The IPO season is chugging along, and we have another initial public offering on our plate in Star Health and Allied Insurance Co, backed by Superstar investor Rakesh Jhunjhunwala. The company is a retail-focused health insurance company and the largest private-sector pure-play health insurance firm in India (out of five) based on gross written premium.

The company’s focus on retail health insurance also makes it the largest retail health insurance company and has a nearly 31.3% share of the private pure-play health insurance market based on gross written premium.

This makes it an interesting IPO to consider for investors. But since there isn’t any listed peer for the company, it is difficult to do a peer comparison. When HDFC Ergo agreed to buy Apollo Munich Health Insurance in 2019, the latter was valued at 6.1 times its book value. When Jhunjhunwala, Westbridge Capital, and Madison Capital bought Star Health in 2018, they paid 6.5 times its book value. Analysts at Jefferies had then said that both Star Health and Apollo Health were quite richly valued. In its IPO, Star Health is being valued at 9-10 times its book value.

The issue size is up to Rs 7,250 crore, consisting of a fresh issue of shares of up to Rs 2,000 crore. Jhunjhunwala isn’t selling any of his shares, while other promoters and shareholders will sell some shares. After the IPO, the promoter holding in the company will fall to 55.10% from 62.75%.

The price band for the issue is set at Rs 870-900. The proceeds of the fresh issue will be used to augment its capital base and its solvency levels.

Forget whether this IPO is expensive or not. Considering it is backed by Jhunjhunwala, there is certainly going to be some appetite for it when it opens today. But at these prices, is this IPO worth your while?

Largest individual agent network among pure-play health insurers

One factor that works in favour of Star Health is its large agent and branch network. The company got nearly 79% of its gross written premium from individual agents in FY21. It also has one of the largest health insurance hospital networks in India of 11,778 as of September 30, 2021. It has pre-agreed arrangements with nearly 66% of these hospitals in this network. Its branches stretch through 25 states and five union territories.

The company’s gross written premium (health insurance) grew at a compounded annual growth rate of 32% to Rs 9,204 crore, while personal accident and overseas travel gross written premium grew at a 5% CAGR to Rs 1,495 crore. Retail health insurance made up 87.9% of the company’s gross written premium in FY21, while group health insurance made up 10.5%, personal accident insurance 1.6%, and overseas travel the rest.

Spike in Covid-19 claims hits the bottom line, combined and solvency ratios

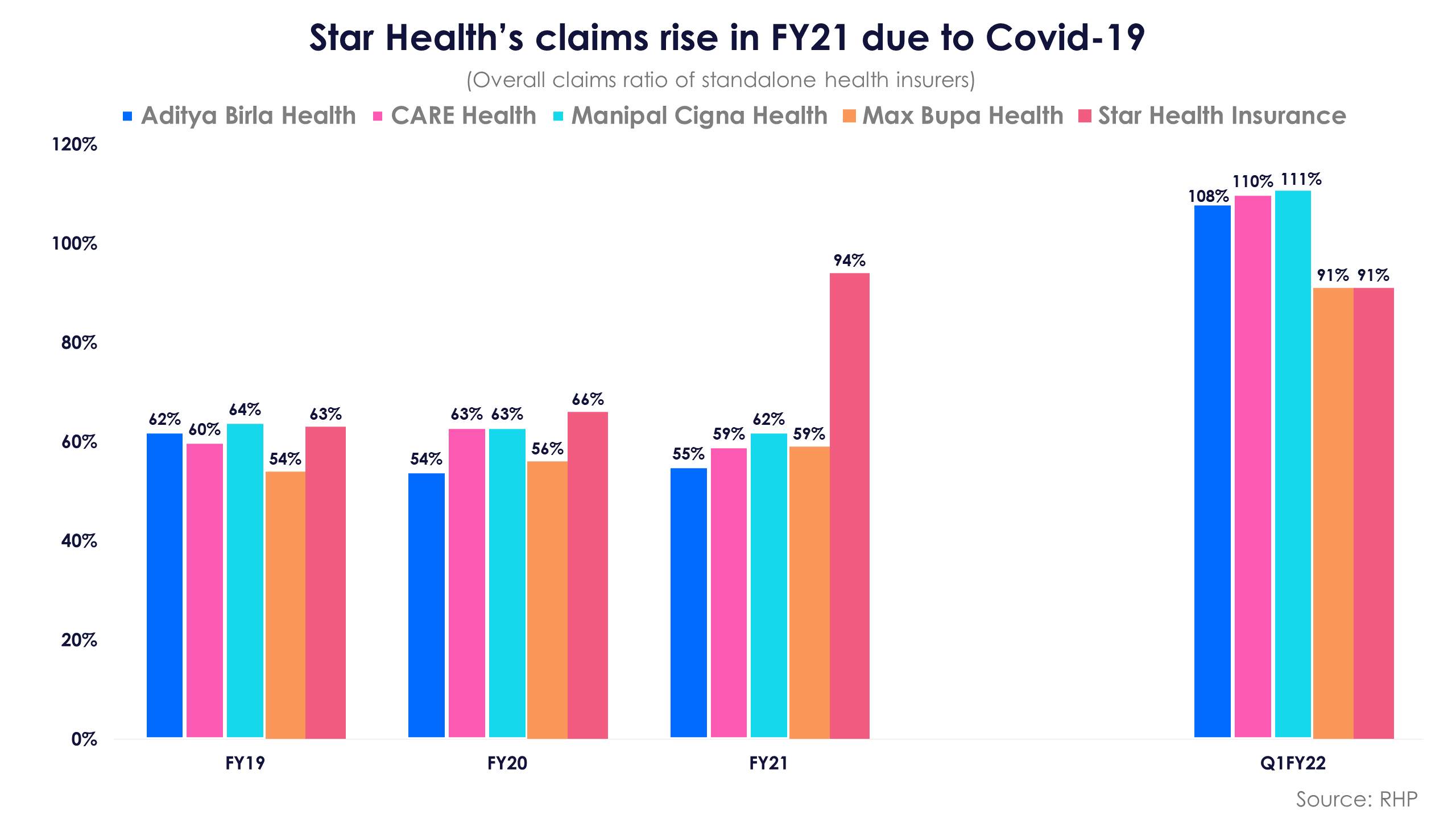

As the pandemic unfolded, the importance of health insurance became clear to many people. This also meant that there were many claims filed over the past 18 months due to Covid-19. The company spent nearly Rs 1,814.5 crore in claims due to Covid-19 in FY21 and this has already touched around Rs 1,639 crore in H1FY22. The claims ratio (net incurred claims divided by net earned premium) gives a better picture of how the business changed over the past 18-21 months.

The retail focus of the company probably led to this huge spike in claims in FY21. Some of its pure-play health insurance peers also saw their claims ratio rise beyond 100% in Q1FY22, which doesn’t bode well, but Star Health’s claim ratio was below 100%.

The retail focus of the company probably led to this huge spike in claims in FY21. Some of its pure-play health insurance peers also saw their claims ratio rise beyond 100% in Q1FY22, which doesn’t bode well, but Star Health’s claim ratio was below 100%.

In FY21, due to lockdowns and the Covid-19 scare across India, many people didn’t go for hospitalisation or elective procedures that were non-Covid-19 related. This meant that the company posted a net profit in H1FY21 compared to a loss in H1FY22 when the spike in Covid-19 cases during the second wave saw a huge rise in claims paid out.

The company’s large claim payouts also dented its cash flows during H1FY22, which resulted in negative operating cash flows.

The company’s large claim payouts also dented its cash flows during H1FY22, which resulted in negative operating cash flows.

The higher claims also hit the company’s efficiency in underwriting claims, with its combined ratio (claims incurred + expenses as a proportion of premiums received) being higher than 100%. This means that the company was paying out more than what it is getting into the business.

The higher claims also hit the company’s efficiency in underwriting claims, with its combined ratio (claims incurred + expenses as a proportion of premiums received) being higher than 100%. This means that the company was paying out more than what it is getting into the business.

This means that the company wasn’t making an underwriting profit during this period.

Higher claims paid also hit the company’s solvency ratio. Solvency ratios show whether the company has enough funds to pay its liabilities. The company will use the proceeds of the fresh issue from the IPO to shore up its capital base. Regulations need the company to maintain a solvency ratio of at least 1.5 times.

Higher claims paid also hit the company’s solvency ratio. Solvency ratios show whether the company has enough funds to pay its liabilities. The company will use the proceeds of the fresh issue from the IPO to shore up its capital base. Regulations need the company to maintain a solvency ratio of at least 1.5 times.

Investors should gauge whether they want to use Star Health Insurance (market leader in retail health insurance) as a play on the future growth in the health insurance market in India. CRISIL Research expects the health insurance market to grow at a CAGR of 18% from FY21-25 to Rs 1.14 lakh crore in terms of gross written premium. India is an underpenetrated market for health insurance, and the Covid-19 pandemic has made its utility pretty clear.

Investors should gauge whether they want to use Star Health Insurance (market leader in retail health insurance) as a play on the future growth in the health insurance market in India. CRISIL Research expects the health insurance market to grow at a CAGR of 18% from FY21-25 to Rs 1.14 lakh crore in terms of gross written premium. India is an underpenetrated market for health insurance, and the Covid-19 pandemic has made its utility pretty clear.

Based on previous large deals in the pure-play health insurance space, this company is definitely richly valued but has a significant market share in its space. This high market share will probably pique some investor interest in this IPO. The fact that the company doesn't have any listed peer might just work in its favour in terms of valuation.