Polycab India is the largest manufacturer of wires & cables in India. The company also entered the fast-moving electrical goods (FMEG) space in 2014 and is growing through new product launches and dealer additions across the country.

Since its listing on stock exchanges in April 2019, the stock has delivered 4X returns for investors, and comparing data for the past one year, it has delivered returns higher than its peers in the electrical wire and cables industry.

The Q2FY22 results saw a resurgence in demand post a subdued quarter impacted by the second wave of the pandemic.

The wires and cables industry is a beneficiary of the recent development of power generation, distribution infrastructure, urbanisation, and smart cities, and comprises nearly 40 percent of the electrical industry in India.

Quick Takes

-

Highest ever quarterly revenues of Rs 3,016 crore in Q2FY22

-

Wires and cables business grew 63% YoY to Rs 4,134 crore in H1FY22 from Rs. 2,534.3 crore in H1FY21 due to improved demand

-

FMEG business grew 40% YoY to Rs 534.8 crore in H1FY22 from Rs. 381.8 crore in H1FY21 with growth across product categories

-

Polycab acquired 100% stake in Bengaluru-based automation company, Silvan Innovation Labs for Rs 18.2 crore in June 2021

-

The company signed an agreement for hiving off its underutilised subsidiary Ryker Base with Hindalco Industries in November 2021

Resurgence in demand in Q2FY22 after a tepid quarter

Polycab reported its highest ever quarterly revenues in Q2FY22 at Rs 3,016 crore. This assumes significance with the background of the previous quarter which was severely impacted by the second wave of the pandemic. Polycab is the market leader in the wire and cable space with a market share of 22% in the organised market. The results reflect the growing demand of the company’s products across segments and geographies.

Input cost pressures hemmed in the growth in profits as prices of the majority of Polycab’s raw materials prices saw inflation. This has been a growing concern across the industry, largely affecting unorganized players who were unable to absorb the input costs resulting in increasing market share of large organised players like Polycab.

Input cost pressures hemmed in the growth in profits as prices of the majority of Polycab’s raw materials prices saw inflation. This has been a growing concern across the industry, largely affecting unorganized players who were unable to absorb the input costs resulting in increasing market share of large organised players like Polycab.

Wires and cables continue to contribute to the majority of the revenues. The growing demand across sectors like energy, real estate and demand for reliable, efficient energy as well as data communication is driving this industry. Polycab supplies cables across industries like power, oil and gas, construction, railways, telecom and real estate, and most of these sectors are seeing recovery post the second wave of the pandemic.

The contribution of the FMEG segment which was 5.5% about five years ago, has now doubled to 11.5%. The revenues from this segment have consistently increased over the last five years and crossed Rs 1,000 crore in FY21. The FMEG business segment revenue grew by 40.6% YoY to Rs 342.9 crore in Q2FY22. Seasonality factor has affected the performance of fans business while lights, switches, conduit pipes and pumps posted healthy growth. Other businesses including switchgear, solar, and water heaters grew 2X on last year’s low base.

The contribution of the FMEG segment which was 5.5% about five years ago, has now doubled to 11.5%. The revenues from this segment have consistently increased over the last five years and crossed Rs 1,000 crore in FY21. The FMEG business segment revenue grew by 40.6% YoY to Rs 342.9 crore in Q2FY22. Seasonality factor has affected the performance of fans business while lights, switches, conduit pipes and pumps posted healthy growth. Other businesses including switchgear, solar, and water heaters grew 2X on last year’s low base.

Since its foray into the FMEG segment in 2014, Polycab focused on products based on upcoming trends. It introduced products like energy efficient fans, and modular switches. It added LED lighting products in 2017 which are being actively promoted by the government as well as being adopted with rising consumer awareness of energy efficient lighting.

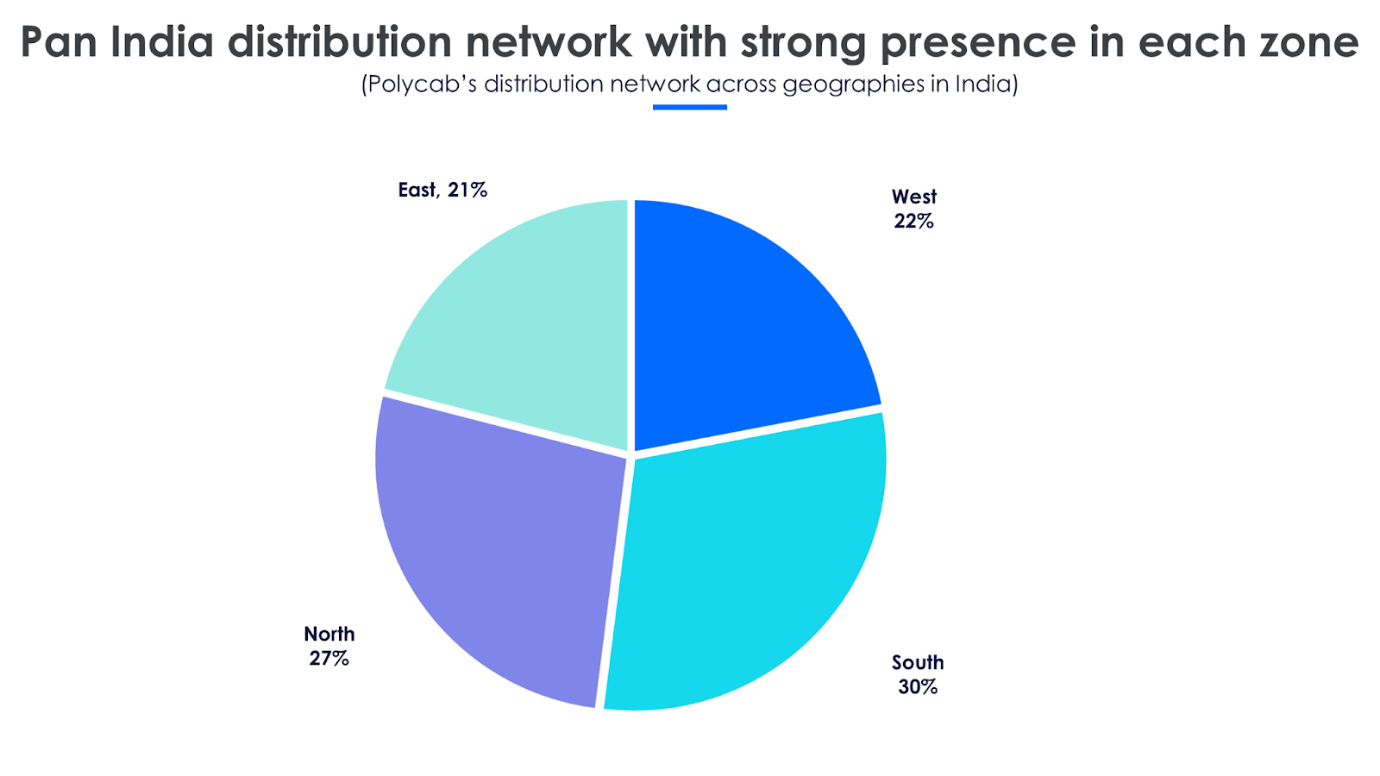

Key factors for growth of the FMEG segment include inhouse manufacturing and strong distribution network for FMEG products covering geographies across India. About 20% of distributors sell wires and cables along with FMEG products, while 52% of distributors exclusively sell FMEG products. Apart from this, branding exercises have helped in brand recall with the use of cine actors for campaigns across print, television and social media. The advertising and sales promotion is now focused on increased advertising on social media and sales promotion.

Hiving off an underutilized subsidiary will reduce debt on the books

As part of its backward integration strategy, Polycab bought Ryker (Ryker Base Pvt Ltd) in May 2020 for the supply of copper rods, a key raw material for all its products. Ryker's total annual capacity is 225,000 MT (metric tonnes), while Polycab’s current demand is in the range of 70,000 - 75,000 MT, leading to underutilisation of the plant. Considering the suboptimal utilisation of capacities and its decision to focus on its core business, Polycab decided to exit this venture.

Polycab signed an agreement with Hindalco Industries, via its wholly-owned subsidiary, Renuka Investments and Finance Limited to divest the entire stake in Ryker at an enterprise value of Rs 323 crore. The cash received from this deal will help Polycab reduce debt.

In order to ensure the continued supply of copper rods, the company entered into a multi-year tolling arrangement with Hindalco where Ryker will continue to process and supply high-quality copper rods on mutually beneficial commercial terms. Polycab expects this merger transaction to complete by December 2021, subject to fulfillment of certain conditions by both parties.

Acquisition of home automation company to widen FMEG portfolio

Polycab entered the home automation space with its brand ‘Hohm’ in 2020. It has taken a step further in strengthening this segment with the acquisition of Silvan Innovation Labs in June 2021.

Polycab has signed an agreement to acquire 100% stake in Bengaluru-based automation company, Silvan Innovation Labs for Rs 18.2 crore. Founded in 2008, Silvan is one of the pioneers in the concept of home automation in the Indian residential market with a proven track record with many real estate developers.

Polycab’s acquisition of Silvan gives it a boost in the home automation segment, augmenting its FMEG offerings. Silvan’s internet of things (IOT) based automation products and solutions portfolio includes lighting management systems, room automation, temperature control devices, contactless controls, curtain control, security devices among others.

On this acquisition, Chairman of Polycab Inder T. Jaisinghani said that the company's ambition is to become a consumer-centric company and the addition of the IoT portfolio aligns with a strategy to address evolving consumer needs.

Polycab laid out its five-year roadmap with the project ‘Leap’ in FY21 annual report. Under this project, it aims to achieve a revenue of more than Rs 20,000 crore by FY26. This project covers an all round development of the operations in terms of operational efficiency, market reach, increase in capacity, wider distribution network, digital transformation, and strong ESG compliance. It aims to grow its retail wires business by more than 1.5x and FMEG business by 2x over the next five years.

Polycab is well positioned with leadership in wires and cables. The FMEG segment is gaining market share over the past few years. Decisions like hiving off the copper rod production subsidiary and expanding FMEG with futuristic IOT products is bound to have an impact on the topline as well as bottomline in coming quarters. Among the players in this segment, Polycab looks currently poised to retain its leadership position in the sector.