By Aakash Athawasya

UPL, the fifth largest agrochemical company in the world, had a host of problems at the start of FY21. Agricultural commodity demand plummeted in April 2020, supply chain issues curtailed agricultural exports, and its $4.2 billion acquisition of Arysta LifeSciences a year ago was not paying off. With this backdrop, UPL’s FY21 was better than expected.

The agrochemical market is cyclical, faring better during the monsoon months due to higher demand from farmers. UPL’s global customer base allows it to reap consistent revenues all year round. In the first half of the year, UPL relies on revenues from Latin America and North America, and during the second half from India and Southeast Asia.

In Q4, even as weather conditions did not suit Latin and North American farmers, the company’s revenues rose. The poor weather conditions in Q4 have continued and the company is expecting lower demand from soybean, coffee, and sugar farmers in these regions in H1FY22. However, Indian demand for agrochemical products is expected to rise due to normal monsoons in 2021 and rising commodity prices globally. Will the decline in demand in Latin and North America due to poor weather conditions take a toll on UPL in FY22?

Revenue surpasses pre-Covid levels

UPL’s Q4 revenues were Rs 12,796 crore, a 15% YoY growth on the back of strong volume growth globally. Revenues from India and Europe grew by 22% and 12% respectively, while North American revenues remained flat owing to supply chain problems.

Even with a high base in the year-ago period due to strong growth in the Brazillian business in Q4FY20, revenues surpassed pre-Covid levels in Q4FY21. Net profits rose by 74% despite the 10% decline in revenues from Brazil due to currency devaluation.

UPL’s earnings before interest and tax (EBIT) margins are cyclical because of the difference in the monsoon months between geographical regions. EBIT margins were 16.4%, a growth of 6.4 percentage points YoY due to strong growth in the India business.

Rising commodity prices will help India revenues in H1FY22

UPL’s revenues are divided between Latin America (mainly Brazil and Argentina), India, North America, Europe, and Southeast Asia. Since these regions have different monsoon seasons, the regional share in total revenue changes every quarter. In Q4FY21, 37% of revenues came from Latin America, and India contributed less than 10% revenues.

The only regional market for UPL that generates more revenues in the first half of a fiscal year than the second half is India. In FY18-22, the Indian market’s agrochemical revenue was 60% higher in H1 than H2. This is because the Indian monsoon months are from July to November, while Latin American monsoons are from November to April.

The only regional market for UPL that generates more revenues in the first half of a fiscal year than the second half is India. In FY18-22, the Indian market’s agrochemical revenue was 60% higher in H1 than H2. This is because the Indian monsoon months are from July to November, while Latin American monsoons are from November to April.

In H1FY22, UPL’s management is banking on higher demand for agrochemicals due to rising rural income and increasing commodity prices. Rural income is growing because of reverse migration, and higher disposable income due to normal monsoons in 2020. Monsoons are expected to be normal in 2021 as well, according to the India Meteorological Department.

Agricultural commodity prices have risen steadily since H1FY21 due to a resumption in production. In H1FY22, the rising price of wheat, sugar, and corn will support the demand for UPL’s agrochemicals. In H2FY22, if high prices sustain, Brazilian farmers will be incentivized to produce these commodities leading to higher demand for UPL’s products. Brazil is the largest producer of sugarcane, coffee, and the second-largest producer of soybean in the world.

Agricultural commodity prices have risen steadily since H1FY21 due to a resumption in production. In H1FY22, the rising price of wheat, sugar, and corn will support the demand for UPL’s agrochemicals. In H2FY22, if high prices sustain, Brazilian farmers will be incentivized to produce these commodities leading to higher demand for UPL’s products. Brazil is the largest producer of sugarcane, coffee, and the second-largest producer of soybean in the world.

UPL’s Indian volumes in Q4 grew by 22% YoY primarily because of growth in herbicides (40% of FY21 revenue) from sales to cotton and rice farmers. In Q1FY22, domestic cotton demand is on a downward trajectory as restricted outdoor movement lowered the demand for cotton apparel, and the labour force at cotton mills declined due to reverse migration. In April and May, cotton mills in the country operated at 25% capacity.

UPL’s Indian volumes in Q4 grew by 22% YoY primarily because of growth in herbicides (40% of FY21 revenue) from sales to cotton and rice farmers. In Q1FY22, domestic cotton demand is on a downward trajectory as restricted outdoor movement lowered the demand for cotton apparel, and the labour force at cotton mills declined due to reverse migration. In April and May, cotton mills in the country operated at 25% capacity.

On the other hand, rice demand is up in 2021. India is expected to export a record 16.2 million tons of rice (13.5% of total production) in 2021, a 12% increase over the previous year. This is due to the rising global demand for rice and reduced production in other countries. Rice-producing nations like Thailand and Vietnam experienced a drought in 2020 and their monsoon season begins only in August. Brokerages expect rising demand for rice to bode well for UPL in Q1FY22.

An area of concern for UPL is the drought in Latin and North American countries. Brazil received very little rainfall from January to April 2021 following a dry 2020. Regular rainfall will return to Brazil only in October 2021, according to meteorologists. This is expected to reduce orange, coffee, and sugar production. The management expects agrochemical demand from coffee, orange, and sugar farmers to decline, but remains optimistic on the demand from winter crops (corn and soybean) between June to September.

Soybean production in the United States is expected to be hit as the central and western regions of the country are experiencing a drought. Craig Brekkas, UPL’s North America head said this is adversely affecting the insecticide portfolio (33% of FY21 revenue).

Consolidated debt declines, cash flows rise in H2FY21

A key concern for UPL since 2019 is the piling on of debt. In February 2019, UPL acquired Arysta LifeScience, a Japanese agrochemical company for $4.2 billion (Rs 30,000 crore). This was financed through debt worth $3 billion (Rs 21,900 crore) and an investment of $1.2 billion (Rs 8,200 crore) by sovereign wealth fund Abu Dhabi Investment Authority (ADIA) and private equity firm TPG Capital. ADIA and TPG took a 22% stake in UPL Corporation, a subsidiary of UPL.

Following the acquisition, UPL’s investors were expecting the company to record strong sales growth in FY20. However, UPL’s revenues in FY20 were disappointing. UPL’s sales in the Indian, European and North American markets grew by just 7% YoY (compared to a 45% growth YoY in FY19). Investors were concerned about the slowing revenue growth amid the debt burden taken.

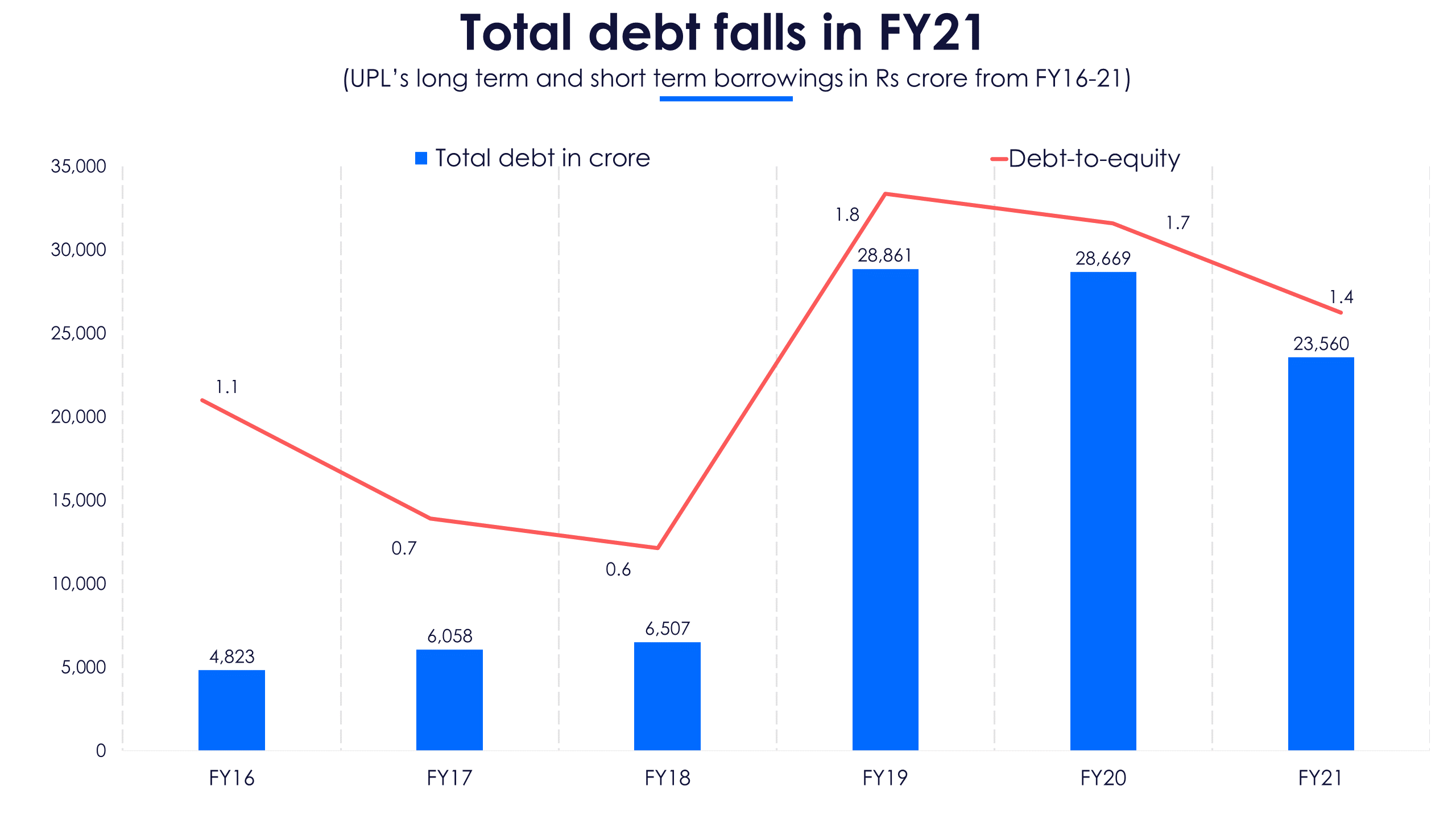

In FY21, these concerns were heightened due to Covid-19. But UPL’s strong performance in the year has allowed it to steadily repay debt. At the end of FY21, total debt was Rs 23,560 crore, a decline of 18% against the previous year. UPL’s debt-to-equity ratio in FY21 was 1.4, down from 1.7 in the previous year.

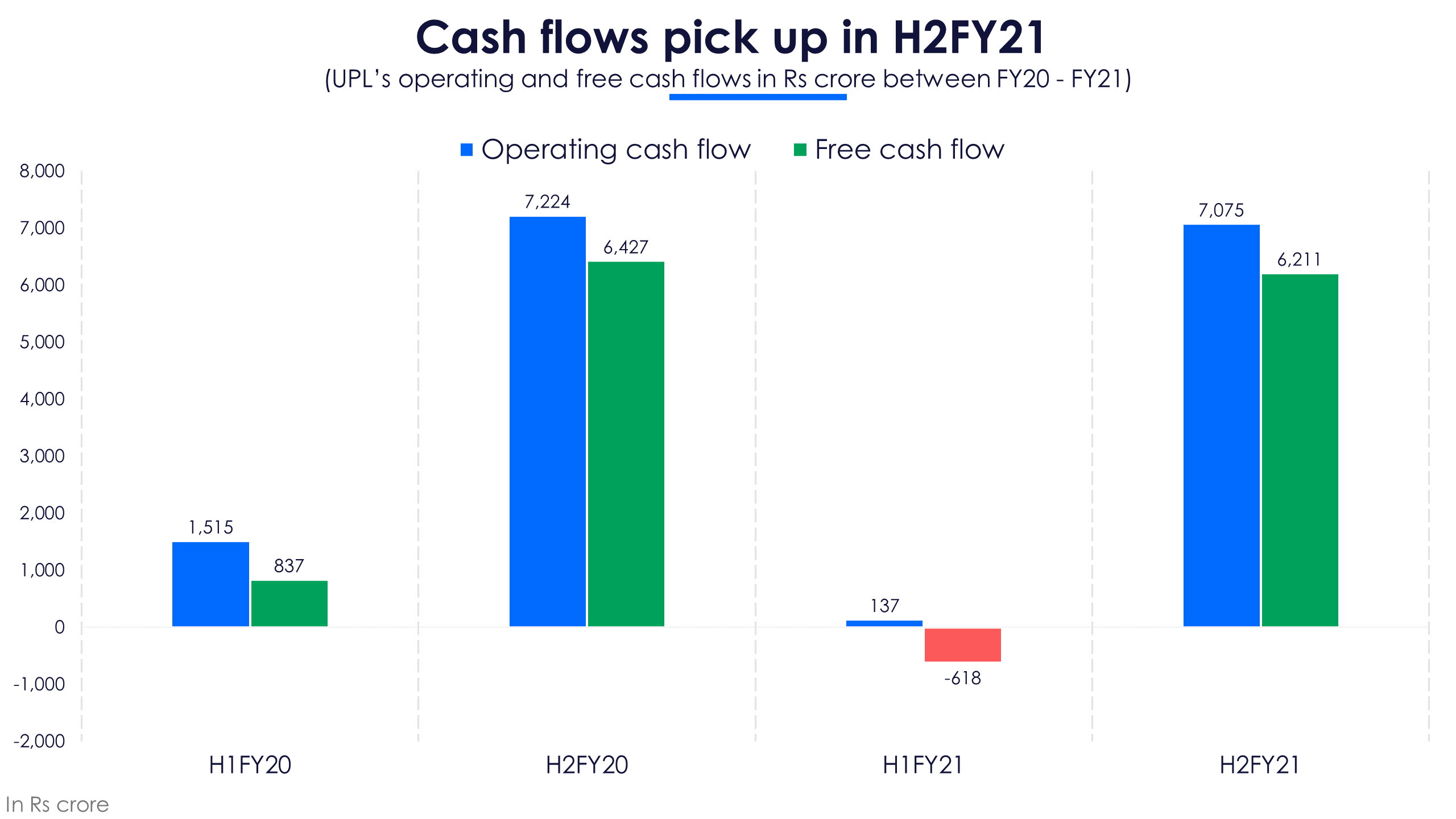

In H1FY21, UPL used free cash flows to pay back debt worth $300 million (Rs 2,200 crore). However, in H2FY21, cash flows picked up. The company has not filed cash flow statements prior to FY20.

In H1FY21, UPL used free cash flows to pay back debt worth $300 million (Rs 2,200 crore). However, in H2FY21, cash flows picked up. The company has not filed cash flow statements prior to FY20.

Capital expenditure (capex) was Rs 1,620 crore in FY21, a 10% rise YoY. The management expects the H1FY22 demand for agrochemicals in India to remain strong especially from rice, soybean, and sugar farmers. In H2FY22, if Latin America and North America receive strong rainfall, demand will shift westwards. Hoping that this will play out, UPL’s allocated capex of Rs 2,200 crore for FY22 , a 35% jump over FY21.

Optimistic rainfall estimates and commodity price rally might fall short

In April 2020, agricultural commodity prices plummeted due to declining production. Since then they have risen due to a recovery in global economic activity, returning demand, and supply chain routes opening up. Agricultural activities are allowed in various states in India despite local lockdowns. Demand for rice, soybean, corn, and sugar is rising, but cotton demand is falling. Rainfall in India is expected to be normal in Q1 and Q2, which will increase demand for UPL’s products.

If Latin America receives normal rainfall in the second half of the year, the demand from coffee, orange, and sugar farmers will return. The management expects farmers to switch to corn and soybean in the winter months. With this demand outlook, the management has given a guidance of a 15% growth in FY22 revenues and a 10% growth in EBITDA.

Two big uncertainties for UPL’s FY22 are commodity prices and weather conditions. If the unfavourable weather in Latin and North America continues and commodity prices correct, demand for UPL’s agrochemical products will fall and the revenue growth’s guidance will be well out of reach.