By Ketan Sonalkar

The consumer durables space is one of the largest and fastest-growing segments within India’s consumer market. It consists of two main categories, home and household appliances, and consumer electronics. Major and small appliances, like air conditioners, refrigerators, washing machines, microwave ovens and vacuum cleaners are broadly classified as home appliances or white goods.

The consumer durables sector has been in the limelight ever since the government announced the production linked incentive (PLI) scheme for white goods under the ‘Make in India’ initiative. The scheme is to be implemented over a seven-year period, from FY22 to FY29 and has an outlay of Rs. 6,238 crore. This scheme has received a good response from manufacturers with a commitment of more than Rs 4,500 crore. Many OEMs (original equipment manufacturers) and contract manufacturers are gearing up to make the most out of the opportunity as well as taking steps towards reducing their dependency on imports to make products more affordable.

Provisionally selected scheme applicants include Daikin, Amber Enterprises, PG Technoplast, Hindalco Industries, Mettube India, Blue Star, Havells India, Johnson Controls, Voltas, IFB Industries, Dixon Technologies, Panasonic India, Syska LED Lights and Haier Appliances.

Changing trends in consumer demand

The consumer durables industry was doubly hit by the pandemic in FY21. Not only did demand get impacted, but gross margins also came under pressure due to rising raw material prices. However, a shift in consumer behaviour was observed from price consciousness towards technologically advanced premium products.

With work from home becoming the new norm, a lot of people operated out of their homes/hometowns and upgraded their refrigerators and washing machines. The preference for higher capacity refrigerators to store more and minimise trips to the supermarket, and an increasing focus on sanitization led to consumers purchasing washing machines with in-built heaters which can effectively remove germs.

This also helped increase sales of air conditioners as people wanted a comfortable environment for working efficiently as many were accustomed to working in air-conditioned offices. Strong demand for premium segment products was witnessed not only from the developed metro markets but also from smaller cities and towns.

Recent results resonate with growing demand in the sector

Results from companies in the sector in Q2FY22 and H1FY22 were characterised by steady top-line growth, driven by demand. The lockdown in Q1FY22 impacted the overall industry. Operating profit margins in the sector came under pressure owing to raw material inflation, particularly in Q2FY22, and it was partially offset by price increases implemented by companies.

Dixon Technologies stands out for its rising YoY revenues. It is also one of the beneficiaries of the PLI scheme. It is a contract manufacturer for Samsung, Xiaomi, Panasonic, and Philips, producing televisions, washing machines, smartphones, LED bulbs, battens, downlighters and CCTV security systems. The revenue growth is attributed to the company signing multiple agreements for contract manufacturing of consumer electronics.

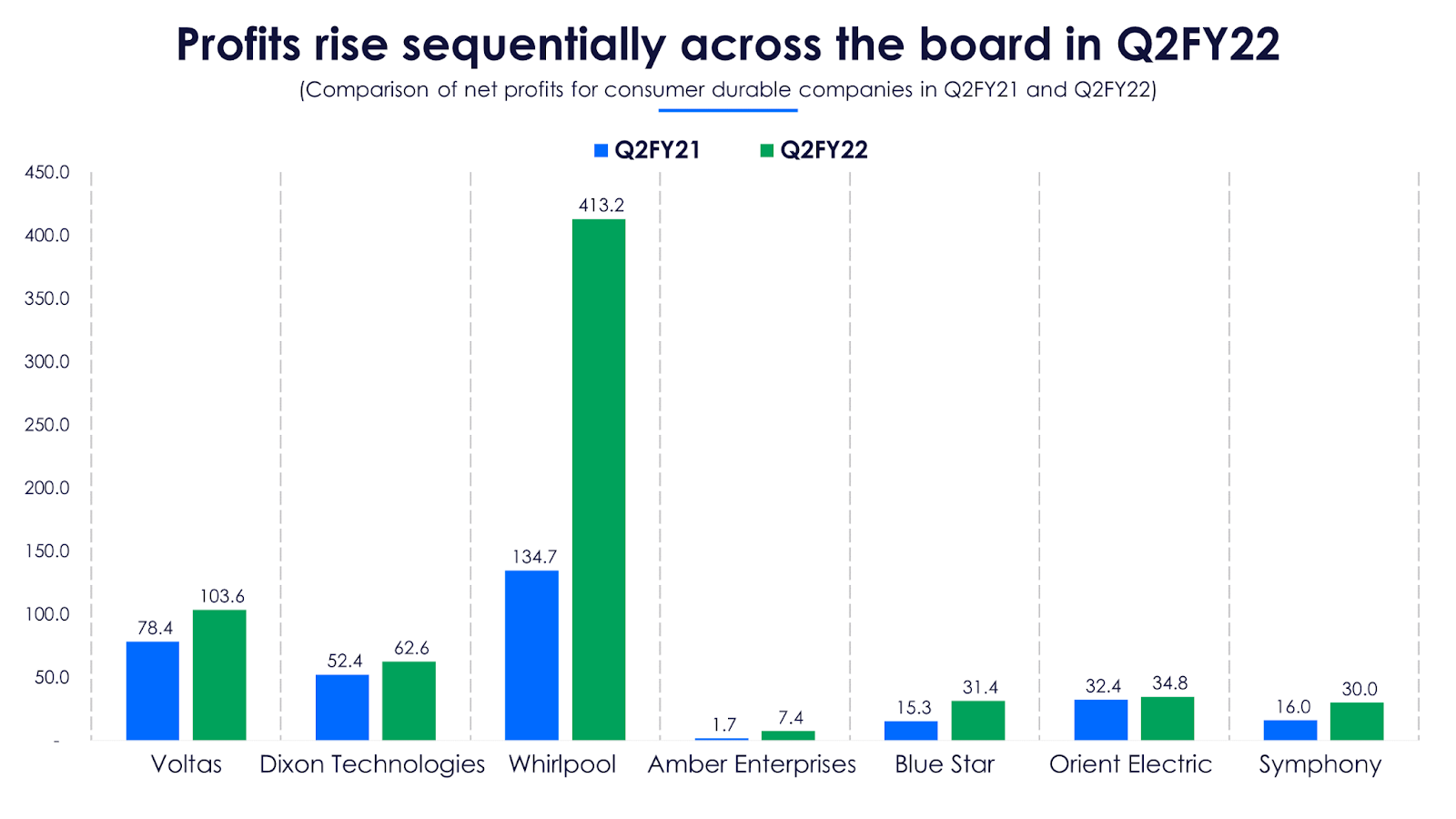

Along with revenue growth, profits have also increased for companies in this sector. They have reported higher profits in Q2FY22 as compared to Q1FY22, indicating signs of recovery in the sector.

While Whirlpool’s profits appear to have soared in Q2FY22, part of it comes from a one-time gain of Rs 324 crore from the transaction where it increased its stake to 87% from 49% stake in Elica, a manufacturer of kitchen cooktops. Even discounting this gain, it delivered YoY profits in Q2FY22, as compared to a loss reported in Q2FY21.

Air conditioners - Voltas maintains its leadership

The market for air conditioners is highly competitive and Voltas is the market leader of the segment. The third place is occupied by another listed company, Blue Star.

Typically the demand for air conditioners picks up in the months of March to June every year with the onset of summer. Due to this, Q4 and Q1 contribute higher revenues as compared to the other quarters.

Both Voltas and Blue Star have bettered their revenues and profits on a YoY basis in Q2FY22. Voltas revenues grew to Rs 1,737.3 crore from Rs 1,650.8 crore, and profits grew to Rs 103.6 crore from Rs 78.3. Blue Star’s revenues grew to Rs 1,103.5 crore from Rs 811.6 crore and profits grew to Rs 21.2 crore from Rs 7.6 crore.

Voltas registered a growth of 40% in Q2FY22 for its energy-efficient inverter AC models. The contribution of inverter ACs within overall ACs increased to 54% against 46% in Q2 FY21.

Amber Enterprises, is a contract manufacturer of AC units and components and it caters to the top ten brands in the market. Its two verticals include room air conditioners and air conditioners for mobility applications such as buses and trains. It witnessed a significant shift in revenue contribution to higher contribution by room ACs. This grew to 52% in H1FY22 from 46% in H1FY21.

Along with air conditioners, air coolers have seen a rise in demand due to people working from home. Air coolers also follow similar sales patterns as air conditioners and demand for these products picks up in Q4 and Q1. Symphony is a player in the air coolers business and in Q2FY22, its revenues grew YoY to Rs 149 crore from Rs 120 crore, while profits grew YoY to Rs 32 crore from Rs 27 crore.

Refrigerators - Higher capacity and products with premium features in vogue

More than 50% of the market share in refrigerators is dominated by two South Korean multinationals, LG and Samsung. Among the listed players, Whirlpool and Godrej together account for about 30% of the market.

In line with the trend for premium products, Whirlpool launched its 4-door 665-litre refrigerators in Q2FY22 with features such as fast freeze and ozone emitter, which reduces odour and prevents bacterial multiplication inside the compartment.

Voltas is also present in the refrigerators category with its Beko range but has a negligible market share. While Godrej is one of the oldest players in this category, it lost its market share due to its models lacking premium features and is perceived more as a mass market brand. To catch up with changing consumer preferences, it recently added premium products with ‘nano disinfection technology’ to its range of frost-free refrigerators. This technology, according to the company, uses a ‘special anti-germ nano coating’ in the air flow duct of the refrigerator, which disinfects it and controls microbial activity in the enclosed refrigerator compartment.

Contract manufacturers also play a key role in this segment. Dixon Technologies manufactures refrigerators for Panasonic and Haier along with other brands. They recently announced that they are ready to start manufacturing refrigerators (direct cool technology) with an initial capacity of 6 lakh units per annum in FY23.

Washing Machines - Trends towards advanced features and automatic machines

Like refrigeration, washing machines are also dominated by Korean multinationals. Whirlpool has the third-highest market share in this category. This is a category that is seeing upgrades from semi-automatic to fully automatic machines and machines with advanced features.

Godrej manufactures fully automatic and semi-automatic washing machines of the top-loading type. These are popular with cost-conscious customers. Recently, it added more advanced automatic front load machines catering to the premium segment.

Dixon Technologies has forayed into contract manufacturing of washing machines. It set up a new capacity in Dehradun in Q2FY22 for washing machines with a capacity of 15 lakh units per annum. The company plans to augment this capacity in FY23 taking it to a total of 24 lakh units per annum.

Will the festive season show its sparkle in Q3FY22?

The trends from the first two quarters indicate a recovery in the sector aided by the demand for technologically advanced products and the use of digital medium to acquire a customer. Ecommerce channels are observing a rise in sales of these products, which before the pandemic were mostly purchased through physical stores.

In its annual report for FY21, the Managing Director of Whirlpool, Vishal Bhola said that with people spending more time at home, they see a fundamental shift in their relationship with their home and a growing desire to improve the home environment. Home appliances are no longer seen as luxuries or a discretionary spend but as basic necessities to ensure the safety and comfort of the family.

Among the companies in this sector, Voltas has demonstrated its leadership in air conditioners and Whirlpool has a substantial market share in both refrigerators and washing machines. Contract manufacturers who received approval under the PLI scheme can be explored by investors as potential investment options. They enjoy the advantage of multiple brands and can scale up accordingly. Two new facilities for the AC component business are approved for Amber Enterprises, and consumer electronics for Dixon Technologies under the PLI scheme.

As per a report by Emkay Global, sustained offtake in premium products after the festive season and volume recovery in entry-level products are critical for revenue growth in Q3FY22. The industry had seen robust 30-50% volume growth across categories in Q3FY21.

As the results for Q3FY21 start coming in, the effect of festive season sales will be reflected in posted numbers. In the consumer durables sector, the trends and growing consumer preferences indicate that investors might be in for some pleasant surprises in the coming days.