By Ketan Sonalkar

The monthly portfolio disclosures by mutual funds gives investors an idea of what the smart money is doing in the market, and an insight into the sectors and companies that are in vogue or have fallen off the radar of fund managers. This month's screener shows some interesting data and insights. Auto manufacturers and auto component manufacturers are on the radar of fund managers. The specialty chemicals space and the insurance sector seem to be of special interest to some fund managers. There is even a ‘contra’ bet on recovery of a severely beaten down sector - multiplexes in the retail space.

HDFC Life Insurance - unexpected trigger paves the way for growth

HDFC Life is one of the first private Indian companies in the insurance business. The pandemic in FY21 gave unexpected impetus to the insurance business with the growing awareness of and need for life insurance. Not surprisingly, revenues in Q4FY21 were highest in the last eight quarters at Rs 584.9 crore. However, the company reported a 33% decline in net profit to Rs 302 crore in Q1FY22. This is due to higher claims owing to the pandemic and more provisioning to mitigate the impact of excess claims. It has set up an additional reserve of Rs 700 crore to service further claims.

The insurance industry is highly competitive and the relationship with group companies is a strategic advantage for HDFC Life. The HDFC Bank channel generates higher revenues than all the other channels viz, agency, broker and online channels. The direct online channels are also growing and will have a bigger share of the revenue pie in the near future. In an underpenetrated market like India,, there is immense scope for growth for life insurance companies and fund managers seem to be convinced by the long term prospects of HDFC Life.

Fund Managers who increased their holdings

Fund managers, Sankaran Naren, Dharmesh Kakkad & Priyanka Khandelwal bought HDFC Life through ICICI Prudential Value Discovery Fund Growth, ICICI Prudential Equity & Debt Fund Growth and ICICI Prudential Equity Arbitrage Fund Regular Growth, respectively. Mahesh Patil, who manages Aditya Birla Sun Life Frontline Equity Fund Growth, also added the company to the scheme’s portfolio.

TVS Motor- Exports help ride out rough times

TVS Motor is one of the largest two- and three-wheeler manufacturers in India. In FY21, the company started out on a muted note, but demand picked up later in the year. While Q3FY21 was strong, the company posted its highest quarterly revenues in the past eight quarters in Q4FY21. Exports played a decisive role in the revenue contribution in Q4FY21, with a YoY volume growth of 74% in exports. The company successfully entered newer export markets and currently exports to around 70 countries across the world.

TVS Motor is looking to mark its presence in the electric two-wheeler space. It launched the electric scooter iQube in Bengaluru in January 2020 adding Chennai, Coimbatore, Delhi, and Pune till July 2021. and plans are afoot to expand dealerships across 20 cities in India, and introduce electric three-wheelers in FY22. The expected recovery of domestic demand and continued performance of exports bode well going forward.

Fund Managers who increased their holdings

Fund managers Sankaran Naren, Dharmesh Kakkad & Priyanka Khandelwal bought into TVS Motor through ICICI Prudential Value Discovery Fund Growth scheme, Mahesh Patil through Aditya Birla Sun Life Frontline Equity Fund Growth scheme. Sohini Andani added TVS Motors to two schemes she manages namely, SBI Bluechip Fund Regular Growth and SBI Magnum Midcap Fund Regular Growth.

Aarti Industries - Synthesis of expansion plans and product leadership

Aarti Industries is a leader in benzene based derivatives within the specialty chemicals space. In FY21, the company started its capacity enhancement of 65 KTPA (kilo tonnes per annum) at Jhagadia and also expansion of capacity at Dahej. The company disclosed that it recently acquired 100 acres of land in Gujarat for further greenfield expansion.

The capacity expansion plans at existing units include the API plant at Tarapur, Dahej, Jhagadia and Vapi units. With a planned capital expenditure (capex) of about Rs 4,500 crore over the next three years. The management guided for doubling of the company’s turnover over this three year period. The fructification of the expansion plans will only consolidate its place within the specialty chemicals space.

Fund Managers who increased their holdings

Some of the fund managers that bought Aarti Industries were Sanjay Chawla through Baroda Multi Cap Fund Plan A Growth scheme, Mehul Dama through Nippon India Nifty Midcap 150 Index Fund Regular Growth scheme and Swapnil Mayekar through Motilal Oswal Nifty Midcap 150 Index Fund Regular Growth scheme.

Inox Leisure - The silver screen awaits a silver lining

A leading multiplex chain, Inox Leisure, was among the worst hit in FY21 due to the pandemic. The extent of the impact can be gauged from the annual revenues for FY21, which are less than half of Q4FY20 revenues. Faced with such difficult times and the onslaught of the second wave in the Q1FY22, most analysts feel that the worst may be over for this sector.

While Inox Leisure renegotiated long-term contracts for some properties, expenses for maintaining non-functional properties still persist. Its business is expected to rebound to normalcy in H2FY22. One of the reasons Inox Leisure may see a quicker revival compared to its peer PVR is the diverse mix of regional and Hindi films slated for release later in the year. Growing interest in this company from mutual fund managers appears to be a ‘contra’ bet, which might play out over time.

Fund Managers who increased their holdings

Chirag Setalvad and Sankalp Baid bought Inox Leisure through HDFC Small Cap Fund Growth scheme, and Mahesh Patil & Dhaval Shah through Aditya Birla Sun Life Multi-Cap Fund Regular Growth scheme. Manish Gunwani & Kinjal Desai bought the multiplex player’s shares in June 2021 through Nippon India Growth Fund - Growth scheme and Amit Ganatra & Sankalp Baid through HDFC Capital Builder Value Fund Growth scheme.

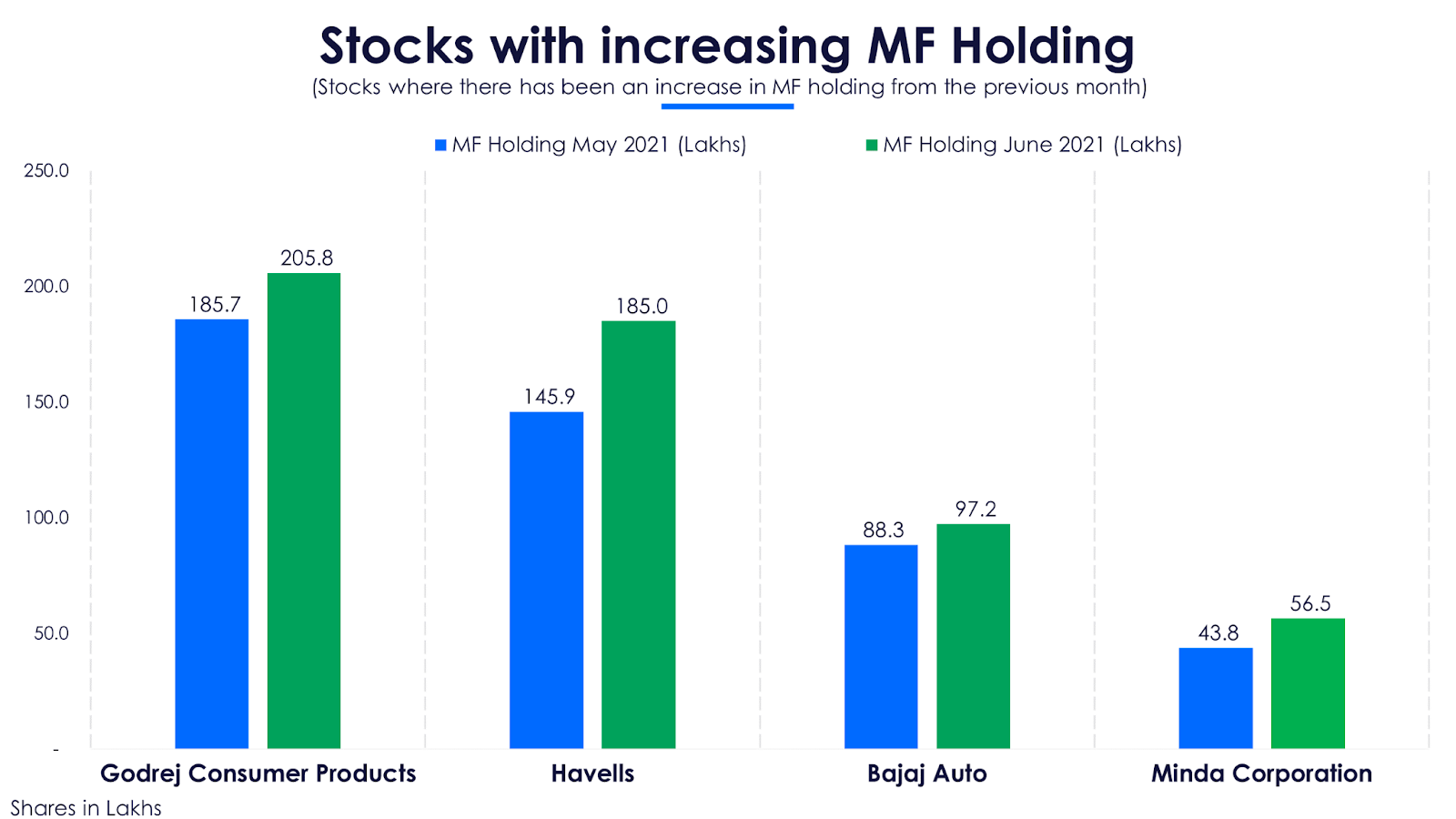

Godrej Consumer Products - High expectations from the new leader

Godrej Consumer Products, a FMCG (fast moving consumer goods) player, sells products like hair colour, household insecticides, soaps and sanitizers. With the demand for cleaning products and sanitizers getting a boost during FY21 due to the pandemic, the company registered an annual YoY revenue growth of 10.7% in FY21, clocking in revenues of Rs 11,095.7 crore. However, analysts perceived it as lagging its peers on many metrics.

That perception changed in May 2021 with the appointment of Mr.Sudhir Sitapati as the Managing Director and CEO of the company. On the day of the announcement the stock price rose a whopping 22%, a rare occurrence for a change of guard in management. Since then, the company’s stock touched its highest levels at Rs 970 a share, last seen three years ago. Fund managers seem to be betting on high performance from the new leader.

Fund Managers who increased their holdings

Krishan Kumar Daga bought Godrej Consumer Products through HDFC Arbitrage Fund Wholesale Plan Growth scheme and Praveen Ayathan & Jalpan Shah through L&T Balanced Advantage Fund Growth. Yogik Pitti bought the company’s shares through IDFC Arbitrage Fund - Regular Plan - Growth scheme and Bhavesh Jain through Edelweiss Balanced Advantage Fund Regular Plan Growth scheme in June 2021.

Havells India - Transforming itself into a premium electrical goods player

Havells India, an electrical wire maker, successfully transformed itself into a leading fast moving electrical consumer goods player. In FY21, the company posted its highest ever annual revenues at Rs 3.375.9 crore. Another highlight of FY21 is the Lloyd brand, acquired a few years ago, which delivered an 4.4% operating margin as against a negetive 2.5% in FY20. Havells India’s deep rural reach helped the company’s revenues grow in FY21. after the first lockdown was lifted in Q1FY21. The company’s increasing focus on R&D (research & development), and premium products that are energy efficient. It expects to gain a higher market share because of this new focus.

Fund Managers who increased their holdings

Hiten Shah added Havells India to Kotak Equity Arbitrage Fund Growth scheme’s portfolio while Sailesh Jain added the company to Tata Arbitrage Fund Regular Growth’s portfolio. Yogik Pitti & Harshal Joshi in IDFC Arbitrage Fund - Regular Plan - Growth scheme’s portfolio and Mahendra Jajoo & Harshad Borawake in Mirae Asset Hybrid Equity Fund -Regular Plan-Growth scheme’s portfolio.

Bajaj Auto - Premium motorcycles and exports make it a smooth ride

Bajaj Auto is a dominant player in the two-wheeler space with products across the spectrum, from commuter bikes to premium bikes. The company’ s focus on exports and premium motorcycles helped it navigate through a tough FY21. It expects to further strengthen its position in the premium segment, with upper-end Pulsars, KTMs, Dominars, Husqvarnas and the soon to be launched Triumph models through its partnership with the UK-based motorcycle maker. Exports to Africa form a largest part of the company’s volumes in FY21, and the exports to Latin America saw an YoY increase of 20% expanding the scope of exports.

Fund Managers who increased their holdings

Abhiroop Mukherjee added Bajaj Auto to Motilal Oswal Flexicap Fund Regular Plan Growth scheme and Motilal Oswal Focused 25 Regular Growth scheme’s portfolios. Hiten Shah bought Bajaj Auto to Kotak Equity Arbitrage Fund Growth scheme’s portfolio, while Sailesh Jain added Bajaj Auto to Tata Arbitrage Fund Regular Growth’s scheme’s portfolio in June 2021.

Minda Corporation - Providing key components to the auto sector

Minda Corporation (Minda Corp) makes automotive components for two-wheelers and four-wheelers. The auto industry was one of the worst affected during Q1FY21 due to the lockdown and most auto original equipment manufacturers and auto component manufacturers had minimal sales during the quarter. This quickly changed from Q2FY21 onwards with demand recovering till Q4FY21. Minda Corp posted its highest revenues in the last ten quarters in Q4FY21 at Rs 803.1 crore. Minda Corp is developing a keyless lock system for two-wheelers, which will be one of the growth drivers in the near future. Though penetration of EVs (electric vehicles) is less than 1%, the company is working on products suitable for EVs to gain an early mover advantage.

Fund Managers who increased their holdings

Milind Bafna added Minda Corp to Aditya Birla Sun Life Pure Value Fund Growth scheme’s portfolio, while K.Lakshmanan & C.Narayan added the auto component maker to BNP Paribas Long Term Equity Fund Growth scheme’s portfolio. K.Lakshmanan & Mayank Prakash bought Minda Corp to BNP Paribas Substantial Equity Hybrid Regular Growth scheme’s portfolio and Mehul Dama in Nippon India Nifty Smallcap 250 Index Fund Reg scheme’s portfolio in June 2021.