By Suhani Adilabadkar

CICI Bank outperformed its top banking quartile peers in Q2FY22 yet again on almost all significant parameters. While the retail loan book continues to push the growth wagon, improved asset quality and lower provisions enthused the street. Analysts maintained their ‘buy’ ratings and increased target prices, retaining ICICI Bank as their top pick from the Indian banking sector.

ICICI Bank’s stock price jumped 11.5% after its September 2021 quarter results were announced. The upsurge was driven by its highest ever quarterly profit, robust retail loan growth, highest ever net interest margin (NIM), strong CASA and robust asset quality in Q2FY22. The second-largest private sector lender touched its new 52-week high of Rs 853 on October 25, 2021.

The bank maintained its top position throughout the pandemic, but in the absence of the third wave and return of competitive intensity, will the motive force smother down or further fire up the growth engine?

Quick Takes:

-

Decline in cost of funds and lower interest reversals aided net interest margin (NIM) expansion in Q2FY22

-

About 32% of mortgage sanctions and 40% of personal loan disbursements, by volume, were end-to-end through the digital channel in H1FY22

-

According to the management, there is low capital expenditure (capex) demand from the private sector, while PSU/government companies are seeing strong capex traction

-

ICICI Bank management also expects credit costs to improve to 1.25% from the present 1.4% levels in Q2FY22 in the absence of a third wave

-

The management will take the decision to unwind Covid-19 provisions of Rs 6,425 crore by the end of FY22

ICICI Bank’s strong show continues in September 2021 quarter

ICICI Bank reported a net interest income (NII) of Rs 11,690 crore in Q2FY22 compared to Rs 9,366 crore in Q2FY21, a rise of 25% YoY. Robust NII growth was driven by strong loan book growth (up 17.2% YoY) and healthy net interest margin (NIM) expansion. NIM was at 4% in the September 2021 quarter, expanding 43 basis points (bps) YoY and 11 bps sequentially. Sequential NIM expansion was aided by a decline in cost of funds and lower interest reversals. Cost of funds fell 12 bps QoQ in Q2FY22.

Provisions & contingencies at Rs 2,713 crore fell 9% YoY (and 5% sequentially) in Q2FY22. Aided by lower provisions and higher NII growth, ICICI Bank reported its highest ever quarterly net profit of Rs 5,511 crore, rising 30% YoY. Growth in deposits (Rs 9.8 lakh crore) continued to be strong at 17.3% YoY as on September 30, 2021, driven by 12.5% YoY growth in term deposits. Average CASA ratio was at 44.1% in Q2FY22 vs 40.3% YoY, a year ago. Loan book growth also moved in tandem with deposit growth of 17.2% YoY at Rs 7.6 lakh crore in the September 2021 quarter supported by retail, SME and business banking portfolios.

ICICI Bank outpaces peers with its strong operational performance

ICICI Bank outpaces peers with its strong operational performance

ICICI Bank’s stock price doubled over the past one year. The bank took the pandemic on, gaining market share by spearheading its retail loan book growth through competitive pricing, a simplified credit delivery process, and leveraging its robust digital platforms. Close peers, HDFC Bank and Kotak Mahindra Bank, implemented a cautious strategy, and reined-in retail loan book growth to tackle the uncertainty due to the pandemic. Both banking heavyweights did not impress the street with their asset quality parameters in FY21. Axis Bank surprisingly put up a better show. Of course, it didn’t outpace HDFC bank and ICICI Bank, but Axis Bank’s loan book growth was on better footing compared to Kotak Mahindra Bank in FY21. Axis Bank’s stock is up 50% over the past 12 months. HDFC Bank and Kotak Mahindra Bank’s stocks gained roughly 30% over the past year.

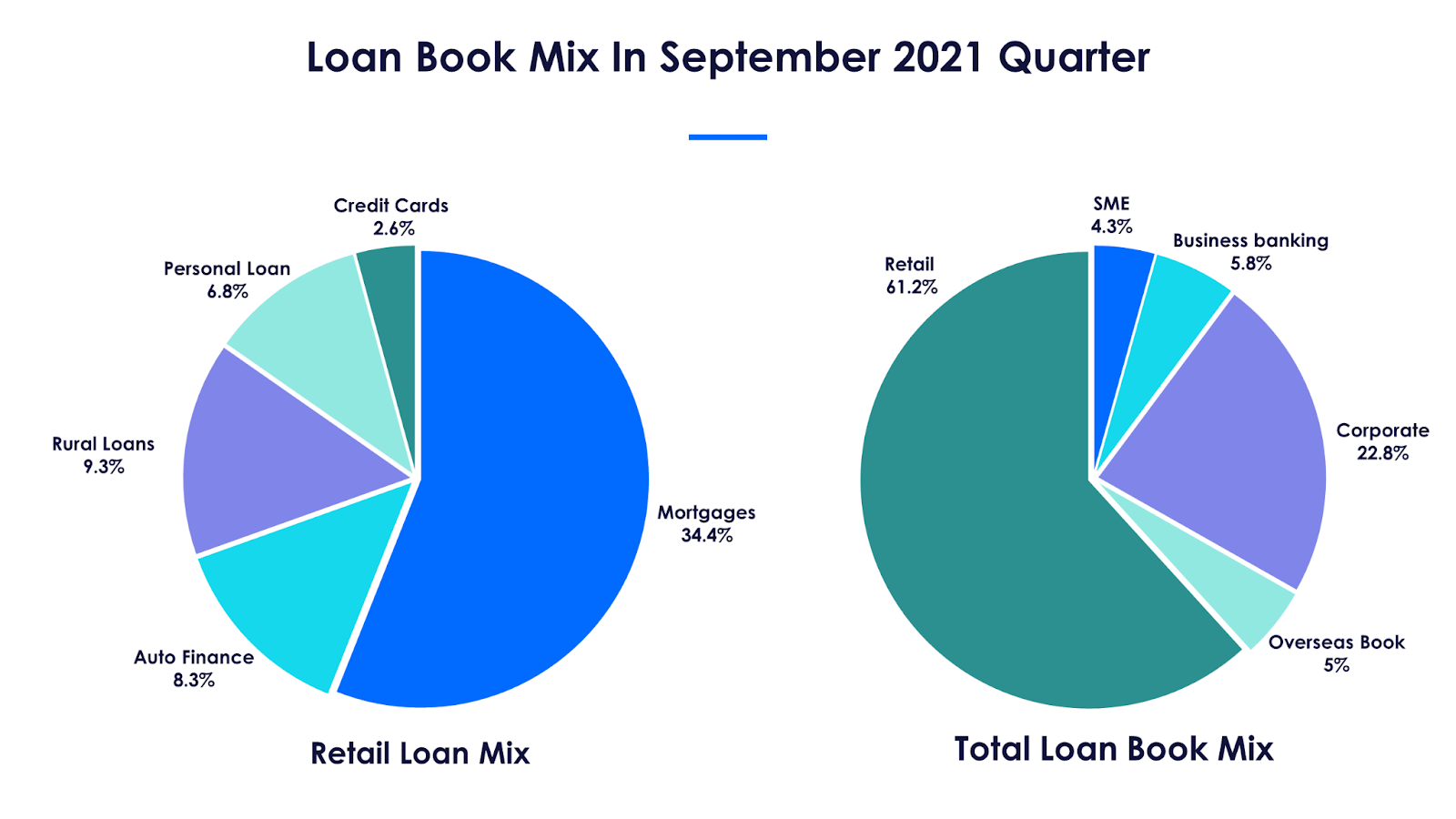

Analysts are gung-ho on ICICI Bank and it's their favourite pick from the Indian banking sector. The second-largest private sector lender surprised the street with its strong operational performance in Q2FY22, setting itself apart from its peer group. The bank reported NII growth of 25% YoY, a seven-quarter high in Q2FY22 - this was the highest among the top banking quartile, driven mainly by a high yield retail loan book which constitutes 61.2% of the total loan book. In addition to retail loans, loans earning a higher yield also include business banking and SME segments, which together constitute 10% of the total loan book and grew by more than 40% YoY in Q2FY22.

The bank reported its highest ever quarterly NIMs in the September 2021 quarter at 4%. High yield retail, business banking and SME business and low cost of funds at 3.53%, the lowest among the private sector peers, supported NIM expansion in Q2FY22. Speaking on NIM growth, Rakesh Jha, CFO at ICICI Bank said that in addition to lower cost of funds, lower NPL additions also helped NIM growth in the September 2021 quarter. Going forward, there would be many moving parts linked to the NIM equation, namely competitive intensity, repo rate movement and external benchmark linked loan book, said Jha.

Another significant operational parameter, the cost to income ratio at 39.9% improved 50 bps sequentially in Q2FY22. Cost to income ratio (operating expenses/operating income) indicates the efficiency at which the bank is run and the lower the ratio, the higher is the profitability for the bank. The cost to income ratio is trending lower for the past two quarters. According to the management, as economic activity picks up, the cost to income ratio might go up in the near term as the main focus is on increasing core operating profit.

Another significant operational parameter, the cost to income ratio at 39.9% improved 50 bps sequentially in Q2FY22. Cost to income ratio (operating expenses/operating income) indicates the efficiency at which the bank is run and the lower the ratio, the higher is the profitability for the bank. The cost to income ratio is trending lower for the past two quarters. According to the management, as economic activity picks up, the cost to income ratio might go up in the near term as the main focus is on increasing core operating profit.

While Kotak Mahindra Bank and Axis Bank reported negative YoY growth in pre-provision operating profit in Q2FY22, HDFC bank grew by 17% YoY. ICICI Bank topped the table with a 20% growth in pre-provision operating profit at Rs 9,915 crore in September 2021 quarter despite a 28% rise in operating expenses (employee and non-employee expenses).

While Kotak Mahindra Bank and Axis Bank reported negative YoY growth in pre-provision operating profit in Q2FY22, HDFC bank grew by 17% YoY. ICICI Bank topped the table with a 20% growth in pre-provision operating profit at Rs 9,915 crore in September 2021 quarter despite a 28% rise in operating expenses (employee and non-employee expenses).

While employee expenses jumped 21% YoY, non-employee expenses increased by 32% YoY. As the economy picks up, the bank is moving aggressively with increased spending on non-employee expenses related to retail business, technology, distribution and brand building. Speaking on non-employee costs, Jha said, “All of these costs, we believe are productive good costs undertaken to improve and increase our core operating profit.” He further added that the bank sees these expenses moving at the current run-rate of 20% in the near term.

Will retail loan growth momentum be sustainable?

ICICI Bank’s retail loan growth came in at 20% YoY driven by home loans, credit cards, personal and rural loans in Q2FY22. With the increase in economic activity, disbursements across all retail products increased sequentially in the September 2021 quarter.

According to the management, mortgage disbursements grew on the back of pre-approved offers, digitisation, and seamless customer onboarding experience. Disbursements of personal loans and auto loans were also close to Q4FY21 levels. Credit cards in force increased by 6% sequentially and credit card spends grew by 47% sequentially.

ICICI Bank maintained a retail loan growth run rate of 20% over the past three quarters. In H2FY22, retail loan book momentum might taper off with a rising base and stiff competition from peers.

With a low probability of a third wave, banks are all out on the retail loan track. Market leader HDFC Bank is back with a vengeance to recover its lost market share in credit cards. HDFC bank issued more than 4 lakh credit cards in the last five weeks of Q2FY22 after the RBI ban was lifted in August 2021. ICICI Bank added 7 lakh in the three months of the September 2021 quarter.

HDFC Bank through its festive campaign, announced over 10,000 offers on credit cards, personal loans, car loans and EMIs. ICICI Bank’s mortgage segment, which constitutes 34.4% of total loan book, will also face tough competition as competitors are offering lucrative loan packages. Kotak Mahindra Bank slashed its home loan rates to a decade low at 6.5%, lowest in the industry while Axis Bank offers a waiver of 12 EMIs on select home loan products heating up the home loan competition. ICICI Bank offers home loans at 6.7%.

Asset quality surprise leaves the street enthused

The markets expected the retail loan growth to continue its double-digit growth in Q2FY22, but improvement in asset quality both sequentially and YoY came as a positive surprise. Gross NPA ratio (percentage of gross NPAs to gross advances) and Net NPA ratio (percentage of net NPAs to net advances) came in at 4.82% and 0.99% and improved 54 and 13 basis points (bps) QoQ respectively in Q2FY22 mainly due to higher upgrades, recoveries and lower slippages. And also improved 33 bps and 17 bps respectively YoY. ICICI bank NPA ratios improved considerably in the September 2021 quarter compared to other top three banks and the management expects NPA ratios to improve further in H2FY22.

ICICI bank’s provision coverage ratio (PCR) at 80.1% is also the best in the industry. In addition to high PCR, the bank holds Rs 6,425 crore Covid -19 provisions, which is about 0.8% of loans. Slippages or fresh accretion of NPAs declined sequentially from Rs 7,231 crore in Q1FY22 to Rs 5,578 crore in Q2FY22. The management expects slippages to moderate further in H2FY22.

While all parameters seem to be improving, analysts are keenly watching the restructured loan portfolio, which rose to 1.3% of total loans (Rs 9,684 crore) in the September 2021 quarter compared to 0.7% (Rs 4,864 crore) in Q1FY22. The bank maintains 20% provision on these restructured loans. According to the management, there might be further additions to the restructured loan portfolio in Q3FY22, but lower than Rs 1,000 crore.