By Suhani AdilabadkarICICI Bank reported a strong and impressive June 2021 quarter. The second largest private sector bank soothed investor concerns after HDFC Bank’s lackluster performance in Q1FY22. ICICI Bank reported the highest YoY growth in net interest income, net interest margin and loan book among the top private sector banking quartile in the June 2021 quarter.

The bank changed tack in 2018, adopting a three-pronged strategy focused on retail loan franchise, deposit base and asset quality improvement. Bearing fruit after a hard toil of 3 years, ICICI Bank is one of the best performing banks amid Covid-19 turbulence.

Quick Takes

Adverse impact of Reserve Bank of India ban on Master Card is negligible for ICICI Bank as its flagship Amazon card runs on Visa

ICICI Bank’s cost of funds at 3.65% is one of the lowest in the industry

Absence of moratorium and lower collections due to Covid-19 second wave disruption led to higher slippages of Rs 7,231 crore in Q1FY22

The management expects decline in slippages in H2FY22 in the absence of a Covid-19 third wave

BB and Below loan book is constant around 1.5% of total loan book over the past nine quarters

Stellar June 2021 quarter performance, helped by high interest income growth

ICICI Bank’s June 2021 quarter performance was driven by strong net interest income (NII) growth and lower provisions. NII (interest earned less interest expended) came in at Rs 10,936 crore in Q1FY22 compared to Rs 9,280 crore, a year ago, a rise of 18% YoY. NII growth was supported by robust growth in loan book (up 17.2% YoY) in Q1FY22. Net interest margin (NIM) stood at 3.89% in the June 2021 quarter, a rise of 20 basis points (bps) YoY and 5 bps sequentially. Excess liquidity deployed in foreign swaps and lower cost of funds (down 15 bps QoQ) aided NIM expansion in Q1FY22.

Net provisions reported at Rs 2,852 crore for the quarter fell 62% YoY and 1.1% sequentially. The bank wrote back Rs 1,050 crore of Covid-19 related provisions in Q1FY22 created in earlier periods. Lower provisions and higher NII growth led to 78% YoY increase in net profit in June 2021 quarter. Net profit came in at Rs 4,616 crore in Q1FY22 compared to Rs 2,599 crore, a year ago.

Provision coverage ratio (PCR) was at 78.2% in the June 2021 quarter. PCR indicates funds kept aside by a bank for its loan losses. Deposits at Rs 9,26,224 crore grew 15.5% YoY in Q1FY22. Average current account and savings account (CASA) ratio stood at 43.7% expanding 270 bps YoY in Q1FY22. As per the management, increasing adoption of the bank's digital platforms and growth in volume and value of transactions supported higher growth in CASA deposits.

ICICI Bank outperforms HDFC Bank amid Covid turbulence

HDFC Bank had edged out ICICI Bank as the largest private sector lender in 2017 in terms of asset base. After a change in management in 2018, ICICI Bank spent time on improving its earnings over the past three years, and is slowly and steadily, on a comeback trail. ICICI Bank’s stock price nearly doubled over the past one year spurred by strong and consistent performance throughout FY21. ICICI Bank is the analysts’ top pick in the banking sector on account of stable asset quality, sturdy deposit base and strong earnings performance.

In the June 2021 quarter, ICICI Bank’s NIM was at a 26-quarter high at 3.89%. Three years ago, NIM was at 3.19% (Q1FY19). Operating amid Covid-19 second wave, NII growth (up 18% YoY) is well maintained and loan book growth (up 17.2% YoY) is healthy. This is completely in contrast to HDFC Bank’s June 2021 quarter performance. HDFC Bank, reported its lowest ever NII growth (8.6% YoY) in Q1FY22. NIMs at 4.1% and loan book growth of 14.4% YoY also did not enthuse investors.

But what is driving ICICI Bank’s superlative growth?

The answer lies in its loan portfolio mix. Moving away from its troubled past of asset quality issues mainly due to lending to low rated corporates, ICICI Bank increased its retail loan exposure from FY16. Retail loans as a percentage of total loan mix increased to 65% in FY21 from 46% in FY16. Instead of lending large ticket risky corporate loans, ICICI Bank preferred advancing low ticket retail loans largely to its existing customer base. Retail loans provide better margins than corporate loans aiding NII and NIM growth. Banks with higher retail loan growth are also better placed to pass on the rise in cost of funds to customers.

ICICI Bank’s retail portfolio (61.4% of total loan mix in Q1FY22) reported double-digit growth throughout FY21 and a robust 20.2% YoY growth in Q1FY22. In comparison HDFC Bank’s retail loan growth was in single digits throughout FY21 and came in at 9.3% in Q1FY22. Loan mix shift towards low margin wholesale book (60% of total loan book in Q1FY22) driven by PSU entities impacted NIMs for the largest private sector lender. Though ICICI Bank’s retail loan book growth looks fiery, management’s cautious approach soothed investors wary of a Covid-19 third wave.

Robust credit growth driven by digital offerings

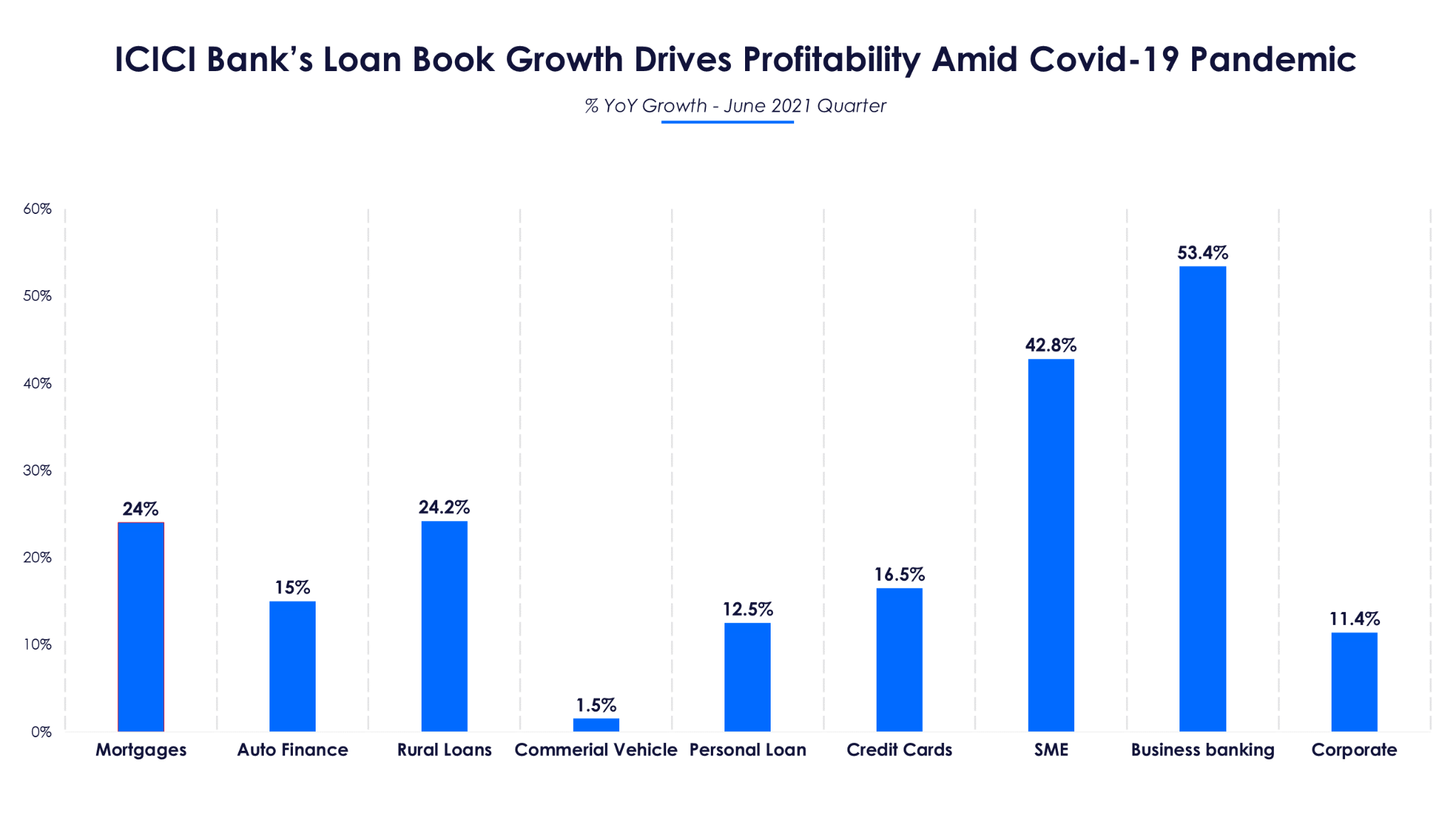

While HDFC Bank pivoted its loan book towards the wholesale segment to navigate Covid turbulence, ICICI Bank continued with its pre-pandemic strong retail focus. The bank’s retail loan book mix includes mortgages, auto finance, rural loans, commercial vehicles and personal loans. Mortgages form the largest constituent with 33.6% of total loan book.

Speaking on mortgages, Anup Bagchi, Executive Director at ICICI Bank said, “Our stance is to do more and more secured loans given what is happening in the environment, so we would want to go towards mortgages and fully collateralized loans”. High margin and low risk mortgages which include home loans, office premises loans, loans against property etc are currently a major growth driver for the banking sector, especially when corporate loan demand is low. ICICI Bank has the highest share of mortgage loans in its loan book compared to its peer group. Mortgage loans grew 24% YoY in Q1FY22.

ICICI Bank’s personal loan and credit card portfolio together constitutes 9% of total loan mix while HDFC Bank’s personal loan or unsecured lending stands at 15%. According to ICICI Bank’s management, 70% of personal loans are advanced to existing customer base which provides strong liability information for credit assessment. And around 85% of personal loan customers are salaried individuals. Personal loan and credit card portfolio grew 12.5% YoY and 16.5% YoY respectively in Q1FY22.

The bank reported stellar growth of 53.4% YoY and 42.8% YoY for business banking (5.4% of loan mix) and SME (4% of loan mix) respectively in the June 2021 quarter. Speaking on robust growth in the business banking segment, Rakesh Jha, CFO at ICICI Bank said that the ticket size of loans is low and the portfolio has adequate collateral.

He further added that though small & medium enterprises (SME) loans’ collateral levels are not at 100% as in the case of business banking, the bank is comfortable with the SME portfolio risk levels. The bank expects the SME and business banking segment to continue with its robust growth trend in the near future.

And lastly, the corporate loan segment has maintained its double-digit growth momentum and grew 11.4% YoY in Q1FY22. While private sector loan demand was lukewarm, PSU’s robust capital expenditure (capex) plans led to strong corporate loan demand in Q1FY22. The central government’s strong capex push by allocating Rs 5.5 lakh crore in FY22 augurs well for the banking sector as a whole. The government incurred Rs 1 lakh crore capex spend in Q1FY22.

ICICI Bank’s robust loan book growth is driven by its comprehensive digital offerings spread across various segments. The bank launched ICICI Stack for retail customers and corporates, merchant stack for retailers, iMobile, InstaBIZ and Trade Online digital platforms to provide frictionless experience and holistic solutions to customers. This strong and seamless digital way of delivery augments business volumes, top-line growth, cost reduction and operating profit expansion.

Speaking on ICICI Bank’s strong digital play, Sandeep Bakshi, Managing Director and CEO at ICICI Bank said, that end-to-end digital sanctions and disbursements across various products increased steadily over the past few quarters. About 34% of mortgage sanctions and 46% of personal loan disbursements by volume were end-to-end digital in Q1FY22. The bank onboarded 95,000 customers using video KYC in the June 2021 quarter.

Stable asset quality, slippages to decline in FY22

Asset quality was stable for ICICI Bank even as the bank witnessed higher slippages in the June 2021 quarter. Gross NPA ratio (gross NPAs as a percentage of gross advances) and net NPAs (net NPAs as a percentage of net advances) came in at 5.15% and 1.16% respectively in Q1FY22. Gross NPAs and Net NPAs increased marginally by 19 bps and 2 bps QoQ respectively in the June 2021 quarter. Slippages or gross NPA additions in Q1FY22 were reported at Rs 7,231 crore of which Rs 6,773 crore was from the retail and business banking portfolio.

The jewelry portfolio with Rs 1,130 crore slippages, which is part of the retail segment is fully secured and the management expects full recovery in the coming quarters. Speaking on slippages, Bakshi said that in the absence of regulatory measures such as moratorium and lower collections due to Covid-19 second wave disruption, slippages would be higher in the first half of the current fiscal for the whole banking system, including ICICI Bank. He further added that Covid-19 induced uncertainty led to higher anxiety levels among customers leading to higher bounce rates in April and May.

While slippages in mortgages were similar to the same period last year, commercial vehicles slippages were higher and personal loans were in better shape compared to Q1FY21. From the second week of June, recoveries improved and though slippages might be elevated in Q2FY22, management expects meaningful reduction in H2FY22 in the absence of a Covid-19 third wave.

Provisions are also expected to decline for the rest of FY22. The bank tightened its provision policy making it more conservative by adding Rs 1,127 crore to provisions buffer during the quarter. The provision coverage ratio (PCR) on NPAs is the highest in the industry at 78.2% as on June 30, 2021. The restructured loan book was also in control at Rs 4,860 crore for ICICI Bank compared to Rs 9,181 crore for HDFC Bank. And lastly the contentious BB and Below loan book is also constant around 1.5% of total loan book over the past nine quarters.

The Indian economy’s recovery from the Covid-19 second wave has been swifter and stronger. Most of the high frequency indicators are showing economic growth moving back to pre-Covid levels in August 2021. This augurs well for the banking sector as a whole. ICICI Bank stock price is near its 52-week high and gained 32% over the past eight months, while it’s a 9% rise for HDFC Bank stock price.