As the country gears up for a gradual unlock, stock markets have been testing record highs. Amid this frenzy, many companies are launching initial public offerings (IPO). One among them is Krishna Institute of Medical Sciences (or KIMS). KIMS’ IPO opens on June 16, the same day as Dodla Dairy.

KIMS is a healthcare provider with operations focussed on Telangana and Andhra Pradesh. It specializes in specialty healthcare services like cardiac operations and pediatrics. KIMS provides a diversified but richly valued play for investors looking at private healthcare.

General Atlantic to sell half its stake

KIMS’ promoters are members of the Bollineni family - Bhaskara Bollineni, Rajyasri Bollineni, Abhinay Bollineni, and Adwik Bollineni, and the family-owned company Bollineni Ramanaiah Memorial Hospitals. Post the IPO, the promoters will hold 55.3% stake in the company. Currently, promoters hold a 42.2% stake, and the private equity (PE) firm General Atlantic holds 40.9%. The PE firm invested $130 million (Rs 960 crore) in KIMS in 2018.

The healthcare company’s IPO is worth up to Rs 2,144 crore, divided between a fresh issue of 24 lakh shares of up to Rs 200 crore and an offer for sale (OFS) of 2.3 crore shares by the promoters and General Atlantic up to Rs 1,944 crore. Ahead of the IPO on June 15, KIMS raised Rs 944 crore (44% of the issue) from 43 anchor investors. The IPO price band is Rs 815-825 per share. Post the issue at the upper end of the price band, KIMS will be valued at Rs 6,500 crore.

Through the OFS, General Atlantic will reduce its stake in the company to 27.9% from 40.9%. It will sell its shares at a 2.6x profit of Rs 824 crore.

Through the OFS, General Atlantic will reduce its stake in the company to 27.9% from 40.9%. It will sell its shares at a 2.6x profit of Rs 824 crore.

From the proceeds of the fresh issue of Rs 200 crore, 75% or Rs 150 crore will be used to repay loans taken by the company and its wholly-owned subsidiaries. Taking the upper end of the Rs 825 price band, KIMS is valued at 4.8 times its FY21 revenue. This is high in the healthcare facilities industry with only Max Healthcare Institute trading at a higher price-to-sales ratio.

Diversified specialty services healthcare provider

Diversified specialty services healthcare provider

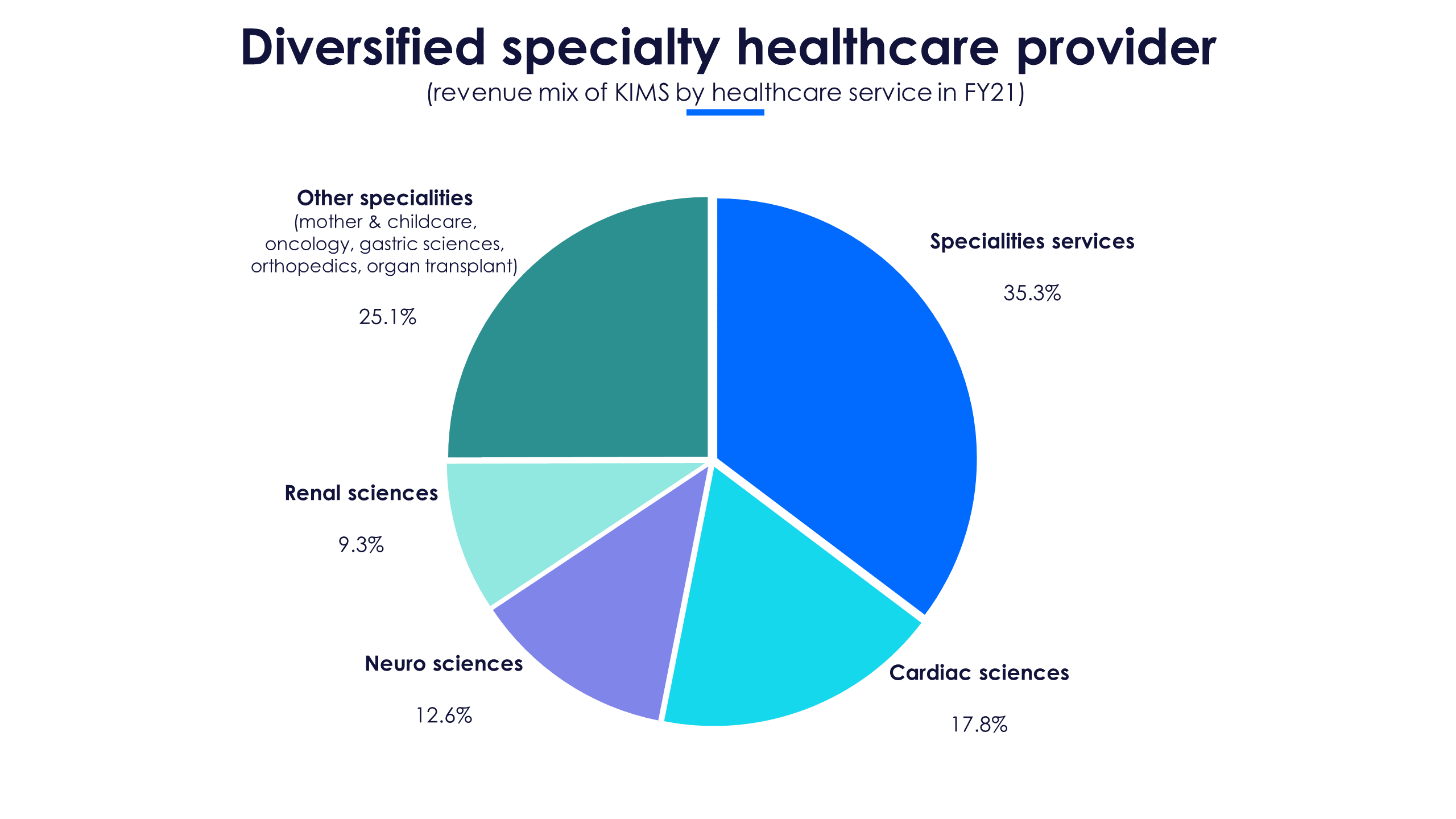

KIMS is a healthcare provider, operating nine multi-specialty hospitals in Telangana and Andhra Pradesh. In addition to this, it has four wholly-owned subsidiary hospitals and two medical sciences institutes. KIMS offers a broad range of specialty healthcare services including cardiac sciences, oncology, neurosciences, gastric sciences, and orthopedics.

KIMS’ revenue largely comes from specialty services which include treatment for dermatology and cosmetology, endocrinology & diabetes, pediatrics, ear, nose, and throat (ENT) treatment, gastroenterology, etc. This constitutes 35% of its revenue mix. Competitors like Apollo Hospitals Enterprises and Fortis Healthcare generate 40-45% of revenues from these services as well. Other healthcare service providers’ revenue comes from specific healthcare services. For instance, 41% of Narayana Hrudayalaya’s FY20 revenues came from cardiac services and 51% of Shalby’s revenues came from orthopedics.

KIMS’ revenue largely comes from specialty services which include treatment for dermatology and cosmetology, endocrinology & diabetes, pediatrics, ear, nose, and throat (ENT) treatment, gastroenterology, etc. This constitutes 35% of its revenue mix. Competitors like Apollo Hospitals Enterprises and Fortis Healthcare generate 40-45% of revenues from these services as well. Other healthcare service providers’ revenue comes from specific healthcare services. For instance, 41% of Narayana Hrudayalaya’s FY20 revenues came from cardiac services and 51% of Shalby’s revenues came from orthopedics.

Healthcare services revenues form 67% of annual revenue and pharmaceuticals sales form 33%. Revenues from both verticals steadily rose from FY19-21.

Profits recover in FY20 and FY21

Profits recover in FY20 and FY21

In FY21, revenues were Rs 1,330 crore, a growth of 18% against the previous year. This revenue growth was because of a 21% rise in income from hospital services, and a 15% growth in sales of pharmaceuticals. Net profits were higher by 70% at Rs 205 crore in FY21 due to an 18% fall in interest expenses during the year.

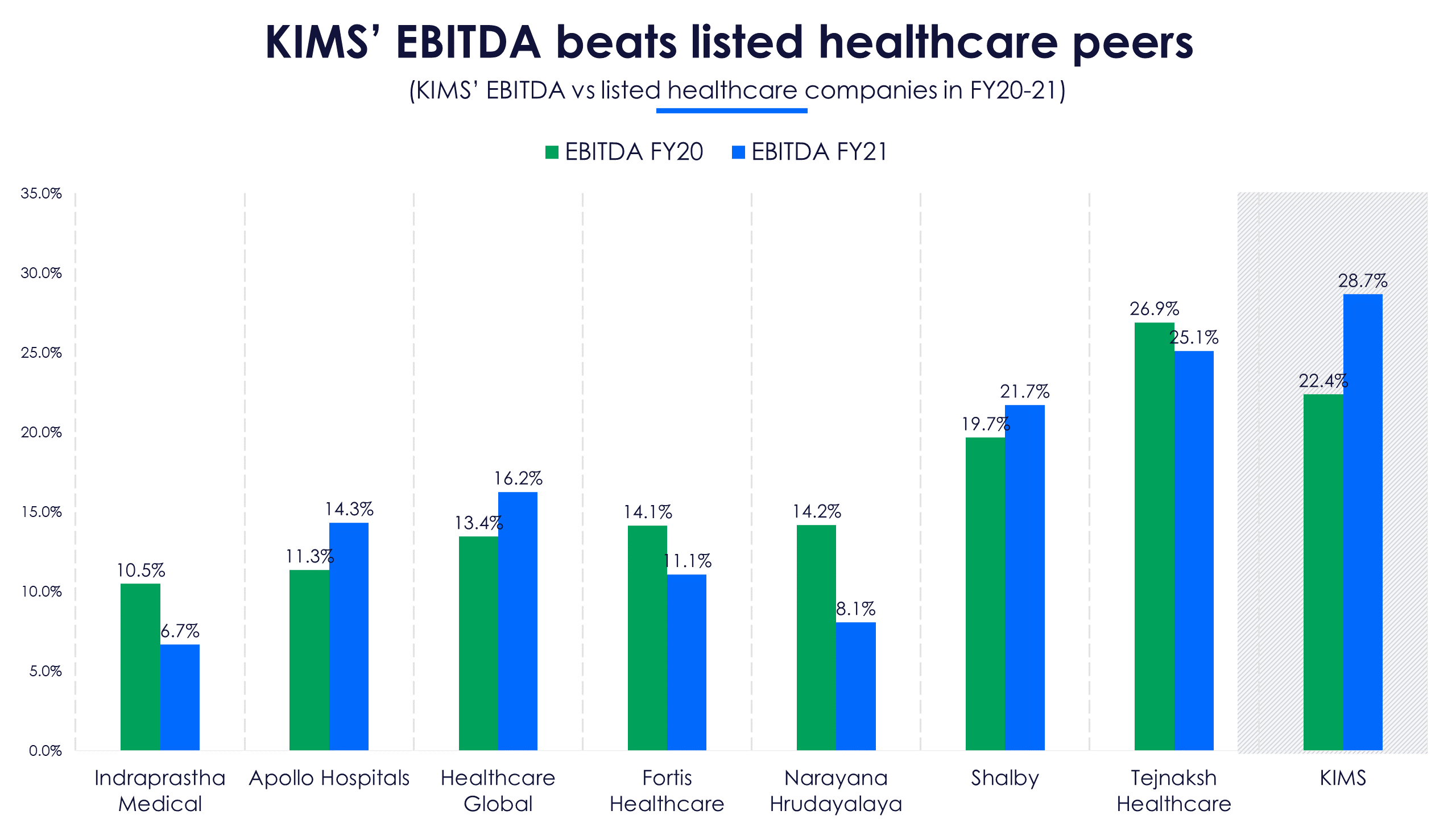

KIMS’ EBITDA margins in FY21 were 28.7%, a 6.3 percentage points increase from the previous year. KIMS’ margins are ahead of its multi-specialty healthcare peers like Fortis Healthcare and Apollo Hospitals Enterprises.

KIMS’ EBITDA margins in FY21 were 28.7%, a 6.3 percentage points increase from the previous year. KIMS’ margins are ahead of its multi-specialty healthcare peers like Fortis Healthcare and Apollo Hospitals Enterprises.

The company’s return-on-equity (RoE) in FY21 was 23.3%, which is higher than its listed peers in the healthcare facilities industry.

Cash flows grow and debt declines in FY21

Cash flows grow and debt declines in FY21

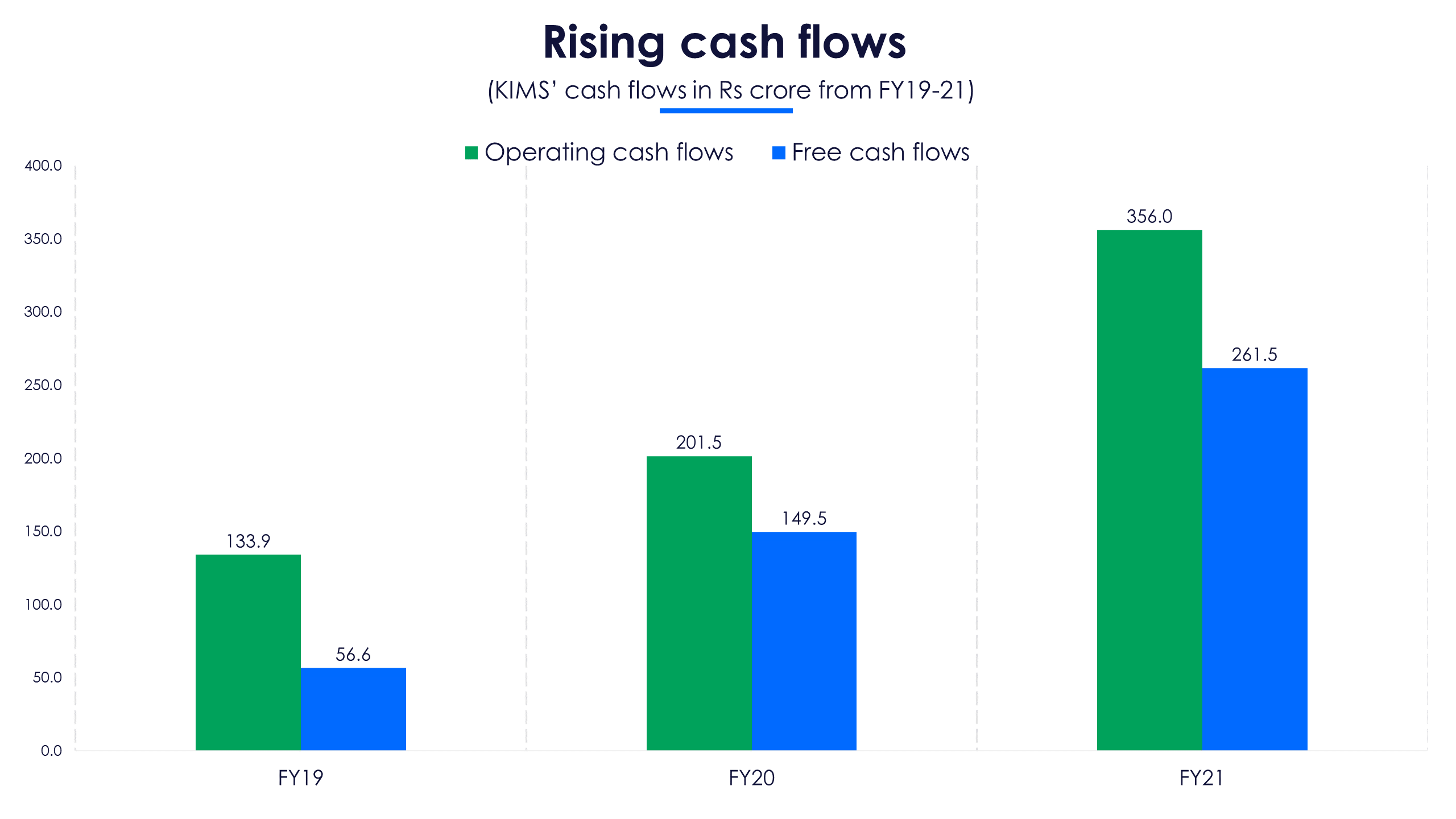

KIMS’ cash flows from operations were Rs 356 crore in FY21, a 76% jump YoY as the company’s net profit grew by 78%. Capital expenditure (capex) rose by 81% in the year to Rs 94 crore. However, due to consistent growth in profits, the company’s free cash flows grew by 75% in the year to Rs 261 crore.

In FY21, KIMS’ total debt was Rs 240 crore, a drop of 14% YoY. This was because the company paid back long term debt of Rs 84 crore in the year through internal accruals. However, short term debt rose by 5.4x in the year. The company will use Rs 150 crore to lower its debt from the proceeds of the IPO. KIMS’ debt-to-equity ratio was 0.26 in FY21, against a debt-to-equity ratio of 0.46 in FY20.

In FY21, KIMS’ total debt was Rs 240 crore, a drop of 14% YoY. This was because the company paid back long term debt of Rs 84 crore in the year through internal accruals. However, short term debt rose by 5.4x in the year. The company will use Rs 150 crore to lower its debt from the proceeds of the IPO. KIMS’ debt-to-equity ratio was 0.26 in FY21, against a debt-to-equity ratio of 0.46 in FY20.

The company did not provide a capex guidance for FY22. However, the management said any capex will be funded from internal accruals as the company has sufficient free cash. With the majority of the proceeds of the fresh issue going towards paying off debt, KIMS has enough room to take on additional capex.

The company did not provide a capex guidance for FY22. However, the management said any capex will be funded from internal accruals as the company has sufficient free cash. With the majority of the proceeds of the fresh issue going towards paying off debt, KIMS has enough room to take on additional capex.

Healthcare set for growth post Covid-19

KIMS offers diversified healthcare services from cardiac-related procedures to pediatrics. The healthcare provider is banking on rising Indian healthcare expenditure. As of 2018, 3.5% of India’s GDP was spent on healthcare. This is lower than most developing countries at 7-10% of GDP expenditure on healthcare.

Higher expenditure on healthcare is expected to boost hospitals and healthcare facility providers like KIMS. This is because of their greater exposure in tier 3, tier 4 cities, and rural India, compared to diagnostic chains. The Indian healthcare delivery (including pharmaceuticals) industry was worth Rs 4.3 lakh crore in FY21. Hospitals made up 61% (Rs 2.6 lakh crore) of the industry. The healthcare industry is expected to grow at a compounded annual growth rate of 18% in the next three years to reach Rs 7 lakh crore by FY24.

Covid-19 negatively impacted private hospitals in FY21, despite it being a healthcare emergency. The pandemic lowered hospital revenues by 8-10% in FY21 as restricted international travel decreased medical tourism revenues for private hospitals, and as domestic patients postponed elective and non-urgent procedures. KIMS’ management said the second wave will decrease revenues even further as regular operations will be interrupted.

Healthcare is the focus of the country in FY22. However, this focus is unlikely to accrue to the top line of private hospitals, which have a different revenue mix. KIMS is a specialty service provider, with no specific niche. This helped KIMS’ earnings grow by 78% in FY21 and generate free cash flows of Rs 261 crore. At nearly 5 times its FY21 earnings, KIMS valuation is the second-highest in the healthcare facilities market. Competitors like Narayana Hrudayalaya (3.2 times) and Apollo Hospitals (1.4 times) are much cheaper options for investors. That said, KIMS’ low debt and growing earnings since FY20 make it worth pondering for investors looking for a play on rising healthcare expenditure.