by Aakash Athawasya

The pharmaceutical industry has seen a rollercoaster of a year. The pandemic looked to be tailwinds for Indian drug manufacturers. But with global lockdowns causing supply-side problems, border tensions with a key raw material provider country, regulatory uncertainties in western markets, and margins tightening, the tide was turning.

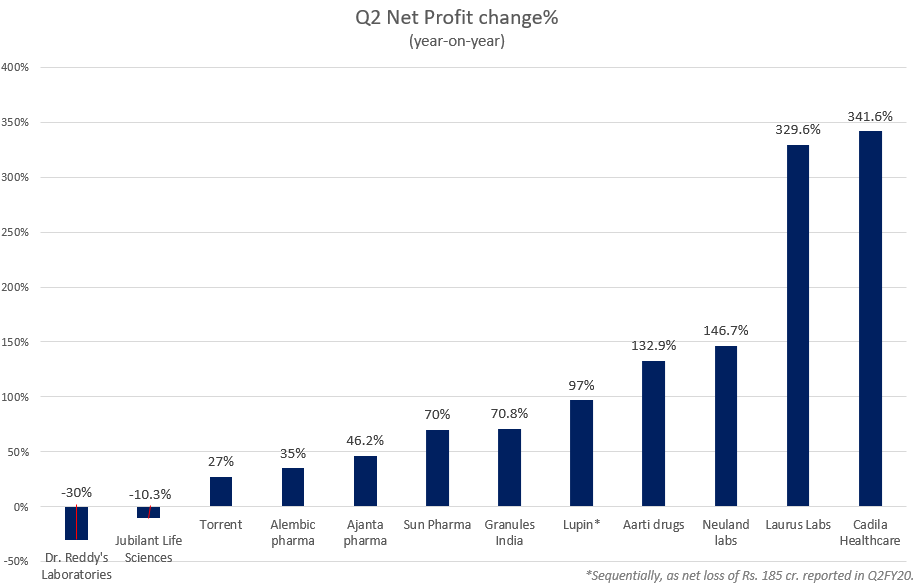

As quarterly results came in, Indian pharmaceutical companies were not just notching recoveries from the lows seen in March, but posting record numbers. Several top pharma companies saw significant net profit jumps, despite problems. However, with a second-wave of COVID-19 infections likely, countries going back into lockdown, and jittery markets, pessimism is in the air. Can the resurgent pharmaceutical industry continue its growth, or will it face headwinds heading into H2FY21?

Broad numbers

While the results of some heavyweight companies are awaited, the sense within the larger pharmaceutical market is clear. The first quarter of the FY21 was one of a ‘bounce back,’ but the second quarter will see either consolidation or reversal.

Sun Pharmaceutical Industries, the country’s largest pharma company by market capitalization, had a strong quarter. Net profits rose by 70% on a yearly basis beating street estimates, with total revenues rising by 5.3%. Torrent Pharmaceuticals reported net profits of Rs. 310 crores, a 27% jump on a yearly basis while revenues remained flat at Rs. 2,017 crores. Dr. Reddy’s Laboratories, which is working with Russia’s sovereign wealth fund to develop the COVID-19 vaccine--Sputnik-V, saw a 30% fall in net profits to Rs. 760 crores, revenues rose marginally by 2%.

Other smaller, albeit key API manufacturers like Neuland Labs, and Granules India, saw strong numbers for Q2 despite broad-based challenges like supply disruptions, and product recalls. Pharma companies that saw the highest net profit growth in Q2 were Laurus Labs and Cadila Healthcare (Zydus Cadila) reporting four-fold increases at Rs. 242.7 crores and Rs. 473.4 crores.

Data source: Company financials

Resurgent margins

With the previous quarter's stocks still in inventory, and revenues recovering with every passing month, margins were slated to increase in Q2. However, the focus was measured keeping in mind spends in R&D and CAPEX, while leaving enough free cash flows.

Granules India highlighted its key focus on improving free cash flows at the start of the fiscal, despite a drop in the same between the quarters ending March and June 2020. Receivables amounted to Rs. 158 crores, and blocked inventory at Rs. 184 crores due to supply constraints, however, the company’s management said it will clear up in 3 to 5 months.

Price increase in raw materials especially for API players is proving a negative for margins. Torrent Pharmaceuticals said last quarter that a few APIs saw a “substantial price increase,” but the same was expected to fall later in the fiscal year. On an overall basis this would eat up 1% to 1.5% of gross margin. The management of the Ahmedabad-based company said that gross margins will sustain at 72% to 73%, as the demand drop will be compensated by the price increase.

Sun Pharmaceuticals saw improving margins, particularly in the specialty products of Ilumya and Levulan, mainly administered through clinics, which have gradually opened in Q2. However, the company stated that margins have not recovered to pre-COVID levels. Overall, due to the aforementioned specialty sales and cost optimization, gross margins improved by 282 basis points on a yearly basis and 87 basis points sequentially.

China-chain

For pharmaceutical majors especially, China is a large source of raw materials. In Q2, many pharmaceutical companies made strong efforts to decrease their reliance on China. Back in June, pharma companies were given a scare when their consignments from China worth Rs. 200 crores were stuck at ports and airports.

Neuland Laboratories, for instance, faced logistical issues sourcing its raw materials from China. The Hyderabad-based API manufacturer previously sourced 45% to 50% of its raw materials from China, which dropped to 20% to 25% this fiscal year. The management is aiming to bring this down to less than 15% in the next 12 to 18 months, with the eventual target being lowering it to single digits. In the past, the company faced difficulties in restocking the anti-seizures drug Levetiracetam which resulted in a financial impact. Since then Neuland began de-risking away from China and looks to backward integrate key raw materials to avoid dependence.

Even Aarti Drugs intends to move away from being dependent on Chinese supplies. Citing the same raw materials sourcing problem, Aarti Drugs stated that generic players do not want to buy intermediates from China if the same is available in India. This is especially true among American and European customers. The company itself does not have any import reliance from China. In the quarter gone by, Aarti Drugs has been investing in import substitute products (ISPs) within R&D and has been looking for partners in Latin America, Africa, Asia, Canada, and Europe, in order to move away from China.

API-heavyweight Divi’s Laboratories is also looking to move away from China. At the start of Q2, the management stated that part of the CAPEX at Rs. 1,800 crores were dedicated to backward integrate intermediates to avoid raw materials supply dependency from China. Within this dependency, Dr. Murali Divi, the MD of the company said that India is positioned to get more opportunities from countries de-risking away from China in the custom synthesis segment, and generic products.

The sentiment in Indian pharma is to find a substitute, rather than import from China, due to the global tensions, supply issues, and volatile prices. Granules faced this issue sourcing its key starting material (KSM) para-aminophenol (PAP) for its API paracetamol.

Granules, similar to Neuland, is instead looking at alternative technology to backward integrate the raw material to avoid sourcing from China. However, no clear CAPEX or R&D spends were given for this. The management of Jubilant Life Sciences is hopeful of capitalizing on the demand that shifts to the Indian-pharmaceutical industry from the west in order to ‘de-risk’ from China. As Pramod Yadav, the CEO of Jubilant Pharma said,

‘Any movement in the US to de-risk them from the China dependency will be beneficial to the Indian industry. And within the Indian industry, the players like us who already have a large presence and the setup, will get more benefit.’

CAPEX ramp-up

Owing to higher demand expected in H2, supply-issues clearing, a global shift away from China, and returning margins, pharmaceutical companies have ramped up CAPEX spends. Most companies reiterated their guidance from Q1, while strategically investing on other growth fronts.

The anti-retroviral API and intermediate supplier Laurus Labs earmarked a CAPEX to spend of Rs. 600 crores for FY21 and FY22. In the first quarter of the current fiscal year, the company used over 30% of the annual CAPEX budget of Rs. 91 crores. The company’s CFO V Ravikumar said the annual CAPEX spend would be via brownfield expansion projects, and the same will become operational in Q2 and Q3 of the next fiscal. The CAPEX spend is expected to increase the API capacity by 20% in the next 12 months, and the formulations (FDF) capacity by 80% in the next 18 months. In Q2, the API and FDF wings generated Rs. 571 crores and Rs. 452 crores in revenue, respectively, amounting to 90% of the company’s quarterly revenue.

Forecasting a rising demand over the next few years, Laurus Labs doubled its CAPEX guidance to Rs. 1200 crores for FY21 and FY22 from Rs. 600 crores. This increase will be used for an FDF site in Hyderabad, via a greenfield project, and an API manufacturing plant in Vizag.

Similarly, Neuland Laboratories, which set aside Rs. 90 crores for the current fiscal year’s CAPEX, has seen growing opportunities. With 63% of the CAPEX budget exhausted in H1, the company’s management said in the recent earnings call that “there may be need for additional CAPEX.” However, no injection was provided in the quarter gone by. To add to this, Unit III, an API and intermediate manufacturing facility in Hyderabad, which was acquired in April 2018, began commercialization in Q2. The facility is spread across 12 acres, with 197 kiloliters (Kl) capacity, and can boost Neuland’s API capacity by 40%.

Continued R&D focus

In addition to CAPEX, R&D continues to be a focus for pharmaceutical companies. While the need to re-source raw materials and import substitutes from China through backward integration will take a few quarters to bear results, investments into R&D have already been rising among domestic pharmaceutical companies.

Sun Pharmaceuticals, the country’s largest pharmaceutical company by market capitalization, in Q1 saw Rs. 421 crores, which amounts to 5.6% of revenue cut out for R&D specifically in advancing its specialty and generic products pipeline. In the quarter gone by the R&D spend increased by 45% to Rs. 613 crores, contributing 7.2% of sales, with 37% of the same accruing to specialty products.

Mumbai-based Lupin intends to cap R&D at 10% of sales, which at the beginning of Q2 stood at 8.7%. The management previously stated that the R&D team had been resized, and are focusing on injectable and complex products, with an expected increase in the specialty front. However, they did not give any numbers. Another pharma major which decreased R&D focus was generic-giant Torrent Pharmaceuticals, recording R&D expenses at Rs. 119 crores for Q2, representing 6% of sales. This is a drop of 8.5% in R&D spending, compared to Rs. 130 crores in the year-ago period.

In May 2020, Laurus Labs announced the incorporation of Laurus Synthesis, the company’s wholly-owned subsidiary that will provide a dedicated R&D focus to its pharmaceutical wing. In Q2, the company’s management intimated that the Laurus Synthesis' R&D plant will be set up in Genome Valley, Hyderabad, and will cost the company Rs. 60 crores. The plant will be operational at the end of Q3FY22.

Aurobindo Pharma in Q1 planned on a CAPEX spend of $49 million (~Rs. 365.8 crores), with an estimate for FY21 at $200 million (~Rs. 1,493.6 crores). However, this number will increase as the company looks to partner with COVID-19 vaccine developers offering contract manufacturing. In the Q2 call, the management stated that Rs. 250 to Rs. 275 crores will be used to build a new facility by Q1FY22 to manufacture and distribute the vaccine. Aurobindo’s own vaccine development, through Auro Vaccines, its US-subsidiary in the preclinical phase.

Jubilant Life Sciences signaled an R&D spend of Rs. 500 crores for FY21, and has exhausted 14% of this amount in the first quarter. Given the larger pharmaceutical trend of increasing R&D as margins recover, and pent-up demand rises, the company expects new opportunities in contract development and manufacturing organization (CDMO), generics, and specialty. In light of the same, the management announced the strategic partnership with US-based SOFIE Biosciences through its wholly-owned subsidiary Jubilant Pharma, which will take a 25% equity stake in the company for $25 million (~Rs. 185.2 crores). The acquisition will allow Jubilant Life to grow production capacity in the theranostic pipeline and support PET manufacturing and distribution within the United States.

Another company which increased R&D based on tailwinds in the quarter gone by was Cipla. In Q1, the company recorded Rs. 200 crores in R&D expenses and the management wasn’t looking to increase the same. However, in Q2, R&D increased to Rs. 226 crores or 4.5% of revenue, as clinical trials for g-Advair, a respiratory drug, were completed. The management’s guidance for R&D spend has increased to 6%-7%, compared to 4.5% in Q2 as more clinical trials are scheduled for H2.

Pipeline expands

Several products that were expected to launch in the last quarter were pushed to Q2 due to regulatory uncertainties, and ongoing development. This coupled with product recalls saw an increase in product filings sequentially, but the guidance set forth in June was maintained.

Cadila Healthcare (Zydus Cadila), in August 2020, launched Remdesivir, a COVID-19 antiviral drug under the brand name Redmac. In June, the Ahmedabad-based company entered into a non-exclusive agreement with Gilead Sciences to manufacture and sell Remdesivir. Further, Cadila received the USFDA approval to launch Doxycycline to treat respiratory infections. In total, the company launched 6 new products in the US in Q2, filed 5 ANDAs, and received 10 approvals (2 tentative). For FY21, the guidance is 30-35 ANDA filings and 45 filings in the next year.

Sun Pharmaceuticals’ US business accounts for roughly 30% of its total sales, hence ts American pipeline bears importance. The company had 92 ANDAs awaiting approval, (20 tentative) and received 4 approvals. Further, it has 55 approved NDAs and 6 NDS awaiting approval. Sharekhan, in its report on the company, said Sun Pharma’s US specialty business, led by its product pipeline, will be a key growth driver for the company.

In Q2, Dr. Reddy’s Laboratories began work on the Sputnik-V vaccine, and it will soon start phase 2 and 3 clinical trials. For the quarter, the company launched 9 and filed 2 ANDAs with the USFDA, with the intention of launching 25+ products in the US for the year. The European business will launch 7 products, which includes 3 in Germany and 1 each in the UK, Italy, Spain, and Austria, with emerging markets pegged for 28 product launches.

Torrent Pharmaceuticals, a late entrant into the US market, will face headwinds due to issues at the Indrad and Dahej plants and hence launches will be delayed. As a result, its focus will shift to the German business following the upgrade of the quality management systems, with analysts expecting an 11% CAGR in the next three years. Its field force is back to 75% to 80% of pre-COVID levels and is expected to return to 90% by the close of Q3. It's India business which accounted for 57% of revenue had 9 launches in H1, with 4 - 5 additional launches in H2. The US business declined by 13% y-on-y and had 47 ANDAs pending approval, 1 filed with 6 receiving tentative approvals, and Levitown to launch in March 2021.

Another Indian company which licensed Gilead Sciences’ Remdesivir is Cipla, under the brand name Cipremi. This was launched in July 2020 for around $50 per 100mg vial. Speaking to Reuters, Kedar Upadhye, the company’s global CFO said, monthly volumes of Remdesivir is seeing a sharp increase since October, with no supply-side constraints. Over 3 lakh vials of Cipremi were sold in India alone by September, with Cipla looking to export the drug as well. Cipla is awaiting a response from the USFDA on its Goa manufacturing plant, following the regulator’s September 2019 inspection, and a warning letter received in February 2020. Beyond this, as of September 2020, Cipla filed 250 ANDAs with 165 approved and 19 tentatively approved with the FDA.

Analyst outlook

Before the Q2 earnings season started, analysts expected domestic pharmaceutical companies to continue from their strong performance in Q1. This was expected to be aided by the recovery in the US market, and domestic market recovery, as the economy opened up. Growing API sales due to stockpiling in the previous months were also expected to support strong topline numbers.

Nirmal Bang estimated cost optimizations to decrease on the SG&A front as doctors returned to work, expecting clinical activity to reach 50% to 75% of pre-Covid levels. This is represented in the gradual recovery of drugs supplied through doctor’s clinics. ICICI Securities expected traction in specialty chemicals, and injectables, towards which Lupin has dedicated future R&D The brokerage also expected recovery in Sun Pharmaceuticals’ dermatology segment and a 2.2% growth in the domestic formulations business.

Following the results, most brokers were positive heading into H2. Among the pharma companies mentioned above, 50 broker reports were published, with 7 recommendation upgrades against 4 downgrades. However, target prices (TP) were raised in 38 reports against 5 TP reductions. Among the companies upgraded were Sun Pharma, Torrent Pharma, Divi’s Laboratories, Cadila Healthcare, and Laurus Labs.

Below is how the broker target prices changed in rupee and percentage-terms between Q1 and Q2 reports.

Data source: Broker reports