By Ketan Sonalkar

The Covid-19 pandemic brought the healthcare sector into focus in FY21. From pharmaceutical companies, hospital chains and diagnostic companies, each is playing a role since the pandemic broke out in fighting the virus.

Diagnostics which include routine tests like blood tests as well as specialised tests to detect specific ailments of the liver, kidney, cancer, etc, play a pivotal role in the healthcare system, which brings us to a diagnostic company that has strengthened its core business in FY21.

Metropolis Healthcare is a dominant player in western India in the diagnostics space. The company listed on the Indian stock exchanges in April 2019 and the stock had delivered 3X returns by the end of June 2021.

Quick Takes

-

Annual revenue YoY grew by 16.7% in FY21 at Rs 1,010 crore

-

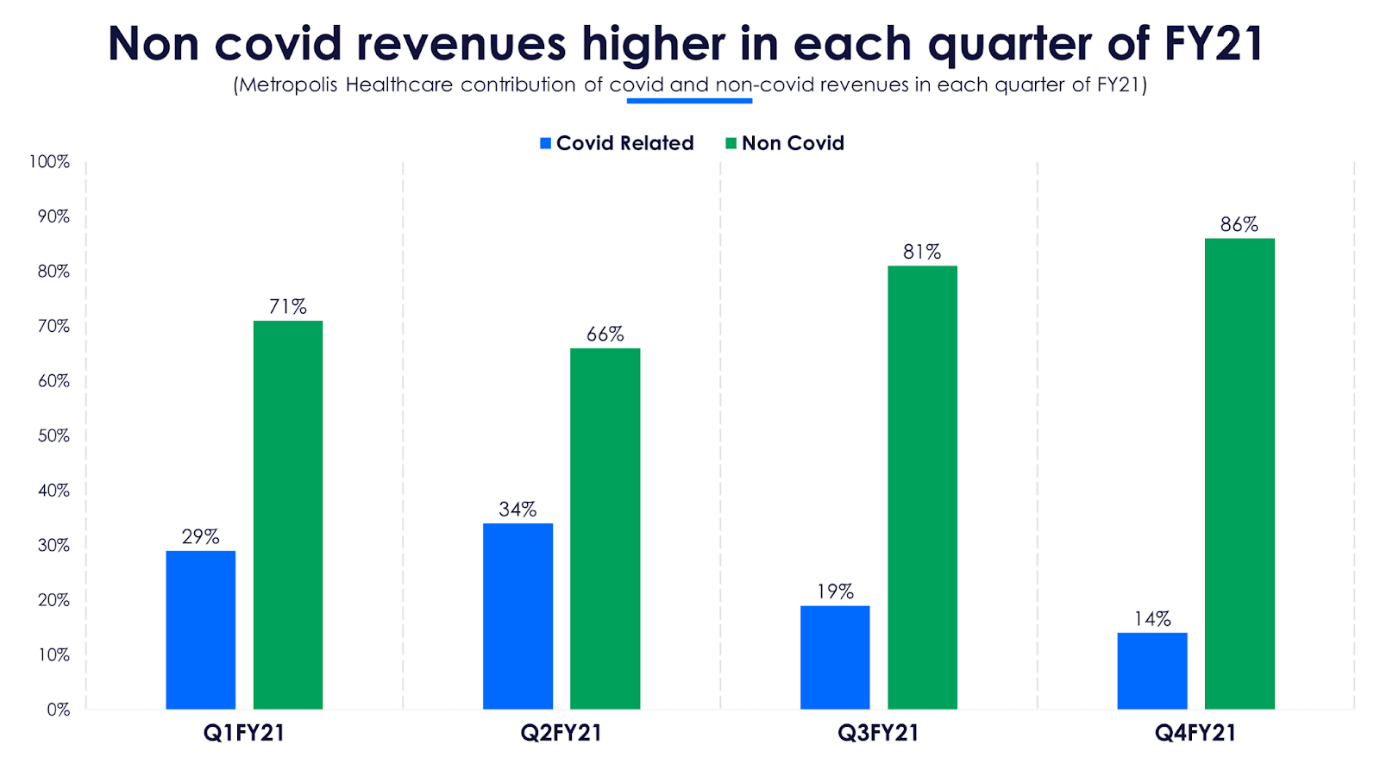

Non Covid related tests generated higher revenue in every quarter of FY21

-

Home visits and digital strategy will be the growth drivers going forward

-

Acquisition will be a key strategy for the company to enter new regions and overtake competition

A challenging year ends on a high note

FY21 was a tumultuous year for Metropolis Healthcare, with its active in the fight against Covid-19 as well as servicing customers for regular and specialised pathological tests. Despite each quarter seeing unique challenges, the company ended FY21 on a strong note with net profit YoY growth of 4X in Q4FY21.

With the onset of the pandemic in Q1FY21, there was a surge in demand for testing of Covid-19. The rapid antigen and RT-PCR tests for Covid19 detection were carried out on a massive scale across the country, and diagnostic companies faced unprecedented demand in these tests alongside a drop in the number of routine and speciality tests. Metropolis Healthcare was one of the first in the diagnostics industry to be approved by the government for Covid testing. After a subdued Q1FY21, Metropolis Healthcare saw both Covid-19 as well as other tests, like the routine blood tests, specialized tests for specific ailments of the kidney, liver, etc generate higher revenues and profits from Q2FY21 onwards.

While Covid-19 testing revenues contributed significantly to the revenues of the first two quarters of FY21, its contribution fell in the last two quarters, despite the increase in number of tests. This was due to capping of prices of Covid-19 tests by the government. Metropolis Healthcare’s revenues grew 40% YoY in Q4FY21 to Rs 293.8 crore, and net profits quadrupled to Rs 61.3 crore.

Western India predominantly drives Metropolis Healthcare’s business, contributing more than half of annual revenues. Metropolis Healthcare’s growth strategy is driven by acquisition of laboratories. During its expansion journey it acquired individual laboratories like Sudharma Labs in Kerala and Sanjeevani in Rajkot, and consolidated them within the Metropolis brand.

Different tests contribute in varying proportions with respect to volume and margins. Routine tests like blood, lipid profile and corporate wellness tests account for the highest volumes while specialised tests, such as tests for cancer detection, and those specific to cardiac, prostrate, liver, etc, contribute more than half of the revenues. The specialised testing revenue contribution grew 19% from FY20, including Covid-19 related as well as non Covid-19 specialised tests. The management will focus on specialised tests going forward to improve margins.

Metropolis Healthcare’s own collection centres have remained limited, in the range of 225-260 centres over the past five years. As a cost optimization measure, most of their own centres are leased spaces.This is part of a strategy to have minimal infrastructure for sample collection and this activity is outsourced to the third-party collection centres. The number of third party PSCs (patient service centres) have increased 6X in the past six years. As part of a rationalisation exercise in FY21, the management decided to reduce non-productive collection centres.

According to management, the target is to add 90 labs and 1,800 service centres over the next 3 years and strengthen its position in existing geographies and expand into new geographies.

Home visits and digital strategy are key growth drivers

Home visits for sample collection played an important role in the growth of business in FY21. The revenue from home visit collections doubled in FY21. Out of Rs 136 crore from the home visit service, Covid-19 related testing revenue was Rs 56 crore and non-Covid-19 revenue was Rs 80 crore. Currently home visit services are available in 60 cities. The company plans to expand this service to 100 more locations in FY22.

A driver of the home visit service is the digital engagement with customers. Enhanced digital strategy caused exponential increase in website traffic and higher booking of appointments. The management also sees digital bookings as an entry point to penetrate tier-2 and tier-3 cities, whereby online bookings for home visits would reduce the need for collection centres. These cities can be serviced without the presence of a lab within that city, as the samples collected at home can be taken to the nearest city with lab infrastructure.

Metropolis Healthcare along with its competition, Dr Lal Path Labs and Thyrocare, are beneficiaries of the growing trend of diagnostic services being consolidated under brands. The structure of city based individual labs is growing outdated due to digital accessibility for customers and a consolidated network that offers customers a much wider range of tests at a more competitive price. The competition is between these established players to expand their footprint by acquiring smaller diagnostic labs.

Apart from established players, growing interest in this sector is drawing other players in the healthcare sector. Reliance Industries recently acquired online pharmacy platform NetMeds. The largest deal in this space is the buyout of Thyrocare by PharmEasy, an online pharmacy, with promoter Dr Velumani and his family selling their stake to API Holdings, the holding company of PharmEasy. The deal is expected to expand PharmEasy’s presence in the diagnostic space, with digital addition of customers and leverage the pan-India network and centralised laboratories of Thyrocare.

Consolidation and competition from online pharmacies in this sector is something that Metropolis Healthcare will have to contend with in the future. Customer acquisition through digital channels is another factor that will determine the success of diagnostic networks.

There is also buzz that Mumbai-based Suburban Diagnostics might be up for grabs, with Metropolis Healthcare and Dr Lal Path Labs eyeing an acquisition. Some PE (private equity) players have also put in their bids for Suburban Diagnostics. If Metropolis Healthcare is successful in its bid, it will further strengthen its presence in the Mumbai region.

Metropolis Healthcare’s growth strategy is driven by acquisitions. In the past 16 years, the company made a total of 23 acquisitions. Currently the deal with Hitech Labs is awaiting completion. Though Covid-19 testing was a big contributor to revenues in FY21, the percentage contribution is declining since the last two quarters with Q4FY21 contribution at 14% of total revenues. As the demand for Covid-19 testing is likely to reduce in the coming quarters, Metropolis Healthcare is focusing on higher margin specialised tests, which would help it grow its core diagnostics business.

Metropolis Healthcare, currently a runner up, has the potential to become a market leader with an aggressive acquisition strategy going forward. This will become an important lever alongside organic growth, and moves in this sector will be something investors should keep their eye on.