By Ruchir SankhlaOver the past week, the market rebounded sharply, with the Nifty 50 rising 4.2% as investors cheered the easing of trade tensions between the US and India. Sentiment improved after US President Donald Trump announced an interim trade deal, cutting tariffs on Indian exports to 18% from 25% and removing the additional 25% levy linked to Russian oil imports.

The technology sector lagged the market, with the Nifty IT index down 6.9% over the past week after Anthropic launched its Claude Cowork plug-ins for legal work, raising competition concerns.

On the policy front, the Reserve Bank of India (RBI) decided to hold steady, keeping its key interest rate (the repo rate) unchanged at 5.25%. Governor Sanjay Malhotra expressed confidence in India’s economy, noting that the Reserve Bank of India’s Monetary Policy Committee raised the FY26 GDP growth forecast to about 7.4%. The RBI gave a slight heads-up that inflation could rise to around 4% in early FY27 due to rising precious metal prices.

Looking ahead, domestic focus shifts to India’s January inflation data, which will be a critical factor in influencing the RBI’s future interest rate stance. "Markets may remain range-bound in the near term, with stock-specific action driven by earnings outcomes and global uncertainties," said Siddhartha Khemka, Head of Research at Motilal Oswal Financial Services.

IPO activity continues steadily this week. Three new issues will open, and four companies are scheduled to debut, after five listings last week.

Five new companies debuted on the bourses in the past week

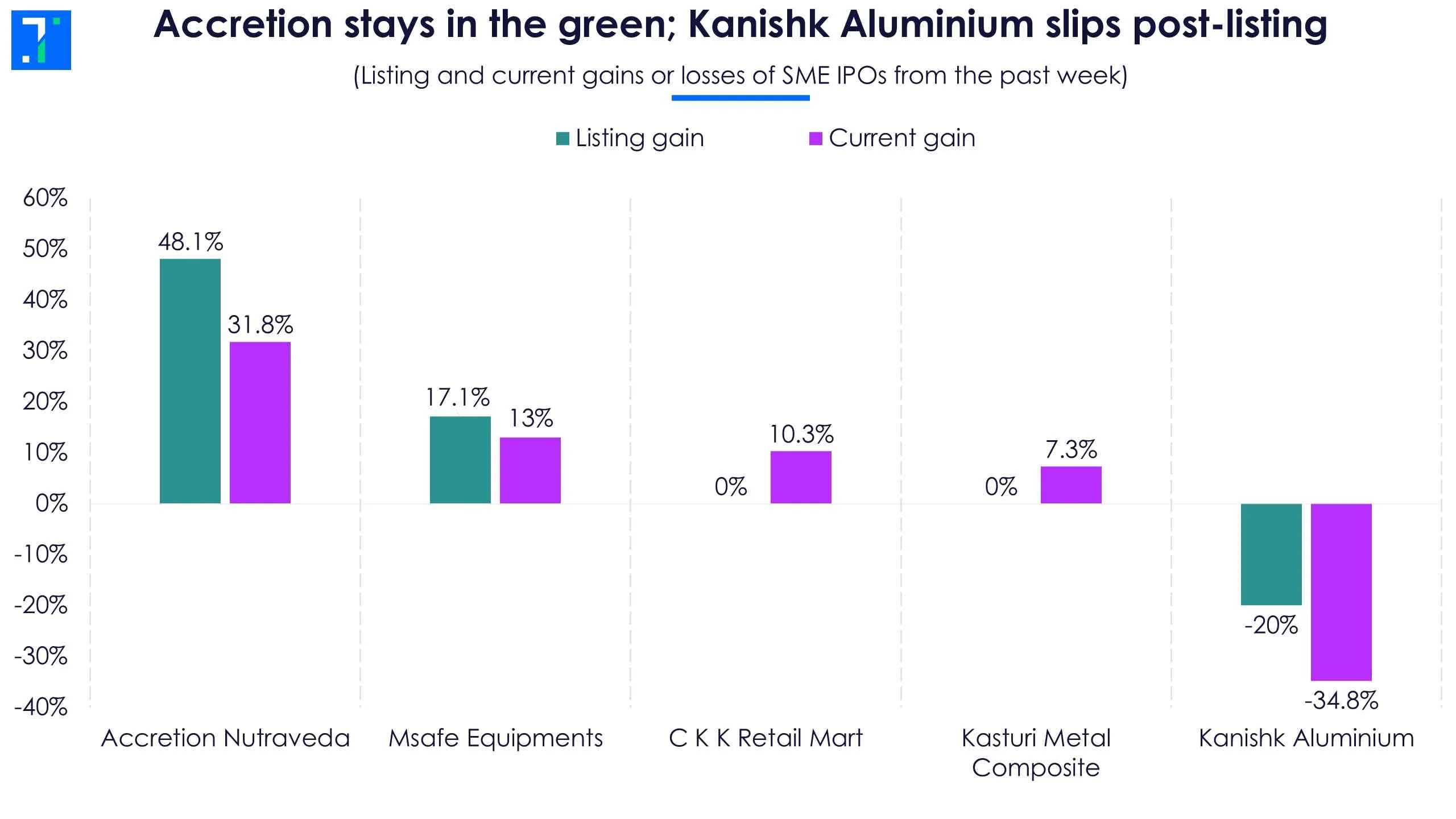

C K K Retail Mart, an FMCG company, made a flat debut on February 6. The Rs 88 crore IPO, which was subscribed 1.6X, listed at its issue price of Rs 163. The company plans to use the proceeds to acquire warehouses. Since listing, the stock has recovered and is now trading around 10% above the issue price.

Msafe Equipments, a manufacturer of height-safety solutions, saw a strong debut on February 4. The Rs 66.4 crore IPO was oversubscribed 154X and listed at a 17.1% premium to its issue price of Rs 123. The Noida-based company intends to use the funds to set up a new manufacturing facility.

Accretion stays in the green; Kanishk Aluminium slips post-listing

Kanishk Aluminium, a Rajasthan-based aluminium products manufacturer, had a weak start on February 4. The Rs 29.2 crore IPO was subscribed 1X, and listed at a 20% discount to its issue price of Rs 73. The stock remains under pressure, trading 34.8% below the issue price.

Accretion Nutraveda, a manufacturer of Ayurvedic products, delivered a strong listing performance on February 4. The Rs 24.8 crore IPO, which saw a 1.8X subscription, surprised the market by listing at a 48.1% premium. The stock opened at Rs 191 against its issue price of Rs 129.

Kasturi Metal Composite, a producer of steel fibre products, debuted flat on February 3. Despite the Rs 17.6 crore IPO being subscribed 16.6X, the shares listed at the issue price of Rs 64. The Maharashtra-based company plans to use the proceeds to set up a fourth manufacturing unit in Amravati to expand capacity. The stock is currently trading 7.3% above its issue price.

This week marks four new SME IPO listings

This week will see four IPO debuts, with no mainline offerings.

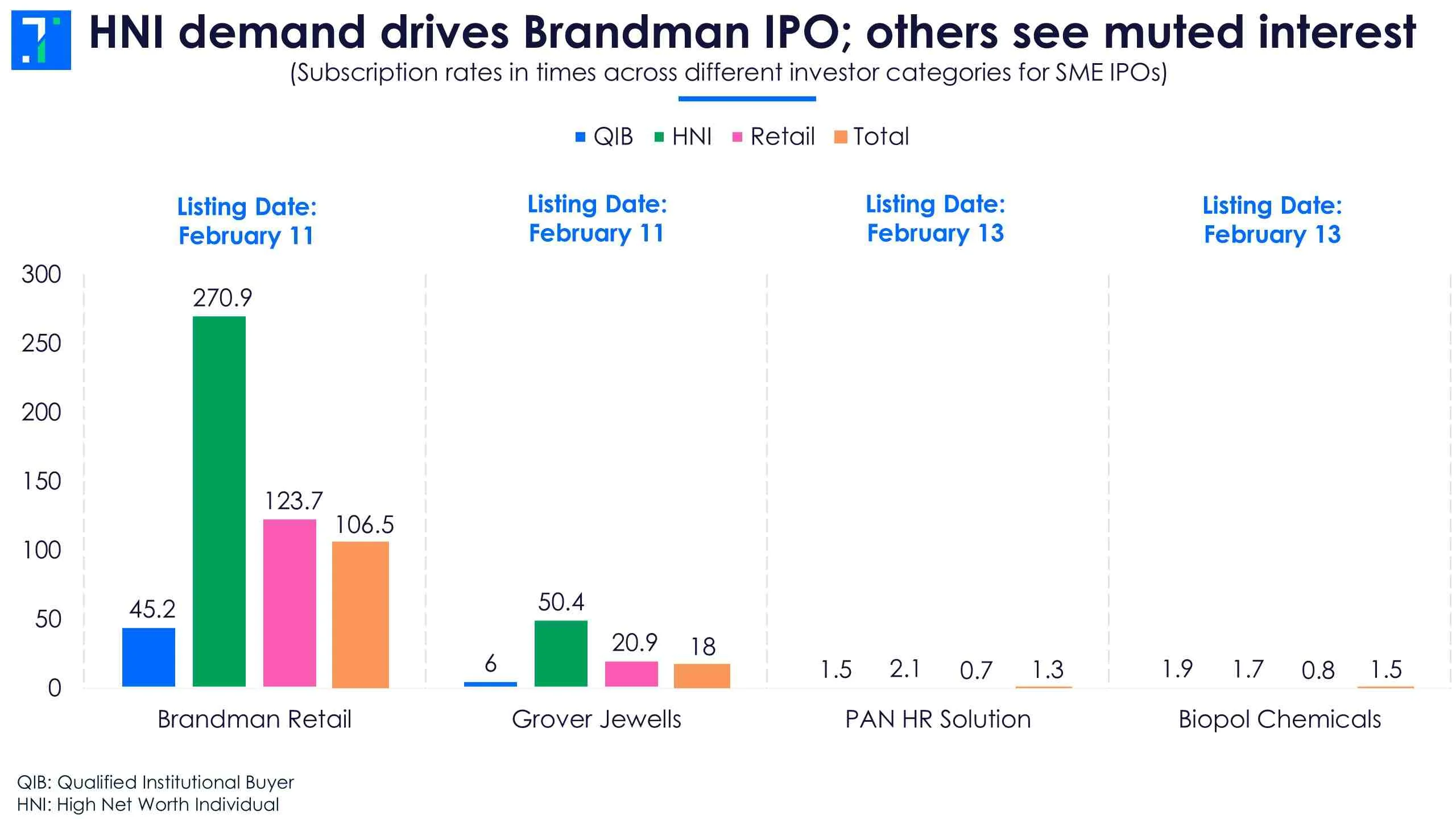

Brandman Retail, a footwear distributor, closed its Rs 86.1 crore IPO on February 6. The issue, a 100% fresh offering priced at Rs 167–176 per share, saw strong demand with a subscription of 106.5X. The company, which operates exclusive brand outlets for New Balance and other labels, plans to use the proceeds to open 15 new retail units. It will be listed on February 11.

Grover Jewells, a gold jewellery manufacturer, closed its Rs 33.8 crore IPO on February 6. The offering, consisting entirely of a fresh issue priced at Rs 83–88 per share, received a healthy response from investors and was subscribed 17.9X. The company will debut on February 11.

HNI demand drives Brandman IPO; others see muted interest

PAN HR Solution, an HR and staffing firm, launched its Rs 17 crore IPO on February 6. The issue is open till February 10. The company will list on February 13. As of the end of the second day, the issue has seen steady interest, with 1.3X subscriptions.

Speciality chemicals manufacturer Biopol Chemicals opened its Rs 31.3 crore IPO on February 6 and will close on February 10, with the listing scheduled for February 13. Investor appetite has been strong, with the issue subscribed 1.5X by the close of day two.

Three IPOs to watch this week: Mainlines take the lead

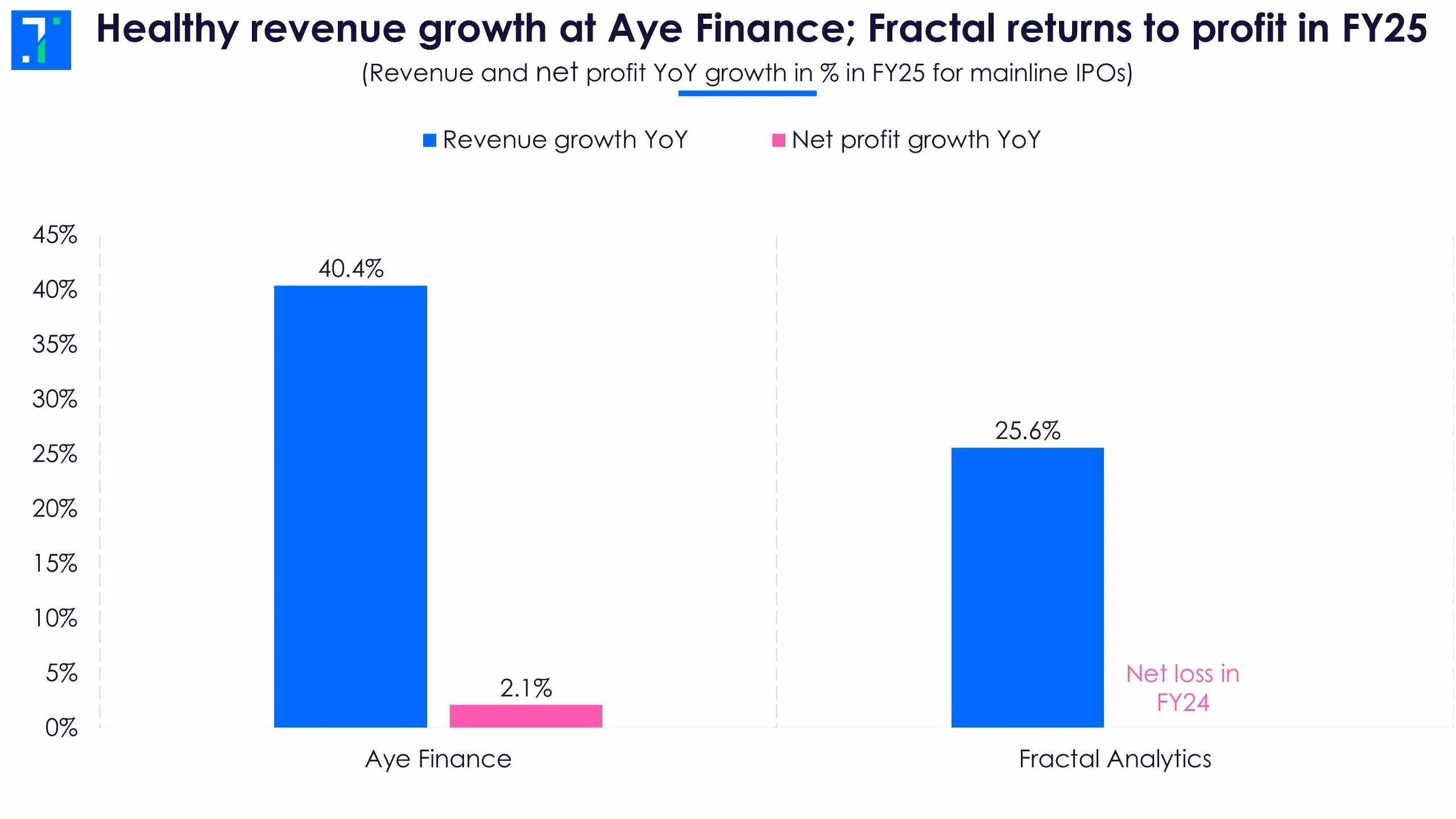

Fractal Analytics, an enterprise AI solutions firm, will launch its Rs 2,833.9 crore IPO between February 9 and February 11. The price band is fixed at Rs 857–900, and the firm will list on February 16. The offering comprises a fresh issue of Rs 1,023.5 crore and an offer for sale of Rs 1,810.4 crore.

Healthy revenue growth at Aye Finance; Fractal returns to profit in FY25

Aye Finance, a Gurugram-based NBFC, will open its Rs 1,010 crore IPO for subscription from February 9 to February 11. The price band is set at Rs 122–129, and the company will list on February 16. The issue comprises a fresh issue of Rs 710 crore and an offer for sale of Rs 300 crore.

In the SME segment, Marushika Technology, an IT products distributor, will open its Rs 27 crore IPO for subscription from February 12 to February 16. The price band has been set at Rs 111–117, and the company will list on February 19. The issue is entirely a fresh issue of 23 lakh equity shares.