By Vivek Ananth

The auto sector’s monthly business dispatch or wholesale numbers are keenly tracked by investors and economy watchers. And the numbers in May 2022 were a sight for sore eyes. Take for example Maruti Suzuki’s domestic wholesale dispatches. The company’s wholesale dispatches more than quadrupled in May 2022 on a YoY basis, even though it grew a meagre 2% month-on-month. …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

The auto sector’s monthly business dispatch or wholesale numbers are keenly tracked by investors and economy watchers. And the numbers in May 2022 were a sight for sore eyes. Take for example Maruti Suzuki’s domestic wholesale dispatches. The company’s wholesale dispatches more than quadrupled in May 2022 on a YoY basis, even though it grew a meagre 2% month-on-month.

The dip in April 2022 points to demand being sucked out by high fuel prices. The excise duty cut by the Centre of Rs 10 has cushioned the blow, helping the month-on-month growth in dispatches to dealers. Although the year-on-year growth in May seems emphatic, India had regional lockdowns due to the second pandemic wave in May 2021. Hence, a year-on-year comparison is misleading.

If we look at Tata Motors, however, it appears the company didn’t need the fuel excise duty cut to post steady wholesale dispatches month-on-month in 2022, especially in May as wholesales remained flat for petrol and diesel cars at 39,887 units. This is even more apparent when we look at the company’s electric vehicle wholesale dispatches which rose nearly 49% month-on-month in May 2022 to 3,454 units.

Mahindra & Mahindra on the other hand saw a huge uptick month-on-month in its domestic wholesales for cars, with dispatches to dealers rising nearly 20% MoM to 26,904 units. This could be partly due to the long waiting period for its popular XUV700 that its customers can’t wait to get their hands on. This could help boost the company’s monthly wholesales going forward as buyers wait for their cars.

If we look at two-wheelers, one player, in particular, is struggling for growth. While Bajaj Auto’s May 2022 dispatches to dealers are higher month-on-month at 96,102 units, it’s just a 3.1% rise compared to April. Bajaj Auto’s monthly dispatches of bikes are below 1 lakh units for the third month in 2022.

If we look at two-wheelers, one player, in particular, is struggling for growth. While Bajaj Auto’s May 2022 dispatches to dealers are higher month-on-month at 96,102 units, it’s just a 3.1% rise compared to April. Bajaj Auto’s monthly dispatches of bikes are below 1 lakh units for the third month in 2022.

On the other hand, Hero MotoCorp’s May 2022 two-wheeler dispatches rose over 17% to 4.66 lakh units on a month-on-month basis.

On the other hand, Hero MotoCorp’s May 2022 two-wheeler dispatches rose over 17% to 4.66 lakh units on a month-on-month basis.

Another listed two-wheeler marker—TVS Motor—also posted month-on-month growth in May 2022 domestic wholesales (up 6.1% to 1.91 lakh units).

Another listed two-wheeler marker—TVS Motor—also posted month-on-month growth in May 2022 domestic wholesales (up 6.1% to 1.91 lakh units).

These numbers show that Bajaj Auto’s two-wheeler wholesales are the outlier. This could also be because Bajaj’s bikes are more premium than Hero MotoCorp’s or TVS Motor’s. But there is some element of recovery in demand among two-wheeler makers, despite the supply chain issues that the industry has faced for many months now.

Commercial vehicle numbers point to slowing infrastructure spending

The commercial vehicle dispatches, especially heavy-duty trucks, point to whether capital expenditure, both private and by the Centre and states, is sustaining. If you look at Tata Motors’ domestic commercial vehicle dispatches, it’s clear that there was a break from the spending spree on infrastructure from April 2022 onwards, which saw commercial vehicles dispatches fall MoM.

And this trend continues across Ashok Leyland…

…as well as Eicher Motors joint venture firm Volvo Eicher Commercial Vehicles. The high fuel prices in April might have played a part in this slowing of wholesale dispatches in commercial vehicles. But another contributing factor could be the slowing of spending by the Centre in the first two months of FY23.

Now the Centre also has to contend with the over Rs 1 lakh crore loss in revenue due to the excise duty cut. While this might not impact the capex plan of the Centre if other revenues provide a surprise on the upside, the commercial vehicle numbers show a slowing in demand for trucks.

Other macro indicators point to tepid economic recovery

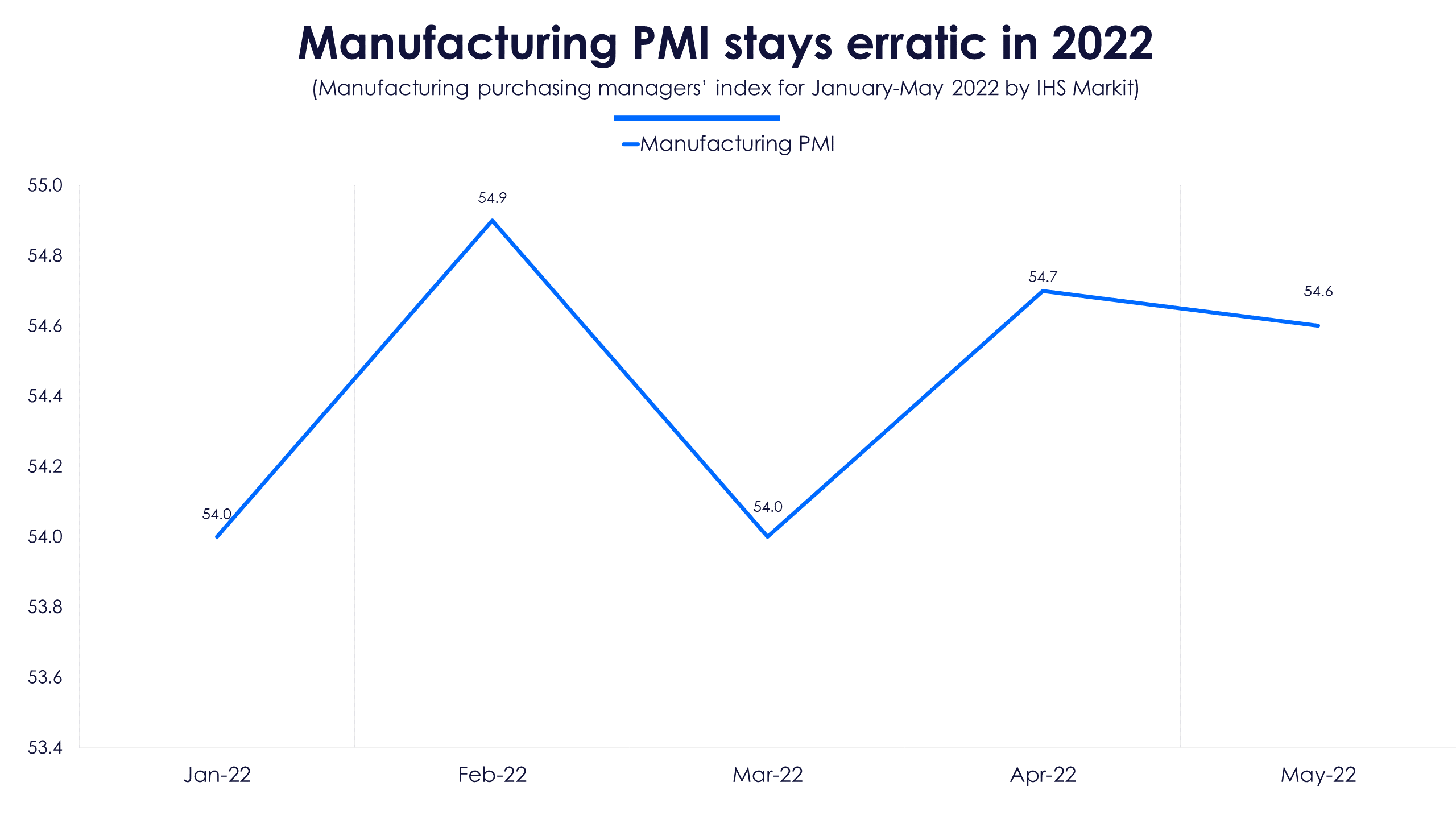

A leading indicator that many track is the purchase managers’ index or PMI. A PMI of over 50 indicates growth in purchasing activities by companies. For manufacturing activity, the PMI has been erratic over the past five months. Although it remained over 50, the numbers point towards an unsteady recovery in manufacturing activity in India.

This is substantiated by the YoY growth in the index of industrial production from January to March 2022. Although the April growth numbers are strong, it’s worth remembering again that the base (April 2021) was low, hence 7.1% growth in IIP is misleading.

To drive this home, the monthly YoY growth in industrial production for the automotive industry from December 2021 to April 2022 was -4.5%, -7.6%, 1.8%, -0.4% and 7.1%, respectively. This shows that even though the monthly numbers may be pleasing to the eye, there are base effect issues that could be inflating the growth in manufacturing activities as well.

Investors who are hoping that India’s growth story is intact should remember that the true measure of growth momentum will only be visible in a like-to-like comparison of various metrics. Under the cloud of the pandemic, the base can be lower, which might inflate the growth numbers. For now, we will have to wait for the June 2022 auto monthly business numbers for more clues on how sustainable the economic recovery really is