When economic activity resumed after the first Covid-19 wave in Q2FY21, the industries that benefited were cement and construction. But this bounce-back was slow, as demand for cement came back faster than supply. As the country opens up once again, how will the cement industry fare?

Looking back, normalcy resumed only in Q3FY21 after the first wave, as cement demand from the housing sector returned but supply lagged with cement production returning in fits and starts. The rise in demand was driven by rural housing due to the central government’s Rs 18,000 crore housing scheme under its ‘Atmanirbhar Bharat’ stimulus program. State governments in Maharashtra, Karnataka, and Uttar Pradesh lowered stamp duties for affordable housing projects in urban areas. This helped cement makers, as the housing sector contributes over two-thirds of overall cement demand.

Even as these demand drivers were in play, cement production was lower by 4% YoY at 80 million tonnes (MTs) in Q4FY21. Continued labour shortage and low operating capacities at cement plants resulted in staggered shift operations. But the signs were positive on all fronts heading into Q4FY21. Atul Daga, the chief financial officer of India’s largest cement maker UltraTech Cement (UltraTech) said during the Q3FY21 earnings call that capacity utilisation improved steadily in the quarter. He added that in Q3FY21, demand from rural areas and the infrastructure sector was strong and expected urban housing to gain momentum in Q4FY21.

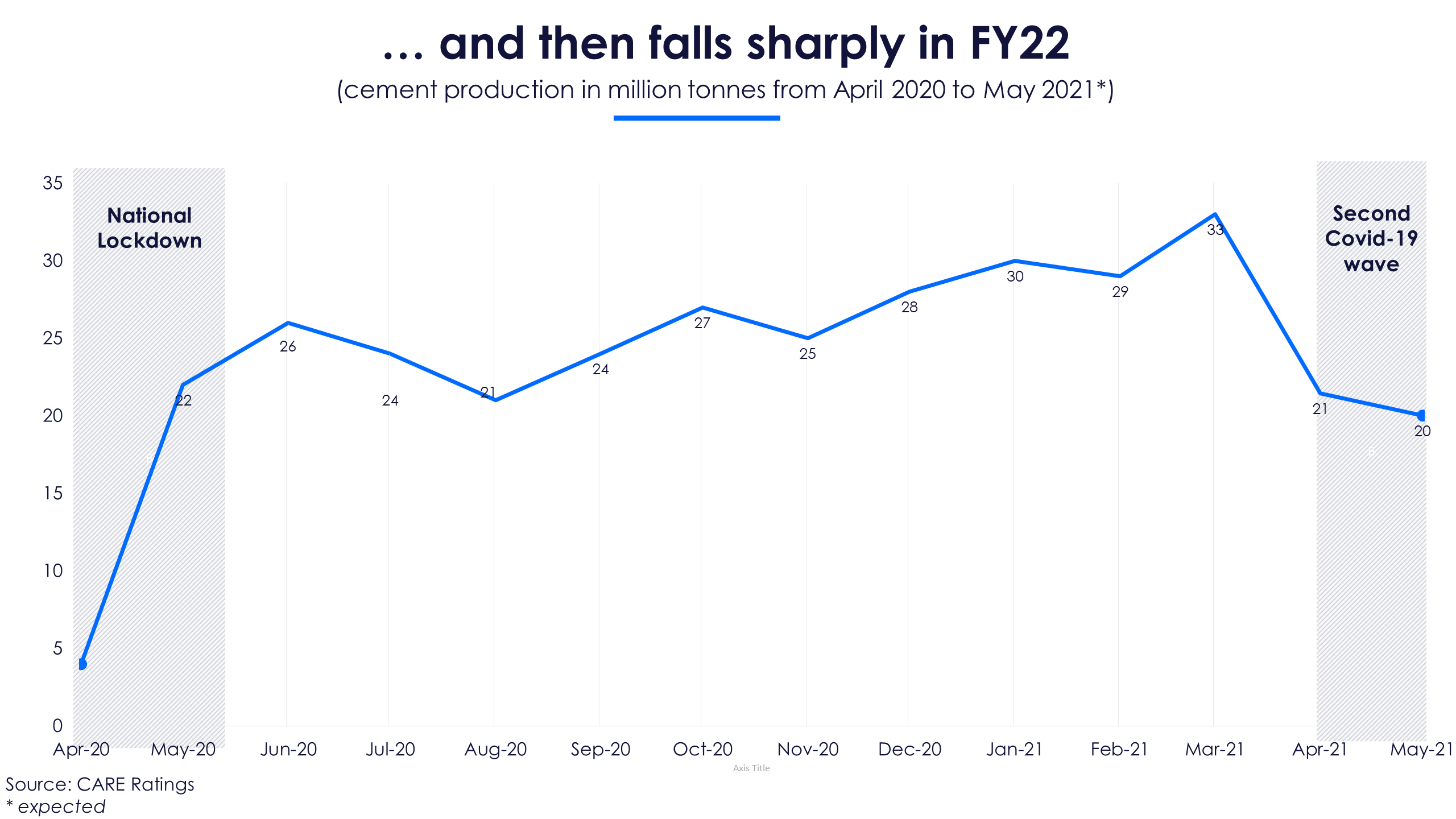

In Q4FY21, with economic activity improving sequentially, capacity restrictions easing, and the labour force returning, capacity utilisation rose to pre-Covid levels. After a 26% decline in cement production in H1FY21, the recovery in H2FY21 helped cement production decline by only 12% in FY21.

In Q1FY22, the second wave halted the cement production recovery. Several states enforced lockdown as Covid-19 cases rose. While commercial activity was permitted, cement production fell. In April, cement production was 21 MT, a 36% decline MoM. This fell to 20 MT in May as lockdowns continued. The decline however was not as sharp as what we witnessed in April 2020, during the national lockdown.

However, falling cement production is the least of the problems for listed cement companies (UltraTech, ACC, Ambuja Cements, Shree Cements). Companies are having to deal with rising raw materials costs (petroleum coke, crude petroleum, rubber, and chemicals used to make packaging materials), and rising Covid-19 cases affecting rural demand. Let’s see what might be in store for cement players in FY22.

Rising input costs and price hikes

Input costs have been rising for the cement industry since Q2FY21. This rise is led by fuel prices, mainly petroleum coke (petcoke), and coal. Fuel accounts for 13% of all costs for the cement industry. In H1FY21, due to reduced economic activity in the United States as Covid-19 cases were rising, petcoke supply was low. Since automobile sales were also muted, the demand for petroleum crude also decreased. In 2021, coal prices are rising steeply but petcoke prices are moderating.

Since sourcing petcoke was difficult, in Q3FY21 and Q4FY21, many Indian cement companies switched to coal as the main fuel source. Atul Daga of UltraTech said in January 2021 that the company reduced its dependence on petcoke and its consumption of imported coal increased. UltraTech, like many cement companies, expected coal prices to moderate by June 2021. But this did not happen.

In May 2021, as cement makers announced their Q4FY21 results, coal prices were higher by 24% since the start of 2021. As coal prices failed to moderate, cement makers expect rising fuel prices to take a toll in FY22. The management of JK Lakshmi Cement during the Q4FY21 earnings call said the impact of rising petcoke and coal prices would be felt in Q1FY22 and Q2FY22. The rising coal prices are expected to increase the operating expenses of cement companies at a time when operating expenses are already elevated.

With operating expenses rising, cement companies hiked prices in Q4FY21. This price hike was different across regions. Cement companies dominant in eastern states (Birla Corporation, UltraTech, Shree Cements, and Dalmia Bharat), hiked prices by Rs 40 per bag, and companies in the north (Orient Cement, JK Cement, JK Lakshmi Cement, and Star Cement), hiked prices by Rs 10 per bag. In Q1FY22, pan India cement prices were raised once again by 4% sequentially to around Rs 376 per bag.

The rise in cement prices is not expected to add to the cement companies’ operating margins for the first half of FY22, analysts said. This is primarily because coal prices have still not tapered. For every $10 (Rs 742) increase in the price of coal per tonne, cement companies’ costs go up by Rs 50 per bag. In Q1FY22, cement prices were hiked by Rs 28 per bag sequentially, but coal prices rose by $36 (Rs 2,670) during that time. Freight costs will also be high in the first half of FY22, due to rising diesel prices. Margins declined sequentially in Q4FY21, and are expected to contract further in Q1FY22 or in Q2FY22 due to rising fuel costs.

Cement companies have exhausted their available inventory of coal. This inventory was procured at a price of $95-100 per tonne (Rs 7,000-7,400), 12% lower than the current price of coal. Prices of coal and petcoke were volatile in Q1FY22 and this is expected to continue in the coming quarters. This is because fuel demand in China, Europe, and North America is still high. Supply to these regions from coal mines in Australia, Indonesia, and Colombia are interrupted because of geopolitical tensions, adverse weather conditions, and blockades to rail lines.

Cement companies have exhausted their available inventory of coal. This inventory was procured at a price of $95-100 per tonne (Rs 7,000-7,400), 12% lower than the current price of coal. Prices of coal and petcoke were volatile in Q1FY22 and this is expected to continue in the coming quarters. This is because fuel demand in China, Europe, and North America is still high. Supply to these regions from coal mines in Australia, Indonesia, and Colombia are interrupted because of geopolitical tensions, adverse weather conditions, and blockades to rail lines.

Cement companies are modifying kilns to use either petcoke or coal, depending on moderating prices. Mahendra Singhi, the CEO of Dalmia Bharat said in the Q4FY21 earnings call said that since both petcoke and coal prices have gone up, the cement maker’s plants have been modified to use either fuel.

What will be key for cement companies in FY22 is how they manage to shift their fuel source from coal to petcoke. These switching costs will have to be kept low as margins will continue to remain under pressure during the first half of FY22.

Rural demand hurt as Covid-19 cases surge

In the first half of FY21, demand from urban housing and infrastructure projects was minimal. This forced cement companies to look toward rural areas to support cement sales. In the Q1FY21 earnings call, the management of Heidelberg Cement said urban demand was reduced due to the national lockdown but the rural demand stayed strong.

Heidelberg Cement’s management said demand from tier 4 and tier 5 cities was high even during the national lockdown in 2020. This was because of relaxed rural lockdowns, continuing commercial activity, the central government subsidies expanding the rural jobs guarantee program, and increasing the minimum support price for crops. This demand from individual housing projects in rural areas helped cement companies’ volume recover in Q2FY21. With pent-up demand and outdoor movement rising in H2FY21, volumes continued to improve.

Economic activity was in full steam in Q4FY21, and the cement industry operated at 95% capacity. The FY22 outlook was further enhanced by the Budget 2021. Finance Minister Nirmala Sitharaman said capital expenditure for roads, highways, and infrastructure projects would be increased by 35% YoY to Rs 5.5 lakh crore for FY22. This expected demand boost came at a time when urban and rural demand beat pre-Covid levels. JK Lakshmi Cement’s management during the Q3FY21 earnings call said the Budget announcements are optimistic and they expect infrastructure demand to boost volumes in FY22. The demand impetus of Budget 2021 was expected to keep the volume growth going.

In March 2021, cement activities carried on uninterrupted as commercial activity was allowed despite rising Covid-19 cases. Cement production was 33 MT in March, a 6.4% rise MoM, and the highest in FY21.

In March 2021, cement activities carried on uninterrupted as commercial activity was allowed despite rising Covid-19 cases. Cement production was 33 MT in March, a 6.4% rise MoM, and the highest in FY21.

Initially, most cement companies felt rural demand would continue to hold strong and commercial activity would carry on in FY22. However, due to the severity of the second wave, rural areas were worse off than urban areas. Heidelberg Cement’s management, who were bullish on rural demand during the first wave, said in May 2021, that the second wave has suppressed business sentiment in rural areas which will adversely affect rural demand.

Cement companies said rural demand was very low in Q1FY22. However, some companies are expecting a normal monsoon between July to September to revive rural demand as several states begin to gradually open up. A good monsoon will lead to a healthy harvest season which will increase disposable income in rural areas. Dhirup Choudhary, the CEO of the CK Birla Group-owned cement maker HIL said during the Q4FY21 earnings call that he expects pent-up demand and the monsoon season to bring back rural demand once the second wave subsides.

Urban real estate and infrastructure to provide demand revival

Rural demand will take time to recover. Till it does, cement companies will look at urban real estate and government infrastructure projects to spur a revival in cement demand.

Urban real estate projects are still operating despite the second wave. Atul Daga said last month the urban real estate momentum of Q4FY21 continued into Q1FY22 and expects the growth in momentum to continue. The reasons for rising urban demand are stamp duty cuts, lower interest rates, and demand for more space. Real estate developers in states like Maharashtra, Karnataka, and the National Capital Region (NCR) said the second pandemic wave did not lead to construction delays like the first. This was because there were fewer restrictions on construction activities. During the first wave, capacity at real estate sites was 20-30% of overall capacity while in the second, capacity is 70-80%.

Cement companies are expecting infrastructure demand to provide the second leg of the demand revival in FY22. Demand from government infrastructure projects was steady in April and May despite the second wave. Various state governments permitted infrastructure activity and made timely payments to contractors to prevent reverse migration of labourers. This increased project executions and decreased pricing pressures.

Due to the steady labour supply, the demand from government infrastructure projects will aid cement demand in Q1FY22 and in Q2FY22. Kailash Jhanwar, Managing Director of UltraTech (which accounts for 30% of total domestic cement production by volume) said during the Q4FY21 earnings call that infrastructure projects continue to run amid state government-imposed lockdowns in Q1FY22. He said state governments allowed infrastructure activities in order to prevent reverse migration of labourers.

Dalmia Bharat’s Managing Director Punnet Dalmia said the growth in the cement market driven by urban housing and infrastructure would largely accrue to the top five cement makers. This includes UltraTech, ACC, Ambuja Cement, Shree Cement, and Dalmia Bharat. He said in the Q4FY21 earnings call, that the top five cement makers can grow by 15% in the next six to eight years.

Housing, and infrastructure demand to hold strong in FY22

The second Covid-19 wave dented the steady progress of the cement industry in Q1FY22. Production volumes dropped by 35% in April 2021, operational capacity was down to 60%, and rural cement demand fell. However, this didn’t put cement companies back to square one as it did other sectors like automobile manufacturers and FMCG makers.

Commercial activities are still carrying on even in areas with lockdowns, albeit at a lower scale. Demand from urban housing projects and government infrastructure activities is expected to ensure a swift demand recovery by Q2FY22, according to Care Ratings. This will help the cement industry grow by 7% in FY22, from an initial growth estimate of 11% before the second wave began.

Margins in the short term are likely to contract. Coal prices are not expected to come down in Q2FY22 as supply constraints in global mines still remain. Cement companies are actively switching back to petcoke from coal. Cement companies exhausted existing coal inventory in Q1FY22. Since coal prices are 12% higher than the prices at which cement companies last purchased coal, cost of production will rise in Q1FY22.

Higher fuel costs will be accompanied by lower sales volumes. This is because rural demand was muted in Q1FY22, and urban real estate and infrastructure demand will likely not make up the volumes. This suggests cement companies will see a contraction in the bottom line in Q1FY22. If the pace of the economic reopening is delayed further, the following quarters of FY22 could follow this predicament. The cement industry’s revival post the unlock in FY22 will likely not be mimicked in FY22.