Inflation cast a long shadow over Q3FY23 for FMCG companies, as costs ate away at volume and demand growth. Rising costs forced FMCG firms to focus on price hikes for revenue growth, and rural consumption dropped for the sixth consecutive quarter. The depreciating rupee didn’t help - that along with input cost pressures and sluggish demand, worsened pressures on margins.

Although the festive season aided sales in Q2FY23, the momentum has slowed down since. Nielsen IQ reported that the FMCG industry in India grew by 7.6% in Q3FY23, compared to 9.2% in Q2.

What about Q4? It’s hard for FMCG CEOs to be too optimistic right now, considering predictions of a hot summer and possibly weaker monsoons. This would put even more pressure on the rural consumer, and hurt demand recovery. The US government’s weather agency, National Oceanic and Atmospheric Administration, predicts a 49% chance of El Nino impacting monsoons in June-July and a 57% impact chance in July-September. However, experts say that more clarity about rainfall will emerge in April-May.

The rural market makes up nearly 35% of the FMCG industry’s sales, and low demand from this market will mute growth prospects. However, some companies are optimistic about rural demand picking up on the back of a robust winter harvest and the Centre’s rural infrastructure push.

Mohit Malhotra, CEO of Dabur India, says, “The operating environment remained challenging during the quarter, rural markets continued to face a slowdown on account of high inflation, uneven distribution of monsoon and down trading by consumers. Having said that, the new age channels performed very well and some green shoots are visible in the rural markets, indicating an early revival in demand.”

Meanwhile, the management of Hindustan Unilever (HUL) maintains a moderately optimistic outlook on demand recovery. But it is clear that recovery in rural demand is dependent on healthy rainfall and decline in inflation - and the direction of both isn’t obvious right now.

Most FMCG players underperform the Nifty 50 index

The delay in rural demand recovery has taken a toll on the FMCG sector, causing it to fall over the past six months.

Only Britannia Industries has comfortably outperformed the Nifty 50 index. The other five companies’ share prices declined during the same time period. The Nifty 50 index fell 3.8% amid heavy volatility.

Large FMCG companies have good durability scores but trade at expensive levels

According to Trendlyne’s DVM classification, Hindustan Unilever, Nestle India, Britannia and Tata Consumer Products have high durability scores.

Meanwhile, all the FMCG players in focus have medium momentum scores, suggesting average to low bullishness in the market, and weak valuation scores, implying that they are trading at relatively expensive levels.

Revenue growth continues to be driven by price hikes

All the companies in focus have witnessed revenue growth on a YoY basis in Q3FY23. Price hikes continued to be the main growth driver yet again as demand was stifled due to inflationary pressures. FMCG companies focused on improving their product mix as most customers were downtrading and buying goods in smaller quantities.

With a growth rate of 17.4% YoY, Britannia Industries leads the pack. It is followed by Hindustan Unilever with a growth rate of 16.1%. Dabur’s revenue has grown the least at 3.5% YoY, given that it has the highest exposure to the rural market. According to the management, the late onset of winter also affected its sales.

High retail inflation eats into demand

Despite FMCG companies passing on the benefits of falling commodity prices to customers, volumes are yet to see significant growth. Reports suggest that price growth in the industry has declined by 200 bps YoY to 7.9% in Q3FY23. Still, customers preferred downtrading to cheaper options, and demand was weak.

Looking at the trends of the wholesale price index (WPI) and consumer price index (CPI) may provide clarity on why retail demand is still weak. The WPI-based inflation has consistently declined since May 2022 and touched a 24-month low of 4.73% in January 2023. Due to a fall in the prices of fuel & power and manufactured products. Whereas, the CPI-based inflation increased to 6.52% in January 2023.

One of the major reasons for this movement in opposite directions could be the difference in weightage each of the indices give to food. CPI gives around 50% weightage to food articles, while it is only 24.4% for the other. Prices of food items like cereals, milk, meat and eggs have risen sharply, leading to high food inflation.

Suresh Narayan, MD & Chairman of Nestle India, believes that consumer price inflation in January crossed 6% due to high food inflation. He adds, “Food inflation is clearly an area to watch out for as far as the company is concerned.”

As high levels of food inflation hurt customers’ ability to spend, demand will likely take longer to recover.

Cost optimisations drive net profit growth

All FMCG players barring Dabur India, witnessed a rise in net profit. Profit growth was driven by healthy sales growth across segments and tight cost controls. Most companies initiated cost management and operational optimisation measures to improve profitability.

Britannia Industries leads the pack in terms of profit growth, with a 151.2% YoY surge on the back of low-cost wheat inventory and a one-off gain of Rs 375.6 crore from a 49% stake sale in one of its subsidiaries. Nestle India comes second with its net profit rising 62.4% YoY on a low base due to a one-off charge of Rs 236.5 crore last year.

Trendlyne’s Forecaster predicts decent revenue growth

Forecaster estimates a double-digit growth in revenue for HUL, Nestle, Britannia and Tata Consumer Products. Britannia Industries is expected to take the lead with a growth rate of 16.1% YoY followed by HUL (12.8% YoY).

However, the outlook for Dabur and Godrej Consumer is not as positive, a growth rate of 7.8% and 8.8% YoY respectively is anticipated.

High input costs continue to eat into margins

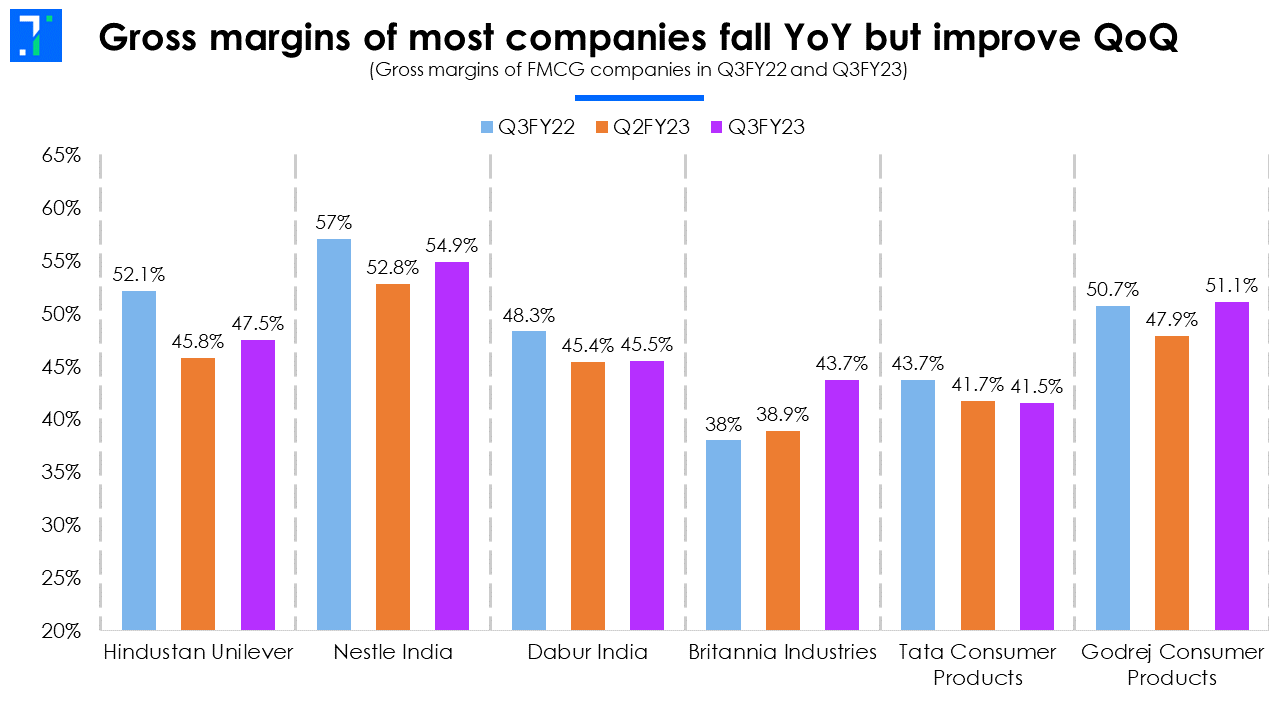

Most FMCG firms continue to see their gross margins erode on a YoY basis due to elevated commodity prices. Although prices of key commodities have fallen from their highs, input costs still remain relatively elevated. Most companies are also limiting price hikes to avoid losing market share.

Only Britannia and Godrej Consumer witnessed a YoY rise in margins this quarter. Britannia’s margin expanded on the back of its low-cost wheat inventory and cost-saving programs. Godrej’s margin growth was led by easing input cost pressures in its India business.

On a QoQ basis, most companies, barring Tata Consumer, saw margins improve on declining commodity prices.

Recovery in rural demand may take longer than expected

FMCG companies expect input cost pressures to gradually reduce amid declining commodity prices. But if high retail inflation persists, demand recovery will take longer than expected. Revival of the rural market depends on healthy rainfall and with predictions of weak rainfall in 2023, the outlook for the rural market looks bleak.

FMCG businesses expect revenue growth to be price-led in the near-to-mid-term. Sanjiv Mehta, CEO & Managing Director of HUL, says, “We remain cautiously optimistic in the near term.” According to him, if commodity prices remain at their current levels, the worst of inflation might be behind the industry. “Having said that, we must be mindful that year-on-year inflation is still high, and so expect growth to be price-led,” he adds.

For FMCG players to see meaningful growth in the coming quarters, there must be an overall recovery in demand. For that, we must wait with fingers crossed for a good monsoon, and lower commodity prices.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.