By Ketan Sonalkar

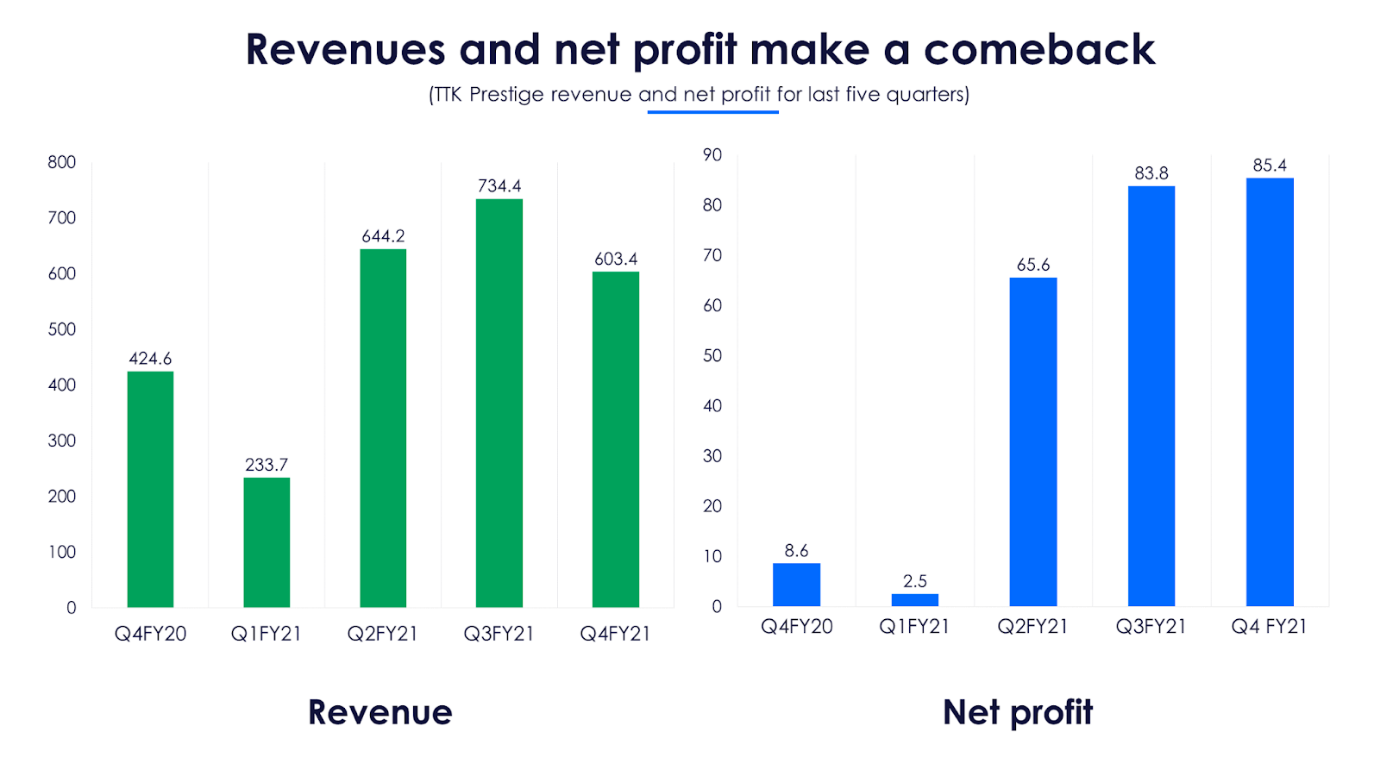

TTK Prestige had a stellar Q4FY21 and registered the highest revenue, net profit and operating profit margin of any Q4 in the history of the company. The results for this quarter assume particular significance in the backdrop of the challenges faced during earlier quarters of FY21.

The pandemic and subsequent lockdown during the first two quarters of FY21 had impacted operations as well as sales. The company took steps to combat the downturn and focused on exports, online channel sales, as well as enhancing its offline presence in under penetrated locations of north and east of India. The impact of these initiatives is reflected in the Q4FY21 results. The markets reacted positively, with the stock price surging 14% on the day results were announced.

Quick Takes

-

Revenues grew 42.1% YoY in Q4FY21 to Rs 603.4 crore from Rs 424.6 crore

-

Net profit in Q4 grew 9X YoY to Rs 85.4 crore from Rs 8.6 crore

-

Exports for the quarter more than tripled to Rs 21.9 crore from Rs 6.90 crore a year ago

-

The company’s free cash flow in Q4FY21 stood at Rs 535 crores post capex and investments in UK subsidiary

Profits surge in Q4 with operational efficiency and new products

TTK’s net profit has grown nine times YoY to Rs 85.4 crore, along with 42% revenue growth YoY to Rs 603.4 crore. Multiple factors contributed to this outcome. The company hiked the prices of its products on account of rising raw material costs, with price increases of 5-15% depending on the products.

TTK’s net profit has grown nine times YoY to Rs 85.4 crore, along with 42% revenue growth YoY to Rs 603.4 crore. Multiple factors contributed to this outcome. The company hiked the prices of its products on account of rising raw material costs, with price increases of 5-15% depending on the products.

The company introduced several new products this year and the sales of these saw an increase in Q4FY21. These include the ‘Svachh’ range of cookers, stainless steel kitchenware, cast iron cookware, and newer models of hobs. The right product mix tailored to various geographies worked well, with products accounting for the kitchen habits of the region. (eg. idli cookers in the south vs pressure cookers in the north) Reduced spending on advertising and promotions also helped improve margins in this quarter.

Exports in Q4FY21 grew YoY by 218% to Rs. 21.9 crore from Rs. 6.9 crore. TTK Prestige’s UK subsidiary Horwood achieved sales of 15.5 million pounds, a YoY growth of 3.3% against the backdrop of continued impact due to Brexit and the Covid-19 pandemic impact during FY21.

According to the management, all channels grew in Q4FY21, with offline channels growing faster than online. Offline channels are significant contributors because most customers like to ‘touch and feel’ kitchenware products before buying.These offline channels include MBOs (Multi Brand Outlets), LFS (Large Format Stores) and Prestige Xclusive franchisees. The online channels which include the e-commerce platforms contributed to 20% of total sales.

According to the management, all channels grew in Q4FY21, with offline channels growing faster than online. Offline channels are significant contributors because most customers like to ‘touch and feel’ kitchenware products before buying.These offline channels include MBOs (Multi Brand Outlets), LFS (Large Format Stores) and Prestige Xclusive franchisees. The online channels which include the e-commerce platforms contributed to 20% of total sales.

A direct rural channel, which opened towards the end of the Q3FY21 with a focus on expansion in rural markets, achieved significant growth during this quarter. The company also increased its distribution via offline channels in the north and east of India, where they had lesser presence. Most of the growth from offline channels came from the new franchisees added this quarter in tier 2 and tier 3 cities, where the company expects faster growth going forward. TTK has been focusing on expansion of its ‘Prestige Xclusive’ franchisee stores, which deal exclusively with the company’s products. The ‘Prestige Xclusive’ franchise stores now stands at 620, up from 545 last year spread across 363 towns across India.

Growth across categories add up to the topline

TTK Prestige has come a long way from being just a cooker manufacturer. It is now well diversified with products like cooking appliances, cookware, hobs, and chimneys. Cookers now contribute to 30% of its total sales. As a key product, the company has made innovations in cookers including the new range of ‘Svachh’ cookers which is a first of its kind with an anti-spill lid.

TTK Prestige has come a long way from being just a cooker manufacturer. It is now well diversified with products like cooking appliances, cookware, hobs, and chimneys. Cookers now contribute to 30% of its total sales. As a key product, the company has made innovations in cookers including the new range of ‘Svachh’ cookers which is a first of its kind with an anti-spill lid.

Among cookers, the majority of its revenues (70%) comes from aluminium cookers, while the rest comes from stainless steel or hard anodised cookers.

Managing challenges while ensuring business continuity

Following the lockdown in 2020, the company made changes and was geared up to ensure that the lockdowns in 2021 did not severely affect its operations. The lockdown in Q1FY21 upended the supply chain and the company decided to reduce dependency on imports of raw materials from China. The process began in Q2FY21 and by the end of FY21, TTK had achieved complete indigenisation of products that were previously imported from China.

Since the second week of May 2021, only two manufacturing units, at Karjan (Gujarat) and Roorkee (Uttarakhand) have been operational due to lockdowns. But according to management, the company has adequate inventory to meet market demand for the next quarter. Despite an ongoing labour strike at its Khardi (Maharashtra) factory since November 2020, the management made alternate arrangements to ensure business continuity and this has not affected production.

Strong outlook for FY22

Cookers are usually replaced in about five years or less, cookware in one or two years, and gas stoves in five years. According to the management, their products find replacements with the same set of customers as they offer them a better value proposition.

The management has guided for a CAGR growth of 15-17% over the next few years. This is on account of both replacement demand and capacity expansion of current products.

The company plans to double its capacity for cookware, and the plant should be operational within the next three months. The plant’s commissioning was delayed due to the pandemic. The capacity expansion for cookers is also under consideration by the management, but a decision, they say, will be taken only after assessment of the impact of the second wave of Covid19. There are plans afoot to double the number of suppliers for the appliances category in FY22. The company outsources the manufacturing of its appliances, and doubling the number of suppliers would strengthen this category which is currently the largest revenue generator for the company.

Can TTK Prestige maintain its leadership?

The cookware and appliances sector is highly competitive with several unorganised and organised players. Due to changes in recent years, including GST (Goods and Service Tax) and the increased role of online channels, the sector is ripe for consolidation.

In FY21 where ‘work from home’ and ‘stay at home’ became a norm for much of the year, a unique opportunity presented itself to the cookware and appliances industry. As people were forced to be home, they were spending more time in the kitchen. Cooking at home became a necessity. A natural fallout was the need to upgrade their kitchen appliances and cookware.

In FY21 where ‘work from home’ and ‘stay at home’ became a norm for much of the year, a unique opportunity presented itself to the cookware and appliances industry. As people were forced to be home, they were spending more time in the kitchen. Cooking at home became a necessity. A natural fallout was the need to upgrade their kitchen appliances and cookware.

Comparing the last quarter with the closest competitors in the listed space, Stove Kraft, Hawkins and Butterfly Gandhimathi, TTK Prestige still dominates. Its revenues in Q4FY21 are more than double of its nearest competitor. Comparing YoY net profit growth, TTK Prestige managed to grow its net profit 9X , Butterfly 2X, and Hawkins only 1.5X.

Stove Kraft operates in the same categories as TTK Prestige and a fair comparison would be at the end of FY22, since Stove Kraft listed as recently as February 2021.

The stock returns for the past few years however, show that investor confidence is higher in the challenger than the market leader. Butterfly Gandhimathi has outperformed its peers on market returns both over the past one year as well as over a five year period.

The stock returns for the past few years however, show that investor confidence is higher in the challenger than the market leader. Butterfly Gandhimathi has outperformed its peers on market returns both over the past one year as well as over a five year period.

While TTK is still dominant, it will be interesting to see if the distance between Butterfly and TTK Prestige narrows in FY22.

TTK Prestige overall managed to better its revenues in FY21 as compared to FY20, with all categories growing in a challenging year. Being a competitive sector, innovative products and strong distribution channels are imperative for staying ahead of the competition going forward.

While the company is ready with a roadmap for FY22, the main challenge for the number one player will be staying on top.