By Suhani Adilabadkar

In the midst of the second wave of the pandemic, Q4 results season is in full flow. HDFC Bank and ICICI Bank reported robust numbers, but Kotak Mahindra Bank fell short of expectations. The fourth largest private sector bank in terms of advances reported a 33% jump in net profit with an improvement in asset quality, and stable net interest margins (NIMs). What disappointed analysts was lower net interest income (NII) growth and slower pace of growth in advances.

The stock reacted negatively, falling roughly 3% after Kotak Mahindra Bank announced its results. After a brief fall, the Kotak Mahindra Bank stock recouped losses, and is trading higher than its previous close.

Quick Takes:

-

Net profit for the quarter zoomed 33% YoY reported at Rs 1,682 crore compared to Rs 1,267 crore, a year ago, aided by 30% rise in other income

-

GNPAs and Net NPAs for March 2021 came in at 3.25% and 1.21%, rising up to 3 basis points sequentially on a pro forma basis

-

Kotak Mahindra’s loan book moved into positive territory in the March 2021 quarter with 2% YoY growth

-

Uday Kotak’s term as MD and CEO will end on December 31, 2023.

NIMs fall, marring a decent quarter

Net profit for the quarter ended March 2021 rose 33% YoY, to Rs 1,682 crore.This was aided by a 30% rise in other income which came in at to Rs 1,949 crore vs Rs 1,489, in the same period a year ago.

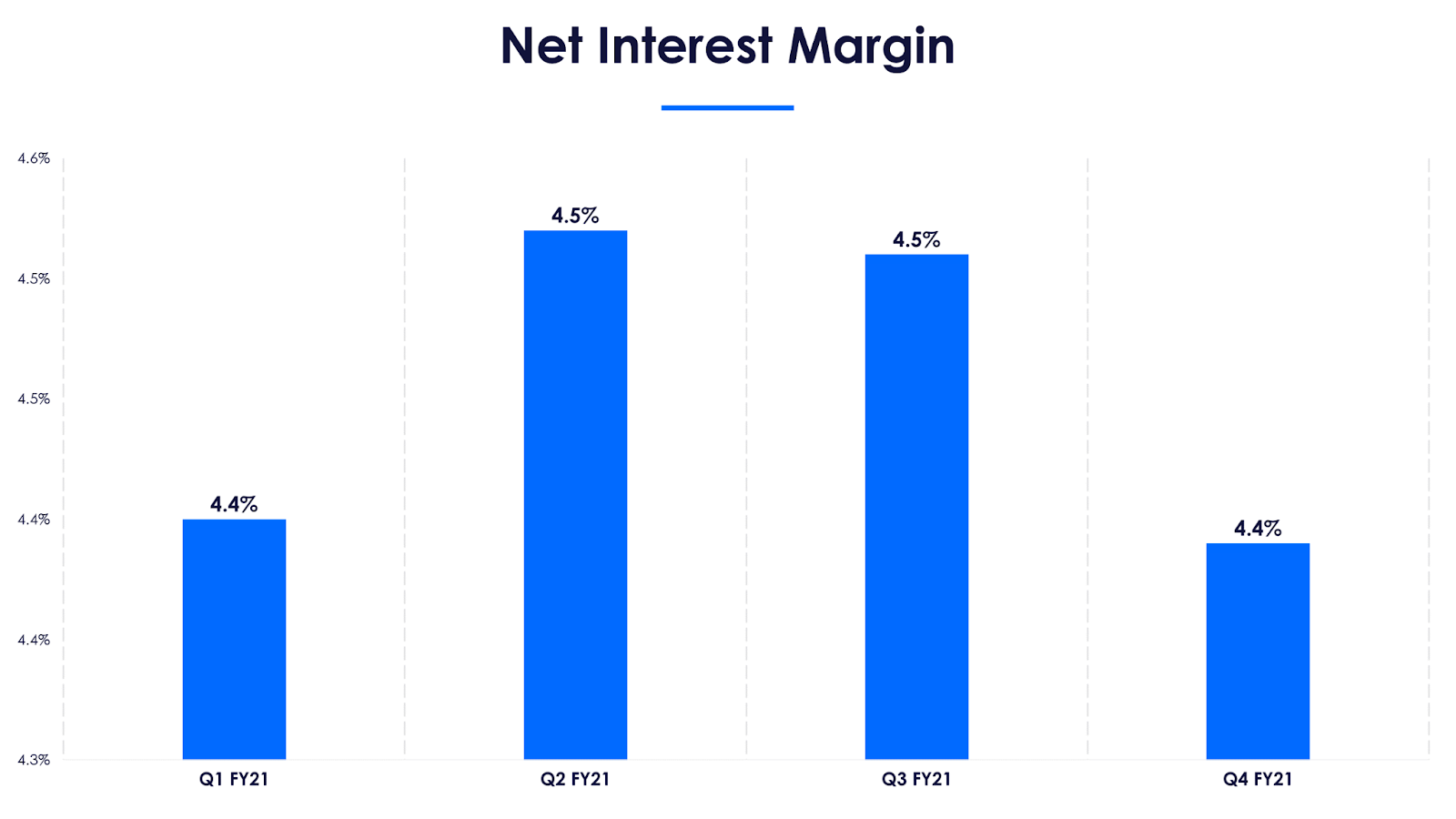

NII rose 8% YoY, reported at Rs 3,843 crore in the quarter ended March 2021, compared to Rs 3,560 crore a year ago. NIMs came in at 4.39%, down 33 basis points (bps) YoY and 12 bps sequentially. Operating profit for the bank rose 18% YoY, reported at Rs 1,458 crore.

Advances grew 1.8% YoY at Rs 2,23,689 crore while deposits grew faster at 6.5% YoY to Rs 2,80,100 crore as on March 31, 2021. CASA ratio (proportion of current and savings account deposits) was 60.4% and cost of savings came in at 3.74%.

Stable and conservative asset quality strategy

In moratorium 2.0 (June-August), about 9.65% of the bank’s book was under moratorium. Rather than recording automatic approval of moratorium for customers, as adopted by various other banks, Kotak Mahindra’s approach was fairly conservative. Customers were given a moratorium on the basis of viability (ability to service future payments) and underlying security.

Nearly 80% of the moratorium loan book is secured. For the remaining customers, underlying weakness was recognized and were consequently moved to the NPA category. Gross NPAs and Net NPAs ratios for March 2021 came in at 3.25% and 1.21%, respectively. Though it is higher than March 2020 (2.25% and 0.71%), on a pro forma basis (for December 2020 quarter), asset quality is stable.

Compared to pro forma numbers of December 2020, GNPA and Net NPA have improved marginally. Total provisions (specific, standard and COVID-19 related) as on March 31, 2021 was Rs 7,021 crore, 95% of GNPA provision.

Kotak Mahindra Bank’s approach has been conservative and aggressive at the same time with no unbridled growth of advances to avoid piling up of bad loans.

Owned by Asia’s richest banker, Uday Kotak, the bank has always adopted a cautious growth path, though its always ready to acquire a rival at the appropriate time and right valuation. Speaking on inorganic growth opportunities, Kotak said that the bank is on the lookout for customer acquisition and capabilities in strong product areas. Addition of physical branches is no more a criterion for acquisition in the era of digitization.

Cautious approach leads to muted loan growth

Cautious approach leads to muted loan growth

Kotak Mahindra’s loan book moved into positive territory in the March 2021 quarter for the first-time post Covid. The bank reported 2% loan book growth, after reporting low single digit deceleration since June quarter FY21. In comparison, HDFC Bank has been growing in strong double digits, with its wholesale loan book rising on an average 25% YoY over the past four quarters. ICICI bank saw muted growth in its wholesale book by avoiding short term lending, but reported double-digit growth in retail loans throughout FY21, touching 20% YoY growth in March quarter 2021.

Even Axis Bank reported a 9% jump in overall advances with its retail and corporate book growing 10% and 7% YoY, respectively in Q4 FY21. Although growth in advances is low for Kotak Mahindra Bank, the bank does not want to shed its cautious stance especially in uncertain Covid times.

Instead the bank’s focus has been on maintaining balance sheet strength rather than short term profitability. Thus, both on the retail and commercial side, secured lending is the major focus area. Clarifying the management's cautious stance on loan growth, Kotak said that though the bank is not averse to unsecured lending, higher emphasis is on mortgages, loan against property, agricultural MSMEs, construction equipment etc. Mortgage would be the major anchor product in the medium to long term for the bank.

Kotak added that Covid has transformed the importance of owning a house in the life of every customer. The Mortgage pie (24% of total advances) has increased 13% YoY in March 2021. To make deeper inroads in the home loan market, Kotak Mahindra has kept its home loan rates lower than larger peers like HDFC Bank and SBI. On an overall basis, retail (63% of total advances) growth has been 8% YoY in March 2021.

For unsecured lending, mainly personal loans and credit card spends, growth has been restrained by design. Peers HDFC Bank and ICICI Bank have been witnessing strong growth in unsecured lending vetted by strict leverage policies, underwriting techniques and digital infrastructure. For instance, 80% of HDFC Bank’s unsecured portfolio constitutes salaried customers and more than 65% of this proportion is employed with highly regarded AAA/AA companies/MNCs/government corporations. Further, Kotak Mahindra Bank’s corporate book has been reporting negative growth over the past four quarters. The corporate book has been witnessing high pricing pressure and thus unable to achieve the requisite risk adjusted return.

For unsecured lending, mainly personal loans and credit card spends, growth has been restrained by design. Peers HDFC Bank and ICICI Bank have been witnessing strong growth in unsecured lending vetted by strict leverage policies, underwriting techniques and digital infrastructure. For instance, 80% of HDFC Bank’s unsecured portfolio constitutes salaried customers and more than 65% of this proportion is employed with highly regarded AAA/AA companies/MNCs/government corporations. Further, Kotak Mahindra Bank’s corporate book has been reporting negative growth over the past four quarters. The corporate book has been witnessing high pricing pressure and thus unable to achieve the requisite risk adjusted return.

Kotak said he would rather park funds in 90-day treasury bills (at around 3.5-3.6%), or in a reverse repo at 3.35% or a foreign exchange swap than lend short-term loans to top rated corporates at 4%. He also said that the main priority of the bank is to create shareholder value in the long term rather than accumulating loans and piling on bad assets.

This is a fair argument in the present Covid environment. But when market leader HDFC Bank, with its loan book growing five times, can grow in double digits while maintaining its asset quality, investors are left wondering why Kotak Mahindra Bank can’t as well.