Specialty chemicals has been a star sector for investors over the past 18 months. Companies in this space make chemicals like alkalis, isobutyl benzene, phenol, sulfonic acid, and other base and performance chemicals. Since the onset of the pandemic, this industry saw significant growth in FY21.

During the initial stages of the pandemic in early FY21, many companies grew increasingly wary of their Chinese dependence when it came to supply chains. To diversify their risks, companies in the pharmaceutical, agrochemical, automobile, and FMCG industries began searching for other procurement and manufacturing options

These industries relied on China to source various chemicals (mainly specialty and commodity chemicals). To capitalize on this global shift in sentiment, the Indian government responded with positive regulation for the domestic specialty chemical industry. Policy initiatives like the production linked incentive (PLI) scheme for end-use sectors (pharmaceuticals, automobiles, and textiles), import bans, and anti-dumping duties are driving demand.

As international and domestic specialty chemical demand grew, listed players (Deepak Nitrite, Vinati Organics, Alkyl Amines Chemicals, Balaji Amines, etc.) focused on increasing capacity, and introducing new products. This was not limited to the extraordinary year of FY21. Chemical players have a long-term vision to grow India’s position as a specialty chemical hub.

Before the pandemic began, domestic specialty chemical makers had a 4.5% share of the global market. In the next five years (FY21-25), this share is expected to double. Needless to say, listed chemical players will benefit. But which chemical verticals will be the most fortuitous and which companies should investors keep an eye on?

Evolving specialty chemicals end-use markets

India’s specialty chemical space was worth $32 billion (Rs 2.3 lakh crore) at the end of FY21. Over the past five years, the industry grew at an 11% compound annual growth rate (CAGR) between FY15-20. Due to the strong global demand for specialty chemicals, the industry is expected to grow at a higher CAGR of 12.4% over the next five years.

The largest constituent of this diverse industry is agrochemicals, valued at nearly Rs 68,000 crore or 29% of the Indian chemicals industry. Other key constituents include surfactants (used in FMCG products like laundry soaps and dishwashing powders), polymers (used in packaging products), and industrial chemicals (used in construction, paints, automotive components, etc.).

In the coming years, brokerages expect specialty chemicals catering to end-use industries like pharmaceuticals, healthcare, and FMCG products, to fuel growth rather than intermediary industries like agrochemicals. Some specialty chemicals like amines are used in the production process of agrochemicals. Brokerages are eyeing a 15% CAGR in chemical segments like flavours, fragrances, nutraceuticals, and cosmetic chemicals between FY20-25.

In FY21, the Indian government and several domestic companies in end-use industries capitalized on the demand shift away from China. In FY21, the government introduced production-linked incentive (PLI) schemes for pharmaceutical and automotive industries which boosted demand for domestic chemicals. Other end-use industries like textiles also received a PLI boost in FY22, and chemical makers are also expected to receive the same.

From growth sans China to China plus one

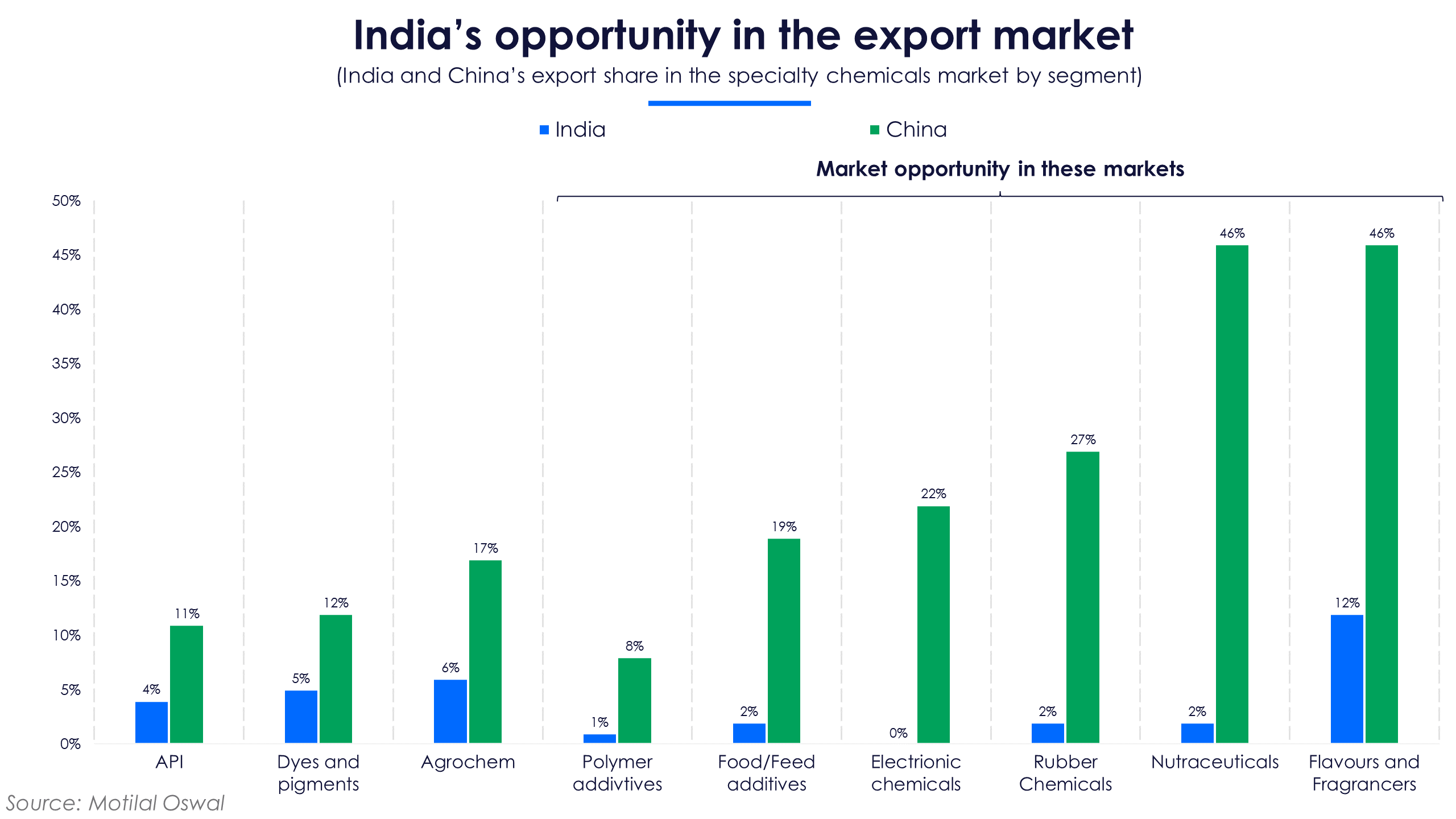

The pandemic set off a chain of events. For India’s specialty chemical industry, a key event was international companies collectively diversifying their supply chains away from China. This trend is called “China plus one” or a strategy to consciously diversify production hubs away from China. From chemicals to manufacturing, several industries are heading out of China. However, China’s grip on the global specialty chemicals market is still strong. But brokerages and specialty chemical companies believe India is well-positioned to take market share away from its neighbour.

China is the leading exporter of specialty chemicals in the world. In FY19, it exported specialty chemicals worth $35 billion (Rs 2.5 lakh crore), or 17% of the world’s specialty chemical exports. In comparison, India’s specialty chemical exports were Rs 64,000 crore, or 25% of China’s exports. China captured this large market share between FY08-FY19 due to cheap labour, government initiatives, and relaxed environmental regulations. However, a year before the pandemic began, several chemical factories in the country were closed in response to stricter emission norms.

As early as FY19, China enforced strict emission norms which resulted in the shuttering of 40% of its total manufacturing capacity. Then in March 2019, a year before the pandemic, a chemical plant in Yancheng exploded, killing 64 people. This set off a chain of events, leading to the government closing many chemical plants due to rising pollution levels and safety concerns. The pandemic made things worse for the Chinese domestic specialty chemical industry as global supply to and from the country was disrupted for the first six months of 2020.

For India’s specialty chemicals industry this presented an opportunity in two areas. First, for the two largest end-use industries — pharmaceuticals and agrochemicals. Second, for chemical companies in niche end-use categories like polymer additives (used in the plastics industry), rubber chemicals, food additives, packaging, flavours, and fragrances.

Heading into FY22, the Indian specialty chemicals industry was set to grow. Alkyl Amines Chemicals’ (Alkyl Amines) Chief Financial Officer Kirat Patel during the Q4FY21 earnings call said the global specialty chemicals market, except China, will grow strongly in FY22. He expects the Indian specialty chemicals to grow more than peers because of international demand and domestic import substitution

Alkyl Amines’ amines competitor Balaji Amines’ management shared a similar sentiment. Balaji Amines’ Managing Director Ram Reddy said the current growth of the domestic specialty chemical industry is because of rising demand due to problems in China. Both Alkyl Amines and Balaji Amines captured this demand as seen in their FY21 revenues.

Amine makers are not the only beneficiary of China’s supply-side problems. Another key beneficiary is chemical makers in the fluorine market. Many pharmaceutical and automobile original equipment manufacturers (OEMs) relocated their fluorine supplies to India from China. This helped India emerge as a fluorination hub in FY21.

During this shift, fluorine companies like Navin Fluorine International and SRF began backward integration of their raw materials, instead of relying on Chinese supply. This helped them negotiate contracts with American and European customers who wanted to reduce dependence on China.

Domestic substitution, the unexpected advantage

While the immediate benefit of the China plus one strategy is the growth of specialty chemical companies’ exports, another benefit is a rise in domestic demand. Many Indian pharmaceutical, automobile, agrochemical, and packaging companies imported raw material chemicals from China. However, following the first wave in Q1FY21, these companies looked for import substitutes due to supply chain bottlenecks.

This shift towards domestic specialty chemical makers helped several chemical companies. An end-use industry in which specialty chemicals found a use case is packaging, specifically packaging for FMCG products like packaged foods, haircare, and skincare products. Two specialty chemical companies that benefited from this were Deepak Nitrite and Vinati Organics.

Deepak Nitrite, on a standalone basis, mainly produces three kinds of chemicals — base, specialty, and performance chemicals. However, the demand for these specialty chemicals from textile, paper, and auto-component makers was muted for much of FY21. What drove the growth in its revenue was high sales from its wholly owned subsidiary Deepak Phenolics which produces phenol and acetone, chemicals used by the FMCG and packaging industry. Due to the pandemic, the consumption of packaged food products increased, which added to its top-line growth. The growth in Deepak Phenolics’ revenues made up for the lack of revenue growth seen in its standalone business.

In addition to phenol and acetone, antioxidant chemicals are used to produce polymers like polypropylene (PP), linear low-density polyethylene (LDPE), and high-density polyethylene (HDPE) which all saw growing demand. These polymers are used in the packaging of FMCG companies’ haircare and skincare products. Due to the shift from Chinese imports to domestic substitutes, the price of these chemicals rose significantly in 2021. This helped the revenue of chemical companies making polymer chemicals like Vinati Organics.

In addition to phenol and acetone, antioxidant chemicals are used to produce polymers like polypropylene (PP), linear low-density polyethylene (LDPE), and high-density polyethylene (HDPE) which all saw growing demand. These polymers are used in the packaging of FMCG companies’ haircare and skincare products. Due to the shift from Chinese imports to domestic substitutes, the price of these chemicals rose significantly in 2021. This helped the revenue of chemical companies making polymer chemicals like Vinati Organics.

Expecting demand from FMCG and packaging companies to continue in FY22, brokerages expect Vinati Organics’ revenue from these chemicals (PP, LDPE, and HDPE) to grow by 8% YoY and contribute nearly 25% of FY24 revenues. Until Q3FY21, Vinati Organics’ antioxidant chemicals portfolio was weak. Then in February 2021, it announced the amalgamation of Veeral Additives, an antioxidants maker, with itself. This made Vinati Organics the largest domestic manufacturer of antioxidant chemicals. When the second wave struck, the demand for antioxidants surged, accruing to its Q1FY22 revenues.

Big capital expenditure plans in place

With international and domestic demand expected to be robust, chemical companies will spend big to expand capacities in FY22. Crisil estimates that specialty chemical companies will increase their capital expenditure (capex) by as much as 50% YoY in FY22. The rating agency expects capex in the range of Rs 6,000-6,250 crore, which is 25% higher than pre-Covid levels. The main reason for this higher spending is to capitalize on the growing demand from the ‘China plus one’ strategy and rising import substitution.

Crisil estimates domestic demand to improve by 20% and export demand by 17-18% in FY22. These two factors will fuel revenue growth of around 20% for large specialty chemical companies during the year.

Specialty chemicals makers that make products used in the manufacturing process of rubber are also increasing their capacity. Companies that are spending heavily to expand their capacities areNOCIL, Alkyl Amines, and Balaji Amines.

The two amine makers (Alkyl Amines and Balaji Amines) announced capex plans to increase acetonitrile production. Acetonitrile is an amine derivative used in the production of rubber products (used by automobile, plastic, and consumer durable manufacturers), and acrylic fibres (used by textile and apparel makers).

For FY22, Alkyl Amines earmarked a capex of Rs 200 crore to double its acetonitrile production to 25,000 tonnes per annum. Balaji Amines is also spending Rs 80 crore to increase its acetonitrile capacity by around 18,000 tonnes per annum. Alkyl Amines held a 40% market share in the domestic acetonitrile market at the end of FY21. The rest was held by Balaji Amines and other smaller companies.

In FY18 NOCIL, the pure-play specialty rubber chemicals maker earmarked a capex of Rs 470 crore to gradually expand capacities at its two plants in Maharashtra and Gujarat. However, the company is still a year away from completing these expansions. Post the addition, which will be completed in September 2023, it will have a total capacity of 1.1 lakh metric tonnes.

Other companies like Vinati Organics and Navin Fluorine still have ongoing capacity expansion from FY21 which will be commissioned in FY23. For the companies that did not provide capex guidance for FY22, brokerages expect capex announcements in the coming months pegged at 2-4% of annual sales.

Despite a high level of capex, most specialty chemical companies are not taking on debt. Companies like NOCIL, Vinati Organics, and Navin Fluorine do not have long term debt on their books. Other companies like Deepak Nitrite, Galaxy Surfactants, SRF, Fine Organic Industries, Aarti Industries, Balaji Amines, Alkyl Amines, and Atul’s long term debt-to-equity ratio was below 1 as of FY21. This will allow specialty chemicals companies to take on debt to fuel growth in the coming years. With domestic demand due to import substitution and export demand due to ‘China plus one’ to continue, the specialty chemicals industry is well poised for growth.