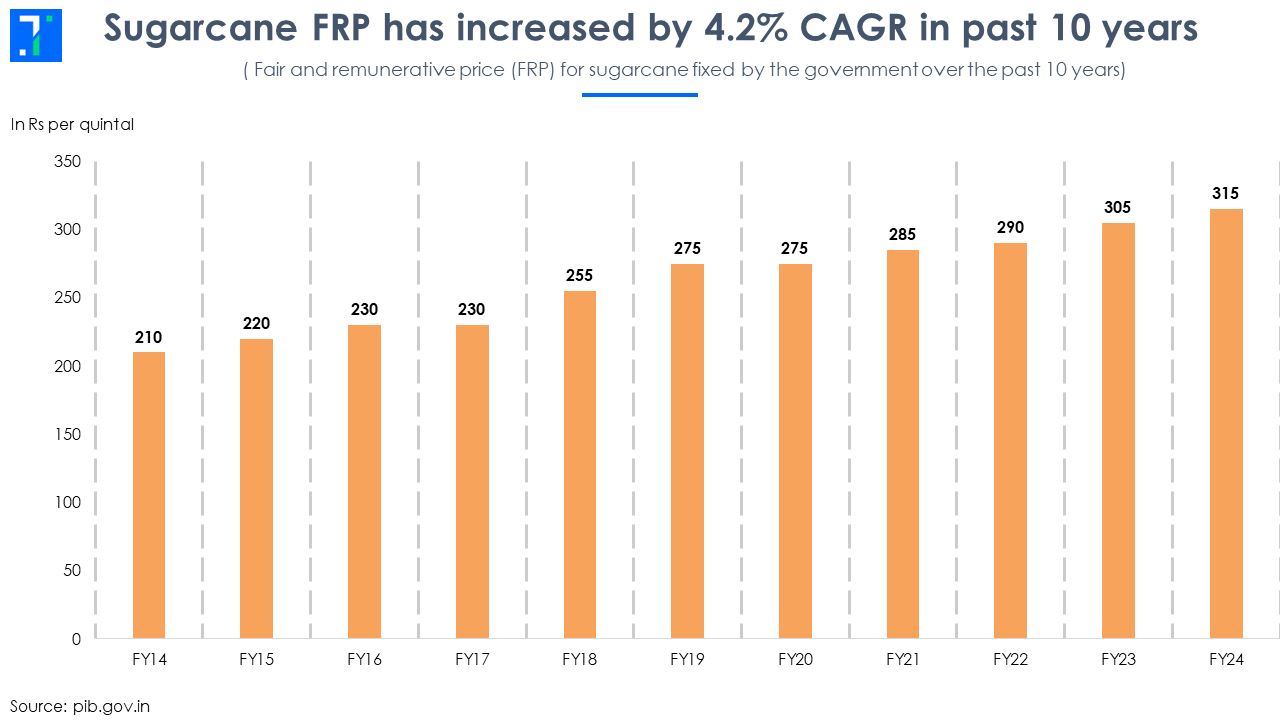

The government’s fair and remunerative price (FRP) of sugarcane for farmers plays a crucial role in deciding the margins of sugar mills. Typically, the government revises the FRP every year to accommodate inflation and the rise in agricultural input costs.

The government tends to increase the FRP by a significant percentage during election years. For instance, in 2018, the government raised the FRP by 10.9%. Such increases are especially influential in states like UP and Maharashtra, which together constitute 23.6% of Lok Sabha seats. However, the current year saw a more modest increase of 3.28% in sugarcane prices, bringing relief to mill owners.

Export restrictions are affecting sugar mills' profits

The government imposes caps on sugar exports to ensure domestic supply and control inflation. In 2021-22 (October-September) cycle, the government initially set the sugar export limit at 100 lakh tonnes. But due to pressure from the sugar mill association and surplus sugar in India, the government allowed mills to ship out 112 lakh tonnes.

The disparity between domestic wholesale and international prices is now above 15%. Restricting the export quota has hit the profitability of sugar mills. Despite having surplus sugar, India has set an export cap of 60 lakh tonnes for the 2022-23 season. The government assumed lower production due to the El Nino effect impacting domestic supply. The current exports have reached 61 lakh tonnes with two more months left in the season.

Even though the government has not yet announced the export quota for the 2023-24 cycle, it's widely believed that it will be initially capped at 40 lakh tonnes, with the possibility of an increase in February 2024. The diversion of more sugarcane to ethanol blending has led to a surge in sugar prices.

Sugar prices surge to multiyear high, millers restricted by quota system

Amid concerns of lower production, higher diversion towards ethanol blending, and increased FRP, millers have raised their prices. Domestic wholesale sugar prices have shot up to a multi-year high. However, the gap between these rates and International prices (which are trading at an 11-year high) is still very high.

Retail prices have skyrocketed to an all-time high as traders sell at higher rates. The wholesale price in July is around Rs 36-37 per kg, while the retail price is hovering in the range of Rs 42-45.

Mill owners are unable to fully capitalize on the high retail prices due to the government’s mill-wise monthly quota system, which it implemented in 2018. This prevents mill owners from selling beyond their quota in the domestic market, limiting their ability to benefit from higher price realisation. For instance, the quota for July 2023 is pegged at 24 lakh tonnes, a 14% YoY increase..

Ethanol emerges as a major revenue source for sugar mills

With the cap on sugar sales, mill owners are now turning to the more lucrative channel of ethanol production.Ethanol blending, an effective method to reduce emissions and make petrol more cost-effective, has gained traction in India through the Ethanol Blending Programme (EBP) introduced in 2003. Since 2016, the ethanol blending percentage has risen steadily, crossing 2% in 2014-15. This initiative helps the government reduce oil imports.

While ethanol can be produced from grains, it is costlier and poses challenges due to erratic availability of grains throughout the year. India, with its sugar surplus, finds it easier and cost-effective to produce ethanol from sugarcane.

In line with that, the government has laid out a road map to achieve 20% ethanol blending by the end of FY25. The ethanol blending percentage by oil manufacturing corporations stands at 11.7% as of June 2023, with a target of 12% by September 2023. The diversion of sugar towards ethanol blending in 2022 reached 40 lakh tonnes, resulting in a savings of Rs 20,000 crore in foreign exchange for the government. The increase in ethanol production has led to higher margins for sugar mills, with ethanol margins surpassing those of sugar by at least 300 bps.

The government initially targeted 15% ethanol blending in the 2023-24 cycle. However, it has recently revised its plans and rolled out a 20% blending program in 11 states. The national average is expected to reach 15% in the 2023-24 cycle, with a portion of the requirement being met by grain-based ethanol due to the insufficient distillery capacity among sugar manufacturers.

Government support boosts ethanol production

The government plays a crucial role in supporting ethanol production through various initiatives. It offers a fixed price for ethanol manufactured from different types of molasses, ensuring stability for distillery owners to assess profitability based on sugar market prices and input sugarcane prices.

To further help ethanol manufacturers, the government provides interest subvention of up to 6% per annum or 50% of the rate of interest charged by banks, whichever is lower, for a tenure of 5 years. This financial assistance has led to increased production of ethanol. Sugarcane-based ethanol production has jumped from 215 crore litres in 2014 to 811 crore litres in 2023.

Thanks to the government’s financial support and fixed ethanol price, many manufacturers are expanding their distillery capacities. For instance, Balrampur Chinni is increasing its distillery capacity by 33% to 23 crore litres per annum. This would help the firm realize 42% of its revenue from the distillery. Dalmia Bharat is also expanding its distillery capacity from 22 crore litres to 32 crore litres by September 2024. The new capacity is expected to contribute 45% of the firm's revenue.

The sugar sector has seen a transformative shift towards ethanol production, supported by the government's initiatives such as fixed ethanol prices and interest subvention. This is creating new opportunities for sugar manufacturers. However, challenges in terms of pricing, export restrictions, and lower production for the upcoming year could stunt the industry’s margins despite the high demand in international markets. As the sector adapts, stakeholders and investors in these stocks have to closely monitor government policies and market dynamics to negotiate and navigate the changing landscape.