By Melissa KoshyThe market bounced back with the Nifty 50 rising over 2% after two weeks of declines. Sentiment improved with an end to the US government shutdown, stronger-than-expected Q2 earnings, easing inflation, and the NDA’s win in the Bihar state elections.

“With inflation easing and earnings ending on a positive note, the environment remains supportive for Indian equities,” said Siddhartha Khemka of Motilal Oswal Financial Services. He added that a potential India–US trade deal could further strengthen the market.

The primary market is set for a calmer week, with just two new issues—one on the mainboard and one SME. Meanwhile, seven companies are scheduled to make their stock market debut, following six listings in the previous week.

Two mainline and four SME IPOs debuted last week

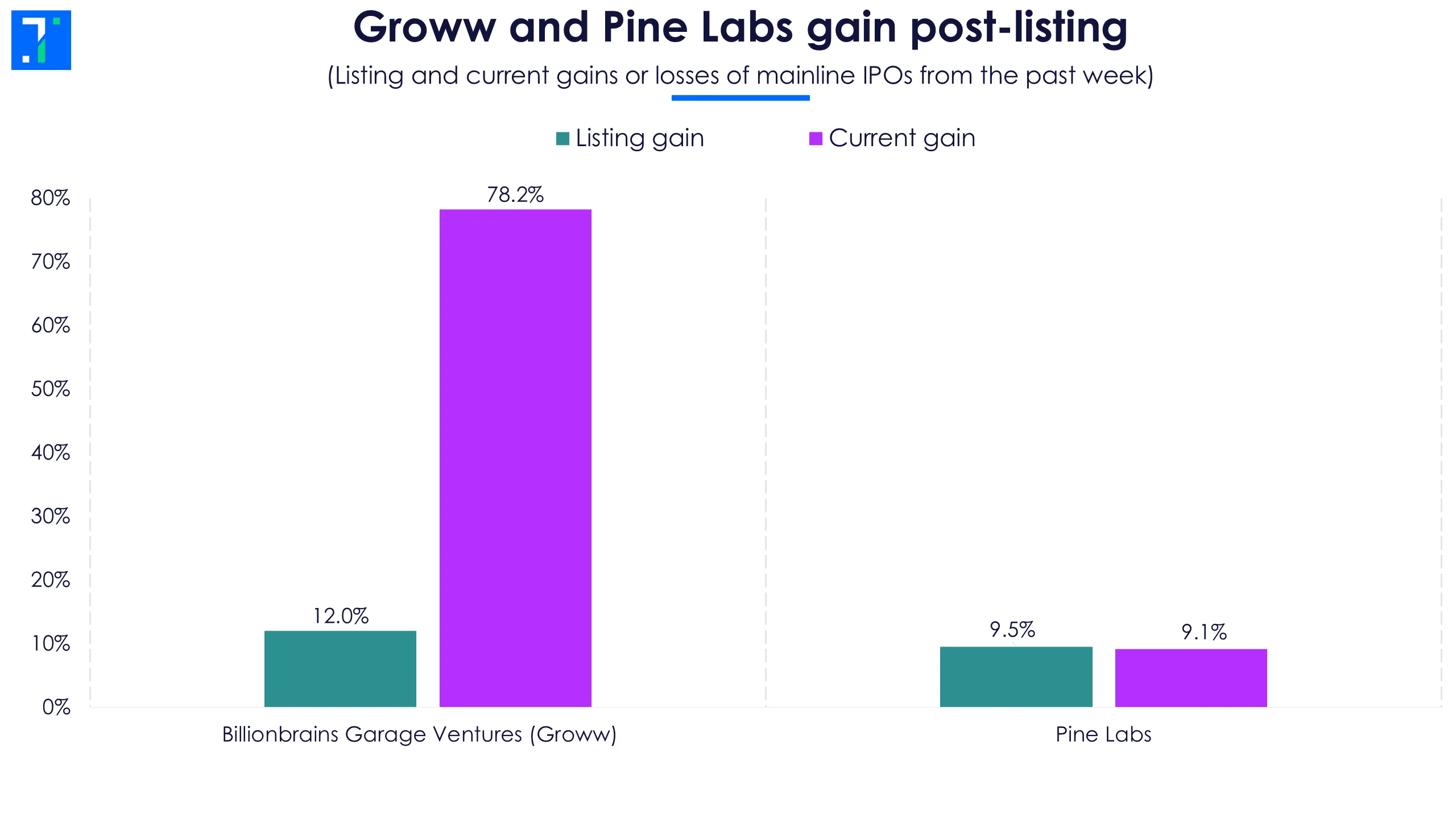

Last week saw two major listings: Groww and Pine Labs.

Groww (Billionbrains Garage Ventures) had a strong debut, opening at a 12% premium to its Rs 100 issue price. Its Rs 6,632.3 crore IPO was subscribed 17.6X. Groww offers a popular platform for investing in mutual funds, stocks, and US stocks. The stock continues to rise post-listing, now trading 78.2% above its issue price.

Pine Labs debuted on the stock market on November 14 at a 9.5% premium. Its Rs 3,899.9 crore IPO was subscribed 2.5X. The company is an Indian merchant commerce platform providing point-of-sale (POS) and digital payment solutions. It is currently trading 9.1% above its issue price of Rs 221.

Groww and Pine Labs gain post-listing

Groww and Pine Labs gain post-listing

Four SME firms also listed last week.

Shreeji Global FMCG had a difficult start and listed at a 20% discount to its Rs 125 issue price. Its IPO received a modest subscription of 3.1X. The company offers spices, grains, and other food products under its "SHETHJI" brand. It is currently trading 20.8% below its issue price.

Finbud Financial Services’ shares made their debut at a 10.6% premium after its IPO was subscribed 4.2X. It offers a loan aggregation platform that assists individuals in obtaining loans from banks and non-banking financial institutions. The company is currently trading 4.8% above its issue price.

Curis Lifesciences, a pharmaceutical company, listed at a 14.1% premium to its issue price of Rs 128. Its IPO witnessed strong demand and was subscribed 69.3X the shares offered. The company currently trades 4.7% above its issue price.

Shining Tools listed on November 14 at an 8.8% discount after its IPO received modest subscription at 1.1X. It designs and manufactures solid carbide cutting tools under the "Tixna" brand for various industries in India. The company is currently trading 17.6% below its issue price of Rs 114.

Physicswallah, EMMVEE Photovoltaic’s listings ahead

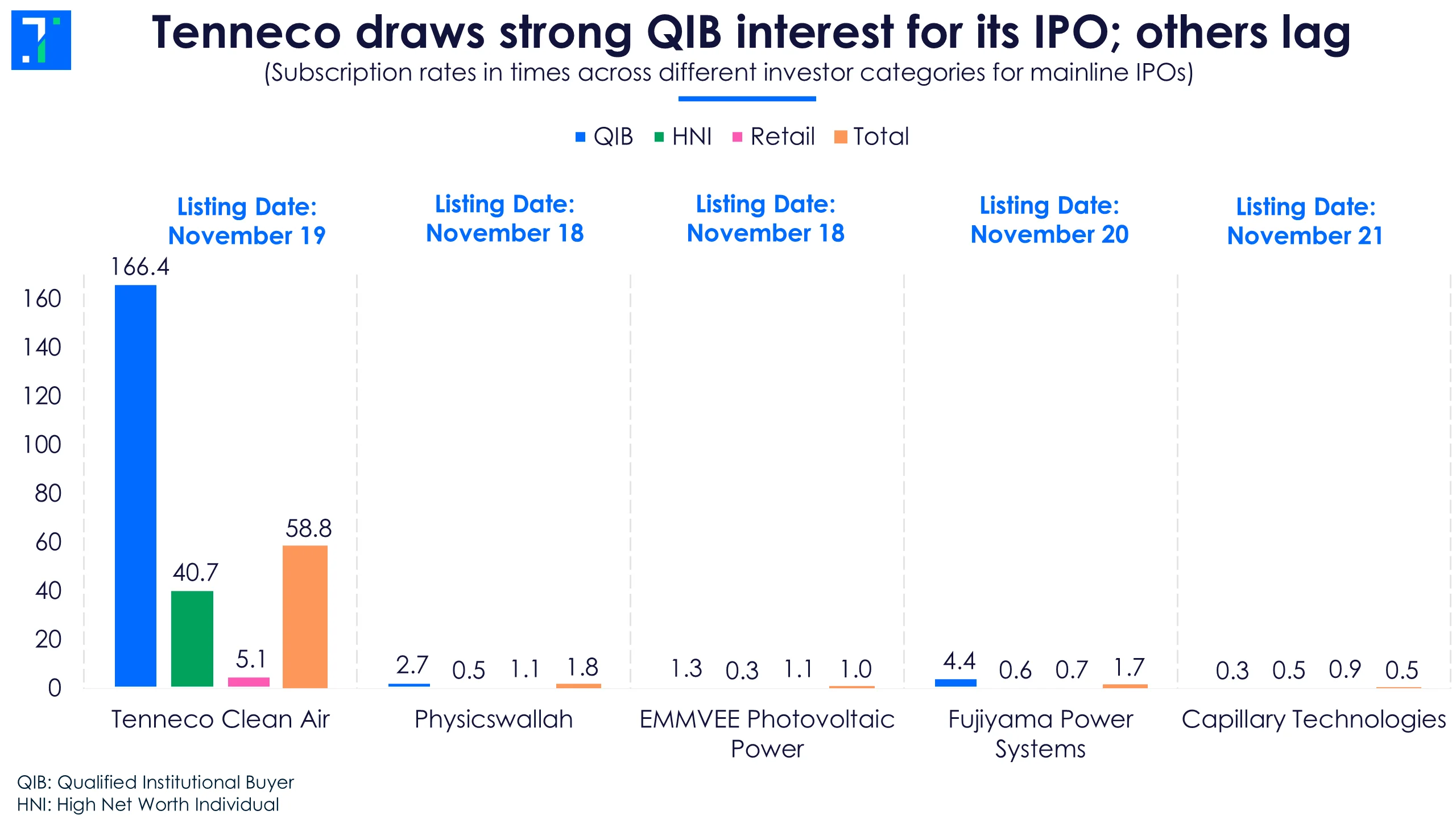

Physicswallah is an edtech company that offers test preparation courses for various competitive examinations like JEE, NEET, and UPSC, and upskilling courses like data science and analytics, and banking and finance. The company is set to list on November 18. Its Rs 3,480 crore IPO was subscribed 1.8X. However, the HNI category was undersubscribed at 0.5X.

EMMVEE Photovoltaic Power, an integrated solar PV module and cell manufacturer is set to debut on November 18, after its IPO was subscribed 1X.

Tenneco Clean Air supplies exhaust after-treatment systems. The company is set to list on November 19 after its IPO saw strong demand, with bids for 58.8X the shares on offer.

Tenneco draws strong QIB interest for its IPO; others lag

Capillary Technologies specialises in customer loyalty and engagement solutions across industries such as retail, FMCG, and hospitality. The company will make its stock market debut on November 21. As on day 2, its IPO was subscribed 0.5X.

Fujiyama Power Systems supplies products and solutions for the rooftop solar industry, offering on-grid, off-grid, and hybrid solar systems. Its IPO received bids for 1.7X the shares offered.

Two SME companies will also make their stock market debut this week.

Mahamaya Lifesciences manufactures and exports crop protection products and bioproducts. The Rs 70.4 crore IPO was subscribed 1.6X and is set to list on November 18.

Workmates Core2Cloud Solution is a cloud and digital transformation firm that helps enterprises modernise and secure their digital infrastructure. It received bids for 131.6X the shares on offer and is scheduled to list on November 18.

Calmer week ahead with two new issues

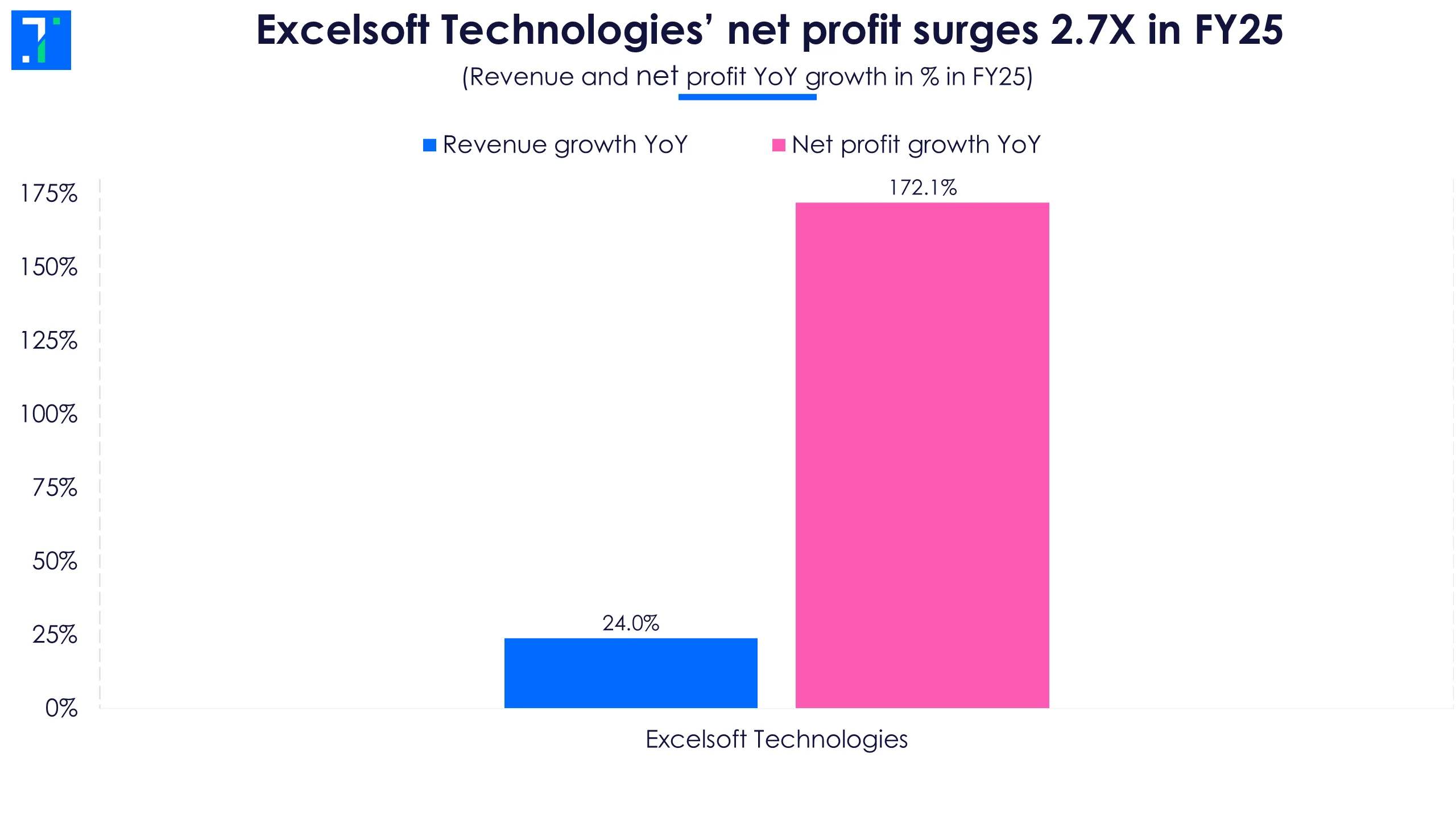

This week will see just one mainboard IPO opening for subscription, Excelsoft Technologies.

Excelsoft Technologies builds AI-powered software for education and training. Its platforms enable clients like universities, publishers, and government agencies to conduct online tests (using remote proctoring), manage digital learning content, and track student performance.

The company plans to raise Rs 500 crore, with a price band of Rs 114-120. The IPO will be open for subscription from November 19 to November 21, with the listing scheduled for November 26. It consists of a fresh issue worth Rs 180 crore and a Rs 320 crore offer for sale.

Excelsoft Technologies’ net profit surges 2.7X in FY25

Excelsoft Technologies’ net profit surges 2.7X in FY25

One SME IPO will also open for subscription this week:

Gallard Steel manufactures steel castings, serving sectors such as Indian Railways, defence, and power generation. Its Rs 37.5 crore IPO is scheduled to open on November 19, close on November 21, and list on November 26.