Team Trendlyne

Amid heightened volatility in the stock markets the world-over, India awaits the launch of what could be its biggest IPO ever in terms of issue size. LIC’s IPO seems lucrative to many investors and the company is leaving no stone unturned for investors to think otherwise. Life Insurance Corporation of India (LIC) is the market leader in the insurance sector and held nearly 65% share in new business premiums (NBP) earned by the sector for H1FY22. While LIC continues to be an undisputed player in this space, its growth has slowed down post Covid-19.

Quick takes:

- LIC’s Indian embedded value (IEV) jumps 5.6X in six months to Rs 5,39,686 crore due to amendments made to the LIC Act, 1956

- LIC’s strong customer base helps it shore up its customer persistency beyond the first year

- LIC still relies on its robust agent network to acquire new business prospects. Post-Covid, LIC lost a substantial number of its agent network, resulting in a market share drop. LIC’s market share in new business fell to 59% in January 2022

- New business premium from digital channel grows, however it’s contribution is mere 1.08% in acquiring new customers

LIC’s new business premium (NBP) growth dampens

LIC’s new business premium sees rampant growth in FY19 and FY20, however, the trend dampens in FY21. Total new business premium, considering both individual and group products, grew 25% YoY to Rs 1.78 lakh crore. However, there is muted growth in new business premium in FY21, with total new business premium rising a mere 3% YoY to Rs 1.84 lakh crore.

LIC’s new business premium sees slow growth because of private players eating up its market share as their customer reach through digital channels is far better. According to a news report, LIC lost 8% market share to its private peers in the last two years.

Despite growth, LIC loses significant market share in NBP

It is very evident that LIC is losing its market share to other private players. In March 2021, LIC’s market share was 66.2% and in less than one year, LIC’s market share stood at 58.9% in January 2022. Now, it isn’t like LIC will cease to be India’s largest life insurer anytime soon. However, it is going to face tough competition from its private peers.

Even though LIC is losing its market share in the NBP space, its business prospects still look good if we consider the trend in gross written premium (GWP). Gross written premium is the principal source of income for an insurer as it measures the revenue growth of a company. LIC’s GWP sees an increase of 6% in FY21. This is double the rise from NBP (3%) for FY21.

Until FY21, LIC’s GWP stood at 4.02 lakh crore compared to 3.79 lakh crore in FY20. Maximum GWP growth came in from participating products with a contribution of 60.9%, while non-participating products contributed 39.1% to total GWP.

LIC’s portfolio is dominated by participating products which is clear from its contribution to total GWP.

Strong customer stickiness: LIC fares well in renewals and persistency

Another factor that determines a life insurer’s ‘revenue’ growth is renewal premiums. Renewal premiums account for subsequent premiums an insured pays to the insurer to keep its policy in operation to avail its benefits. The total renewal premium earned by LIC in FY21 is Rs 4.02 lakh crore, a 6% rise from FY20.

To get a fair understanding of how an insurer is able to retain its customers, the persistency ratio is key. It depicts the percentage of policyholders who continue to pay their renewal premium. Persistency for LIC fell in FY20 to 85% for the 13th month from 88% in FY19 but sees an improving trend in FY21. In FY21, the persistency ratio for the 13th month rises to 87%.

However, for H1FY22, LIC’s 13th month persistency stands at 78.8%, much lower than its private peers. HDFC Life, ICICI Prudential Life Insurance, and SBI Life Insurance have better persistency ratios than LIC (85.9%, 85%, 84.5%, respectively) at the 13th month.

But surprisingly the private players aren’t able to hold ground when it comes to the 61st-month persistency ratio. LIC’s 61st-month persistency for H1FY22 stands at 61% compared to 52.3% for HDFC Life, 51.8% for ICICI Prudential, and 49.7% for SBI Life.

LIC caters to various sections of society, including the lower-middle class. According to a report from Bloomberg Quint, 10% of the savings of Indian households go to LIC. This is larger than the deposits made with India’s largest lender, the State Bank of India. With purchasing power reducing for the middle-income section because of the second-wave of Covid-19 pandemic, persistency ratio took a hit in FY20. But persistency seems to be returning to normal levels as seen in H1FY22 numbers.

LIC still relies heavily on its agent force to grow its business

Covid-19 proved to be a watershed event for many businesses as they reoriented their operations to suit the new normal. This typically meant increasing their reliance on digital channels of sales or tie-ups. LIC, though, relies heavily on its agent force of 13.5 lakh to service customers. This is higher than the agent network of all private life insurers.

Prior to the pandemic, LIC’s robust agent network worked in its favor as it could efficiently expand the company's presence in semi-urban, rural and other remote regions. However, the movement of these agents was hampered during nationwide lockdowns in the first wave, and state level lockdowns during the second wave. Many of these agents are no longer actively working with the company. The number of active individual agents at LIC fell by over 15% to 8.96 lakh between the end of FY21 and H1FY22.

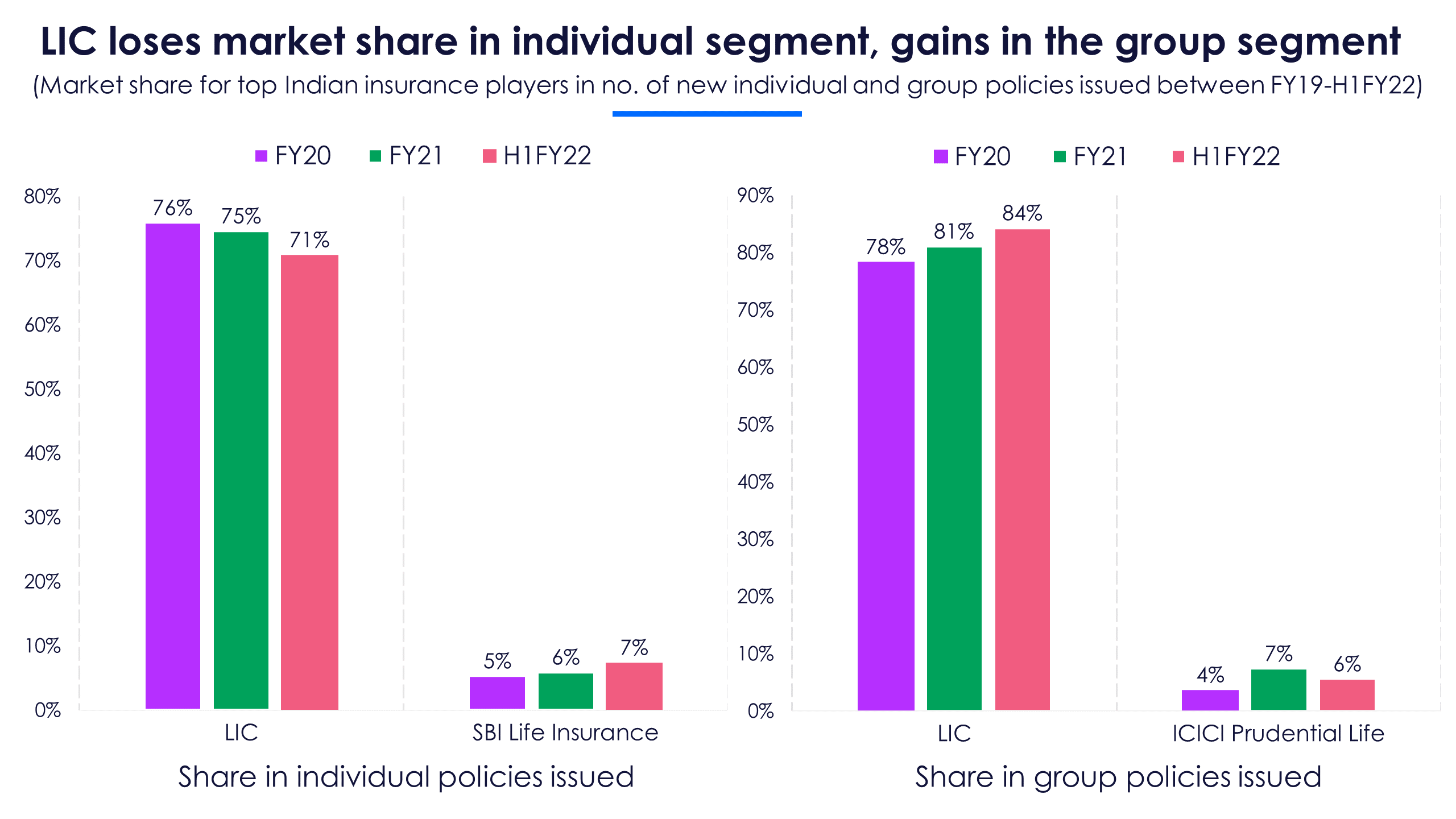

The above trend also explains why the company lost market share in the individual policy segment from FY20. Private players like SBI Life and HDFC Life gained at LIC’s expense. The thing to note here is that LIC is still the largest player in this segment by new business premium at 51% in FY21. Notably, LIC continues to gain market share in the group policy segment. Group policy provides coverage to a group of people which can be a professional group or an informal group. The sales activity for this segment is primarily handled by LIC’s full-time employees and little reliance is on the independent agent network.

If we consider the new individual policies issued by LIC in rural and urban regions of India, the company lost market share in both regions. Interestingly, the loss of market share was more acute (six percentage points) in the rural segment in H1FY22 vis-à-vis at the end of FY21. SBI Life’s market share in rural India rose by 2.5 percentage points to 9.5% in the same period.

Interestingly, LIC’s new business premium per individual policy i.e., transaction ticket size is at Rs 26,892, the lowest amongst the top 10 players, due to its massive market coverage. According to news reports, another reason for this low-ticket size could be the loss of market share in the premium individual segment.

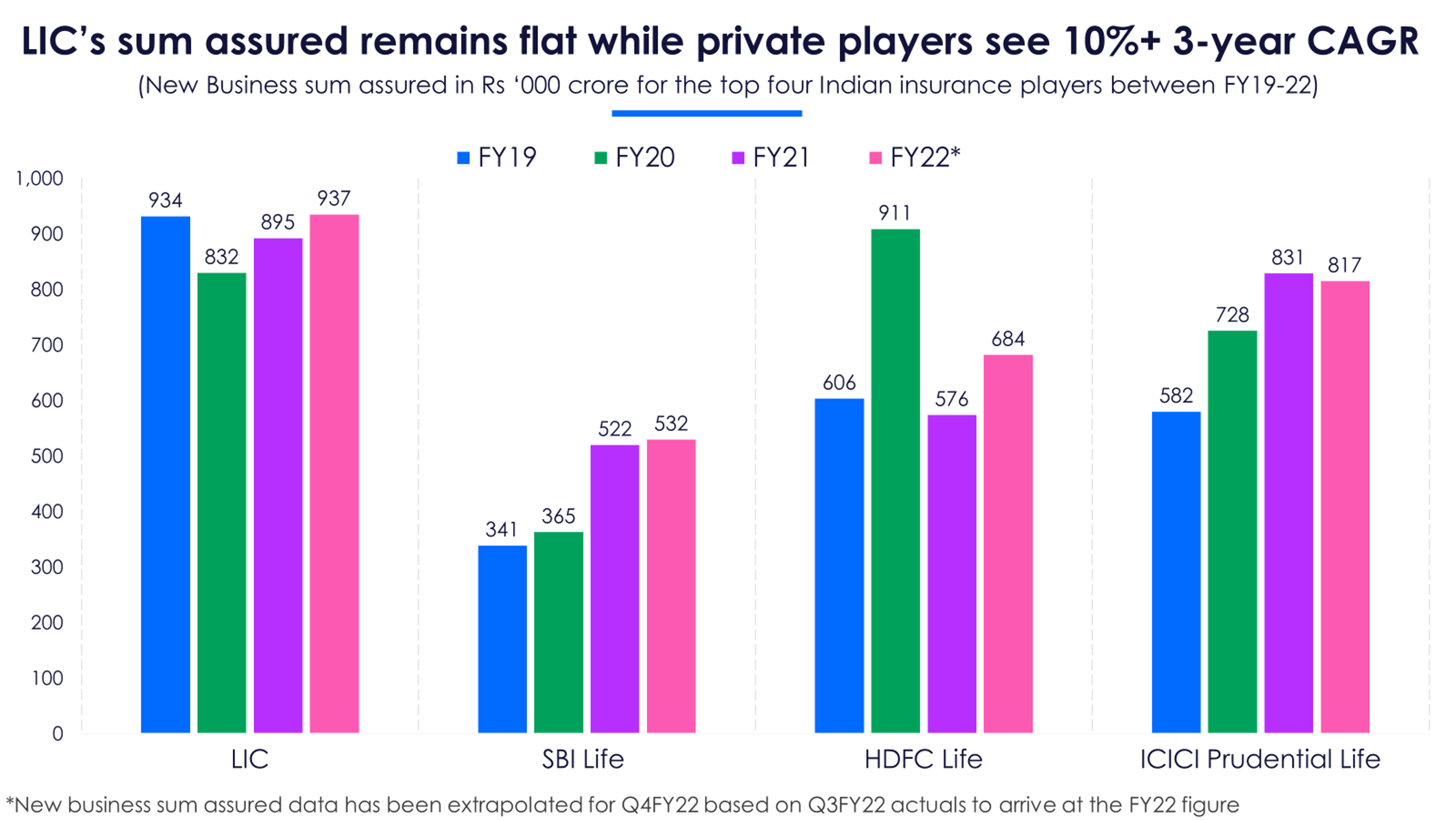

LIC’s slow transition to alternate sales channels, especially digital, inhibited its growth in terms of the new business sum assured. Sum assured is a pre-decided amount that an insurance company pays to the policyholder if an event takes place. Accordingly, new business sum assured would essentially be a function of both the no. of new policies issued by an insurer and the pre-decided amount on the same. If we observe the overall trend in LIC's new business sum assured (for both individual and group policies) metric, it remained range-bound between FY19-FY22.

On the other hand, private insurance players such as SBI Life and ICICI Prudential life saw their new business sum assured grow at over 12% CAGR between FY19-22.

Notably, the total amount insured by LIC for all the individual policies combined declined at a CAGR of 8% between FY19 and FY22. This is in line with the fact that the no. of individual policies issued by the company were lower by 4.2 lakh in FY21 vis-a-vis FY19. Assuming a ballpark figure for H2FY22, the company will issue nearly 2.04 crore policies in FY22, lower by 10 lakh as compared to the FY19 figure. The ballpark figure assumed here is 1.3 crore which is in accordance with the actual no. of policies issued in H2FY19, a normalized year.

Claims settlement ratio for an insurance company is the ratio of insurance claims settled by it to the number of insurance claims incurred by it. Ideally, an insurance company should have a track record of settling at least 75-90% of all claims received by it.

LIC settled insurance claims (for deaths only) of Rs 16,182 crore in the first six months of FY22 which were 26% higher than the settlement amount for the entire FY20. This was on the back of the deadly second Covid wave which occurred in April-June, 2021. Notably, LIC’s claims settlement ratio fell from 98.3% in FY21 to 94.2% in H1FY22.

Other established players also reported a fall in this metric with only HDFC Life and Bajaj Allianz maintaining the ratio above the ideal mark of 95%.

Over five-time jump in LIC’s embedded value allows it to list at a lower valuation multiple

LIC’s Indian embedded value (IEV) was at Rs 95,605 crore as of March 31, 2021. In six months, this IEV leaped 5.6 times to Rs 5,39,686 crore.

Embedded value (EV) represents the present value of future profits and the market value of the insurer’s net assets. The main reason for this multifold jump in EV is an amendment passed in 2021 which made amendments to the LIC Act, 1956. Previously, LIC operated with a single fund, and the surplus from participating (par) businesses and non-participating (non-par) businesses were distributed between the policyholders and shareholders in a ratio of 95:5. The amendment allowed the company to bifurcate this existing single fund into par funds and non-par funds. The shareholders now have a 100% claim on the profits from non-par funds, which led to the multifold jump in the EV. This Increase in the EV allows the company to have a lower valuation multiple (market cap/EV multiple) to raise the same amount of capital.

LIC’s Assets Under Management (AUM) as of September 2021 is valued at Rs 39,60,000 crore. LIC invests 25% of its AUM in equity, which comes to roughly Rs 9,90,000 crore. Sensitivity analysis by Milliman in the DRHP explains that a 20% fall in its equity investment will lead to an erosion of 14.5% of the total EV of LIC which shows the pull of the equity markets on LIC.

LIC is gradually realizing the importance of digitalization in insurance space

LIC has a large digital presence with its website having 1.75 crores registered users and its app for policyholders had 51 lakh users. The policy premium payments made through digital channels stood at 46.06% and spent Rs 361.4 crore on its IT infrastructure in FY21.

Although almost half of all premium payments collected by LIC are through the digital channel, the NBP from the channel is insignificant. The digital channel contributed only 1.08% of total NBP in FY21. Even though the NBP from the digital channel is growing rapidly, it’s contribution is almost negligible to LIC’s business.

According to reports, 13% of life insurance policies were purchased through the online channel in India, in FY21. The pandemic only hastened the process of tech adoption. As LIC was heavily dependent on its agents, the lockdowns in place restricted social mobility, thus hurting its sales. Private insurers increased their market share despite having a smaller number of agents all put together than LIC, due to their digital marketing.

LIC plans to digitize further by tying up with more bank partners and digitizing the onboarding process through banks. LIC has started an initiative to increase procurement of insurance business through online channels by training its agents to use its online onboarding platform. So far the initiative has increased the number of policies issued online by 250% to 144,654 in September 30, 2021, from 41,241 in FY21.

If the rumors of LIC’s IPO going on hold aren’t to be believed then the issue date is to be announced shortly. Investors will look to value the company higher taking all factors into consideration. Business-wise, it looks like LIC is stuck between carrying forward its old ways and adopting new technology to match up to its private peers.