By Ketan Sonalkar

ICICI Prudential Life Insurance (ICICI Pru Life) presented its Q2FY22 results, post the second wave of Covid-19. The first two-quarters of FY22 saw huge covid related claims accompanied by an increase in penetration of insurance cover. Claim provisions, as well as new products with Covid-19 cover, are changing the dynamics of the insurance industry.

In such a scenario, ICICI Pru Life posted its highest ever Q2 revenues. It also improved its score on industry-specific metrics and is gaining market share among private life insurance companies.

Quick Takes

-

ICICI Pru Life clocked highest ever Q2 revenue in Q2FY22 at Rs 772.6 crore

-

Total claims on account of second wave in H1FY22 stood at Rs 1,879 crore

-

The company's absolute VNB (value of new business) grew 45% YoY to 873 crore for the first half of FY2022

-

More than half of the sales in Q2FY22 were contributed by linked policies (unit linked insurance plans)

-

The annuity business segment witnessed strong growth of 95% YoY in H1FY22 to Rs 1,347 crore

Strong quarter with contributions from all channels

ICICI Pru Life has the distinction of achieving its highest ever Q2 revenues in Q2FY22, since its inception. Historically in a given financial year, Q4 is the highest revenue contributor for any insurance company, with large numbers of policies purchased for income tax benefits before closure of the financial year.

ICICI Pru Life’s Q2FY22 revenues surpassed Q4FY21 revenues, setting the expectation of exceeding these numbers in Q4FY22.

Quoting the management on the results, “Significantly, we posted our best-ever September on monthly sales for any year since inception. Our new business sum assured grew by 35 per cent year-on-year to Rs 3.37 trillion in H1FY22, and we continued to be the private sector leader with an overall market share of 13.2 per cent.”

Sales was led by the bancassurance channel, which contributed 39% with the channel having a total of 23 banca partnerships. This is followed by the agency channel at 24%, where another 12,000 agents were during H1FY22.

Sales of insurance products are calculated based on a metric called APE (annualized premium equivalent). APE is specifically used when sales contain both single premium and regular premium business. Single premium insurance policies require a single lump-sum payment from the policyholder.

The regular premium policies are annualized by taking the premium amount and multiplying it by the frequency of payments in the billing cycle. APE is the sum of the regular annualized premium from the new business in addition to 10% of the first single premium in a given period.

APE of linked products (unit-linked insurance plans) now stands at 51% in Q2FY22, after dipping to 44% in Q1FY22. The QoQ increase in the linked products is due to the launch of new funds, such as the balanced advantage fund and ESG (environment, social and governance) fund, which found takers in a section of the customer base.

While linked products contributed 85% in FY17, ICICI Pru Life, over the last few years, has reduced its dependence on this segment and diversified its product mix. In Q2FY22, non-linked products contributed 30%, group insurance share increased to 5% and protection products share grew to 14%. In the last few quarters, ICICI Pru Life is gaining share in the group insurance business with focus on large corporates.

VNB (value of new business) in insurance industry parlance, is a metric to measure performance of insurance companies. VNB is the profit the company makes on policies sold during the period after accounting for all the costs incurred and assuming future premium payments and mortality. In life insurance, VNB is the present value of future profits associated with new policies sold during the accounting period.

ICICI Pru Life’s VNB grew 45% YoY to Rs 873 crore in H1 FY2022. New business premium (NBP) surged 45% YoY to Rs 6,461 crore in H1 FY2022.

Improvement across insurance industry metrics and ratios

ICICI Pru Life’s solvency ratio stood at 199.9% in Q2FY22, well above the regulatory requirement of 150%. The assets under management stood at Rs 2,37,087 crore in Q2FY22, up 31% YoY.

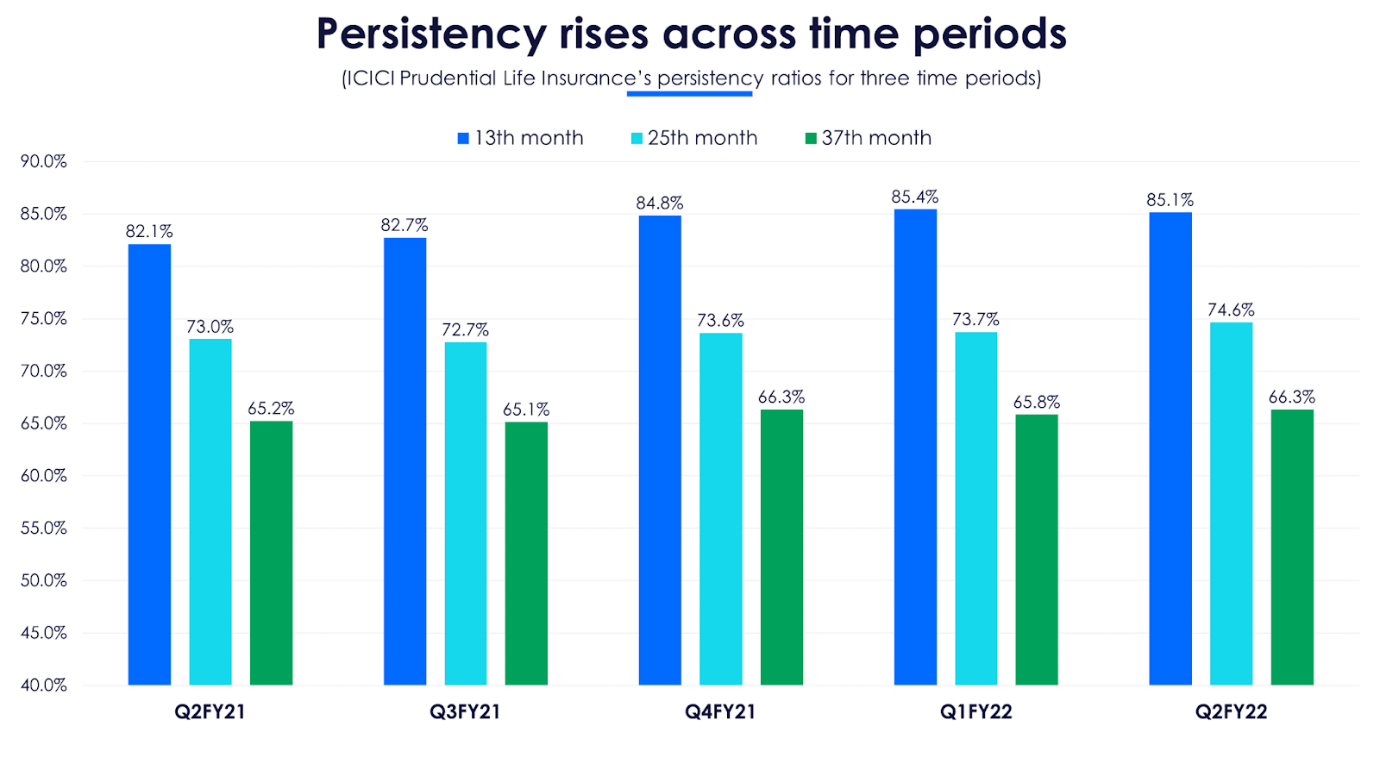

Persistency ratio is the proportion of policyholders who continue to pay their renewal premium. It helps identify the stickiness of policyholders, and whether they keep paying their premiums.

ICICI Pru Life’s 13th month persistency ratio improved to 85.1% in Q2FY22, rising from 82.1% for the same period last year. Increasing persistency ratios across time periods indicates the growing proportion of policyholders paying their insurance premiums on time. The improvement in persistency ratio is also on account of the increased awareness of life insurance after the outbreak of the pandemic.

Significant impact due to second wave of Covid-19

The pandemic unfortunately claimed many lives since its outbreak. Life insurance companies are settling massive numbers of claims due to Covid-19. The full-year claims due to Covid-19 in FY21 were Rs 354 crore. The second wave of Covid-19 which was more severe, saw ICICI Pru Life settle claims for Rs 1,879 crore in H1FY22.

Claims net of reinsurance during H1FY22 were Rs 862 crore as against Rs 198 crore in the same period a year ago. ICICI Pru Life has made a provision of Rs 412 crore for future COVID-19 claims, including IBNR (incurred but not reported).

For a given period, the total number of claims may not go reported in the same period. Insurance companies have provisions for these claims in the form of reserves such as the IBNR reserves. These reserves are also kept for situations where the existing reserves may prove insufficient for the claims that have been understated.

As an operating process, reinsurance is carried out by insurance companies to pass on part of the risk on policies covered. Reinsurance is a process whereby the reinsurer takes on all or part of the risk covered under a policy issued by an insurance company in consideration of a premium payment. It is a form of an insurance cover for insurance companies.

In a con call with analysts, ICICI Pru Life’s management said that re-insurers have indicated another price increase. It will pass on the entire hike to customers, and does not expect any material impact on margin.

HDFC Life declared its results close on the heels of ICICI Pru Life, which has fared better than HDFC Life on key metrics. In Q2FY22, ICICI Pru Life’s YoY revenue growth stood at 23.5% vs 18.4% for HDFC Life, while ICICI Pru Life’s VNB YoY growth stood at 45% as against 24% for HDFC Life.

The life insurance industry is growing at a rapid pace and ICICI Pru Life is among the top private insurance players. Whether it can further gain market share and command leadership in the sector is the next challenge for the company. With a stellar Q2FY22, investors need to keenly track the next two quarters and the litmus test for Q4FY22 would be to surpass the Q2FY22 performance.