By Ketan Sonalkar

The monthly portfolio disclosures by mutual funds in December give investors insights into what the smart money is doing in the market. It also helps investors understand the sectors and companies that are currently in favour or have fallen off the radar for mutual fund managers.

This screener shows stocks where mutual funds increased holdings in December 2021. Fund managers had their eyes on a state-owned enterprise, a power exchange as well one of the largest IT services companies. They were also interested in an engine manufacturer and a white goods player.

Wipro - New leadership and acquisitions change its trajectory

Wipro is one of India’s leading IT services companies and is currently fourth in terms of market capitalization. It saw a turnaround in its performance over the last six quarters after the new CEO Thierry Delaporte took over in July 2020. This was also aided by the rapid digitalisation across industries since the onset of the pandemic.

It concluded several M&A deals over the past year, including Capco, its biggest-ever acquisition at $1.45 billion. The immediate impact of the Capco acquisition worked well with 22 joint deals for Wipro. It also closed 11 large deals with a total contract value of$600 million in Q3FY22. Significant deal wins saw $50 million accounts grow from 39 to 44 and $100 million accounts grew from 11 to 15 over the last four quarters.

Fund managers who increased their holdings in Wipro

Fund managers who bought shares of Wipro are Raviprakash Sharma for SBI ETF Sensex scheme, Shreyash Devalkar and Hitesh Das for Axis Bluechip Fund Growth scheme, Harsha Upadhyaya for Kotak ESG Opportunities Fund Regular Growth scheme, and Bhavesh Jain and Bharat Lahoti bought for Edelweiss Balanced Advantage Fund Regular Plan Growth scheme.

NMDC - Record output supported by strong steel demand

NMDC is India’s largest iron ore miner and is a state-owned enterprise. It is one of the lowest-cost iron ore producers in the world. As per data for December 2021, its iron ore production rose to 3.95 MT from 3.86 MT YoY. Its total sales of iron ore during April-December 2021 also increased to 28.36 MT from 22.27 MT in the corresponding period a year ago recording one of the highest numbers in recent times.

Another development for NMDC is the board approval for a proposal to demerge its under-construction steel plant in Nagarnar, Chhattisgarh. The steel plant is scheduled for commissioning over the next four to six months and the demerger process by Q4FY22. The demerger is also positive as it limits the liability of NMDC investors of any further investments and/or delay in commissioning the steel plant and would strengthen NMDC’s balance sheet.

Fund managers who increased their holdings in NMDC

Shares of NMDC were added by Bhavesh Jain and Dhawal Dalal to Edelweiss Arbitrage Fund Regular Growth scheme, Hiten Shah to Kotak Equity Arbitrage Fund Growth scheme, Harshal Joshi and Arpit Kapoor to IDFC Arbitrage Fund - Regular Plan - Growth scheme, and Bhavesh Jain and Bharat Lahoti to Edelweiss Balanced Advantage Fund Regular Plan Growth scheme.

Indian Energy Exchange (IEX) - Charging up India’s short term power markets

IEX is one of India’s two electricity exchanges and controls more than 95 percent of spot volumes. It is also planning to introduce short-term contracts lasting up to one year to tap buyers as opposed to traditional long-term contracts. The company’s monthly volumes are growing rapidly and registered a YoY growth of 24% with 9,035 million units (MU) traded in the month of December 2021, despite concerns of the Omicron virus. In Q3FY22, it recorded a 37% YoY growth with a total traded volume of 27,677 MU.

IEX is gearing up for the government’s plan to optimize electricity prices to lower the cost of power purchase to consumers, based on the implementation of Market-Based Economic Despatch (MBED) – Phase1. Power demand by all states is proposed to be met through a central pool allocating power at the optimal price. Currently, state power distributors source power from available sources within the states, invariably ending with a higher energy cost. MBED will allow more cost-efficient power plants to produce more, reducing costs for buyers.

Fund managers who increased their holdings in Indian Energy Exchange

Ratish Varier and Rohit Seksaria bought shares of IEX for Sundaram Small Cap Fund - Regular Plan - Growth Option scheme, Karthikraj Lakshmanan and Mayank Prakash for BNP Paribas Arbitrage Regular Growth scheme, Neeraj Kumar for SBI Arbitrage Opportunities Fund Regular Growth scheme, and Rajeev Bhardwaj for Invesco India Arbitrage Fund Growth scheme.

Kirloskar Oil Engines (KOEL) - Growth in demand aided by infrastructure push

Kirloskar Oil Engines is one of the world’s largest generator set manufacturers, specializing in both air-cooled and water-cooled engines (2.5HP to 740HP) and diesel generating sets across a wide range of power output from 5kVA to 3,000kVA.

Revenues are rising for each of the last four quarters with revenues in Q2FY22 at Rs 1,008.8 crore. Commenting on Q2FY22 results, the management said that they are witnessing good traction in the healthcare segment, infra development, and schemes like Jal Jeevan mission. During Q2FY22, with the new product launch 'i-land', it expanded into allied businesses in the water management solutions business.

Fund managers who increased their holdings in Kirloskar Oil Engines

Anand Radhakrishnan and R. Janakiraman bought shares of KOEL for two schemes, Franklin India Flexi Cap Fund Growth scheme and Franklin India Taxshield Growth scheme, Saurabh Pant for SBI Large & Midcap Fund Regular Payout Inc Dist cum Cap Wdrl scheme and Anand Radhakrishnan and Ajay Argal for Franklin Build India Fund Growth scheme.

Granules India - Mitigation of raw material disruption would be a long term cure

Granules India is a leading generic player in the Indian pharmaceutical industry, with two-thirds of its revenues coming from North America and Europe. Granules sources part of its raw materials from China and due to the Chinese dual energy policy, and increase in logistics cost and procurement prices, the company’s margins were hit in the past few quarters.

Granules plans to re-allocate its capex spending for backward integration in order to reduce its dependency on imports, especially from China. The benefits of this exercise are expected to accrue from FY24 onwards.

It has 68 ANDA (abbreviated new drug application) filings and has launched 19 ANDAs to date. The company is focused on investing primarily in large- to medium-volume products. Some low-volume and high-value products such as controlled substances and niche molecules for the development pipeline form part of its product portfolio.

Fund managers who increased their holdings in Granules India

Shares of Granules were added by Krishan Kumar Daga and Arun Agarwal to HDFC Arbitrage Fund Wholesale Plan Growth scheme, Harshal Joshi and Arpit Kapoor to IDFC Arbitrage Fund - Regular Plan - Growth scheme, Rajeev Bhardwaj to Invesco India Arbitrage Fund Growth scheme, and Sailesh Jain to Tata Arbitrage Fund Regular Growth scheme.

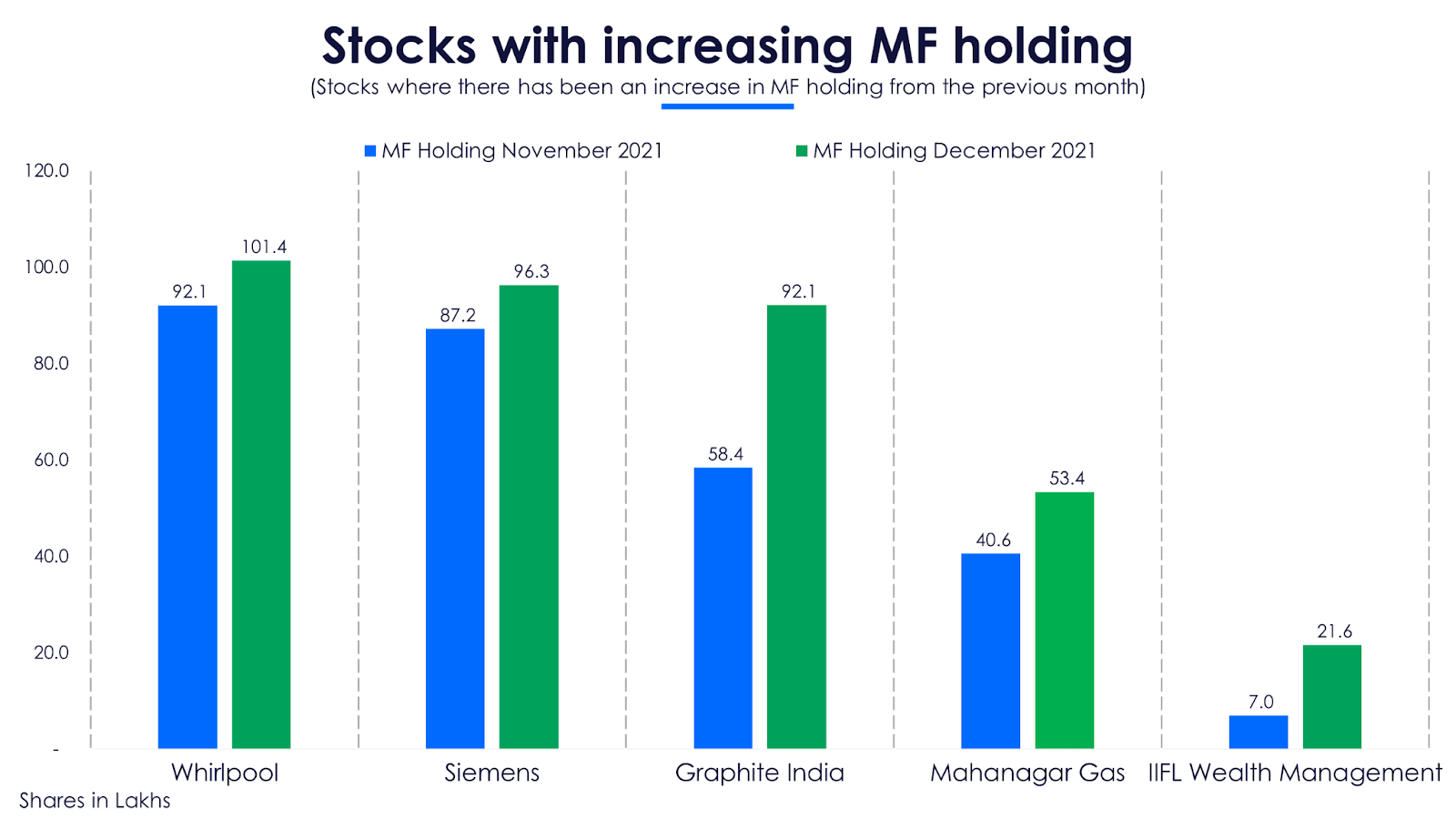

Whirlpool - Expected to ride out the growing demand for premium products

Whirlpool of India is a leading white goods manufacturer with a sizable market share in refrigerators and washing machines. It was one of the few stocks which gave negative returns to investors in FY21. With the consumer durables sector picking up demand, FY23 is expected to bode well for this sector. Demand for this sector is coming from customers upgrading their white goods as people are working from home. Premium products across categories are witnessing higher demand as compared to entry-level products.

Whirlpool has expanded its product portfolio in recent years. It entered the water purifiers segment in 2018 and recently added cooktops with the acquisition of Elica PB India. The complete range of products is manufactured in-house at its three factories with 95% components sourced locally. This sets it apart from peers that are dependent on contract manufacturers.

Fund managers who increased their holdings in Whirlpool

Buyers for Whirlpool this month included Anand Radhakrishnan and R Janakiraman for Franklin India Flexi Cap Fund Growth scheme, R. Janakiraman and Mayank Bukrediwala for Franklin India Prima Fund Growth scheme Mahesh Patil for Aditya Birla Sun Life Frontline Equity Fund Growth scheme and Anand Radhakrishnan and R. Janakiraman for Franklin India Taxshield Growth scheme.

Siemens - Rising government infrastructure spending opens up new opportunities

Siemens India, is an integrated technology provider and a leading powerhouse in electronics and electrical engineering. Siemens’ strength lies in energy and infrastructure including transmission and distribution, automation, urban infrastructure, and other business. Siemens’ revenues in Q2FY22 stood at Rs 4.358 crore and are the highest in the last ten quarters.

The announcement of increased government spending on Indian infrastructure and the revival of key sectors such as construction, mining, capital goods and automobiles are opportunities going forward. One such project recently bagged by the company in December 2021 is Pune Metro project with an order size of Rs 900 crore. Siemens will provide project management, turnkey electrification, signalling, and communications for the project.

Fund managers who increased their holdings in Siemens

Shares of Siemens were added by Hiten Shah to Kotak Equity Arbitrage Fund Growth scheme Milind Bafna to Aditya Birla Sun Life Pure Value Fund Growth scheme, Rajeev Bhardwaj to Invesco India Arbitrage Fund Growth scheme, and Abhiroop Mukherjee and Siddharth Bothra to Motilal Oswal Flexicap Fund Regular Plan Growth scheme.

Graphite India - Riding the commodity cycle with higher steel demand

Graphite India is the largest Indian producer of graphite electrodes by total capacity. Its manufacturing capacity of 98,000 tonnes per annum is spread over three plants at Durgapur and Nashik in India and Nuremberg in Germany. While it manufactures a full range of graphite electrodes used in the production of steel, it stays focused on the higher-margin, large diameter, ultra-high power (UHP) electrodes.

The steel demand outlook in India for the remaining part of the year is expected to be positive with a pick-up in the infrastructure. Higher demand was witnessed in graphite electrode prices but needle coke prices continued to rise in tandem impacting margins.

Graphite India has approved a capex proposal for a 35 MW hybrid (wind and solar) renewable power plant to supply captive power to the electrode plant in Nashik. The estimated project completion period is a year from the award of the construction contract.

Fund managers who increased their holdings in Graphite India

Shares of Graphite India were bought by Aniruddha Naha and Vivek Sharma for PGIM India Midcap Opportunities Fund Regular Growth scheme, Aniruddha Naha and Ravi Adukia for two schemes, PGIM India Flexi Cap Fund Regular Growth scheme and PGIM India Small Cap Fund Regular Growth scheme, Gopal Agrawal and Sankalp Baid for HDFC Multi Cap Fund Regular Growth scheme.

Mahanagar Gas - A utilities play on clean energy

Mahanagar Gas(MGL) is a city gas distribution company and operates in Mumbai, its adjoining areas, and Raigad district of Maharashtra. CNG (compressed natural gas) sales contribute more than 70% of its total sales volume.

MGL’s CNG sales volume surpassed pre-Covid levels in Q2FY22 and is expected to grow further. However, margins are likely to reduce from higher levels in the medium term owing to the high gas cost. MGL hiked its gas prices twice in Q3FY22 due to the substantial increase in the prices of imported RLNG. MGL's input gas cost has also gone up considerably and the hike for consumers is expected to partly offset its costs.

MGL converted 2,500 commercial vehicles to CNG in Q2FY22. It plans on offering schemes to incentivize growth in this segment. MGL is in talks with Mumbai’s municipal corporation regarding retrofitting 185 BEST buses to CNG.

Fund managers who increased their holdings in Mahanagar Gas

Buyers in Mahanagar Gas included Krishan Kumar Daga and Arun Agarwal for HDFC Arbitrage Fund Wholesale Plan Growth scheme, Bhavesh Jain and Dhawal Dalal for Edelweiss Arbitrage Fund Regular Growth scheme, Karthikraj Lakshmanan and Mayank Prakash for BNP Paribas Arbitrage Regular Growth scheme, and Harshal Joshi and Arpit Kapoor for IDFC Arbitrage Fund - Regular Plan - Growth scheme.

IIFL Wealth Management - Rising client base of wealthy individuals

IIFL Wealth Management is one of the leading wealth management franchises in India. Products under its umbrella include mutual funds, AIF (alternative investment funds), and loans.

The company delivered stellar results in Q2FY22. It posted its highest revenues in the last 10 quarters at Rs 503 crore and highest profits in 10 quarters of Rs 142.5 crore during Q2. With more wealthy individuals looking for wealth management solutions, IIFL Wealth Management is gaining traction in this investor segment.

Fund managers who increased their holdings in IIFL Wealth Management

The addition of shares of IIFL Wealth Management was done by Priyanka Khandelwal and Roshan Chutkey for ICICI Prudential Banking and Financial Services Fund Growth scheme, Gopal Agrawal and Sankalp Baid for HDFC Multi Cap Fund Regular Growth scheme, Ankit Agarwal for UTI Small Cap Fund Regular Growth scheme and Taher Badsah and Pranav Gokhale for Invesco India Growth Opportunities Fund Growth scheme