By Divyansh PokharnaBears hit the market last week as Nifty 50 fell 1.8% on worries of tariffs weighing on India exports. Heavy FII selling outweighed strong domestic buying, dragging down stocks across large, mid, and small caps.

India’s gross domestic product (GDP) grew a surprising 7.8% in the April–June quarter. This was higher than expected in real GDP terms - adjusted for inflation, but nominal GDP growth (expansion at current market prices) slowed to 8.8% from 10.8% in the previous quarter, showing that inflation has cooled.

CLSA has raised its GDP growth forecast for FY26 from 6.1% to 6.3%, supported by steady performance in industry and services sector. Nikhil Gupta of CLSA said, “The outlook has a downward bias because the recent growth was driven by early government spending, which may not last in the coming quarters.” He also expects the RBI to cut interest rates by 25 to 50 bps by the end of 2025.

But the action in the primary market seems to be unstoppable, as there will be eight new public issues hitting this week, including one from the mainboard segment. In addition, ten companies will make their stock market debut, following ten listings last week.

Ten new companies listed in the past week

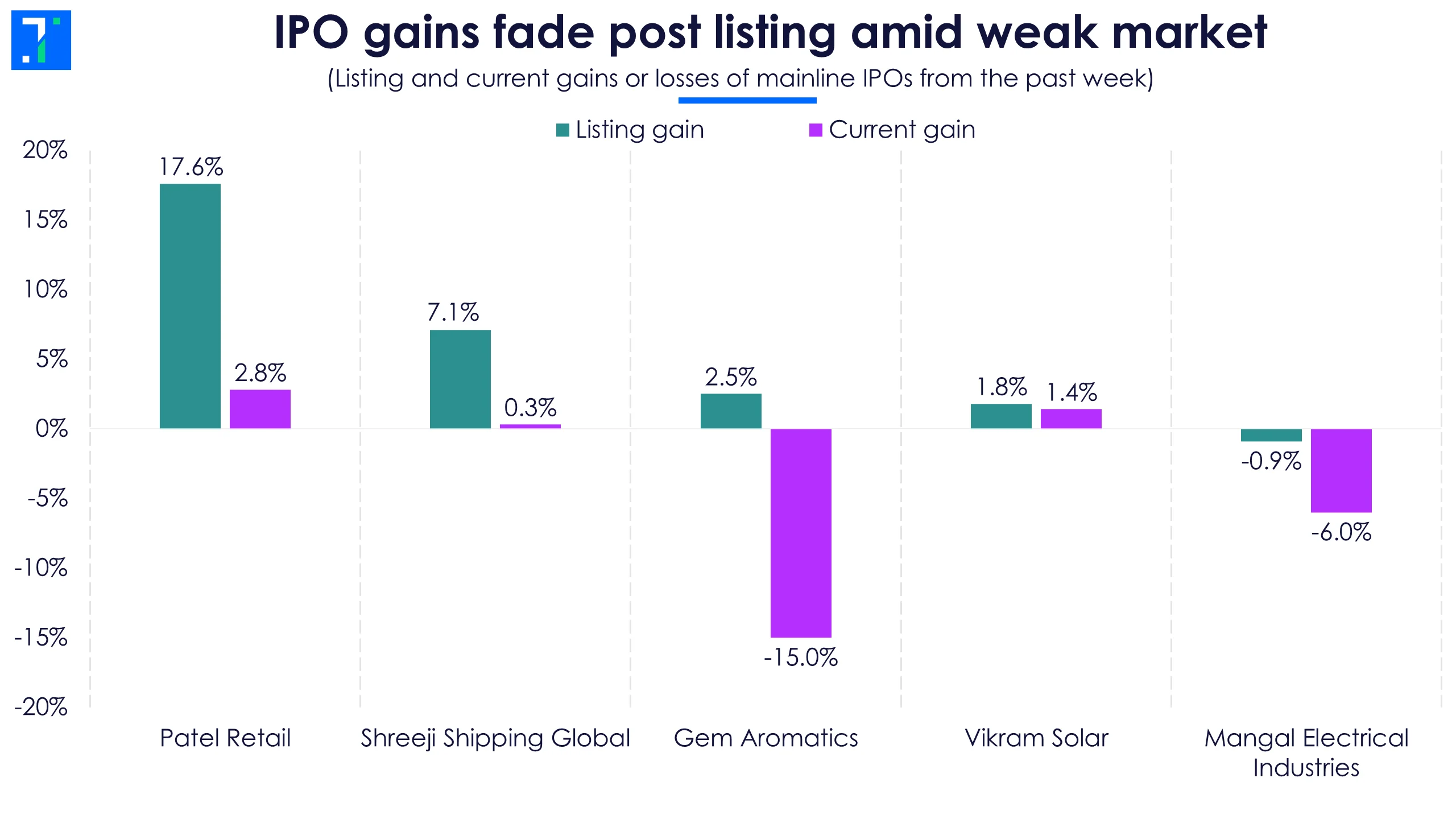

Patel Retail and Shreeji Shipping Global listed at premiums of 17.6% and 7.1% over their issue prices. Patel Retail’s IPO was subscribed 95.7X, while Shreeji Shipping saw 58.1X. Both stocks fell after listing but continue to trade above their issue prices.

Gem Aromatics and Vikram Solar debuted with moderate gains, with subscriptions of 30.3X and 54.6X respectively. Gem Aromatics has since slipped to a 15% discount, while Vikram Solar is trading 1.4% above its issue price.

IPO gains fade post listing amid weak market

Mangal Electrical Industries was the only mainline IPO to list at a discount, opening 0.9% lower after being subscribed 9.5X. The stock is now down 6% from its issue price.

Among SMEs, Anondita Medicare stood out with a strong debut, listing 90% higher after a massive 277.5X subscription. ARC Insulation Insulators also listed on August 14 with a 16% premium, after a 17.5X subscription.

Classic Electrodes and Shivashrit Foods listed on September 1 with gains of 14.9% and 4.6% respectively. Their IPOs were subscribed 165.4X and 2.8X. LGT Business Connextions had a weak debut, listing at a 20% discount after a modest 1.2X subscription. The stock has dropped further and is now down 31.4% from its issue price.

Amanta Healthcare opens for subscription; seven SMEs to hit the market

Amanta Healthcare is a pharmaceutical company that makes sterile liquid medicines, mainly injections. The company also makes medical devices. Its IPO opened for subscription on September 1, will close on September 3, and is set to list on September 9. The company aims to raise Rs 126 crore through a fresh issue, with a price band of Rs 120–126 per share.

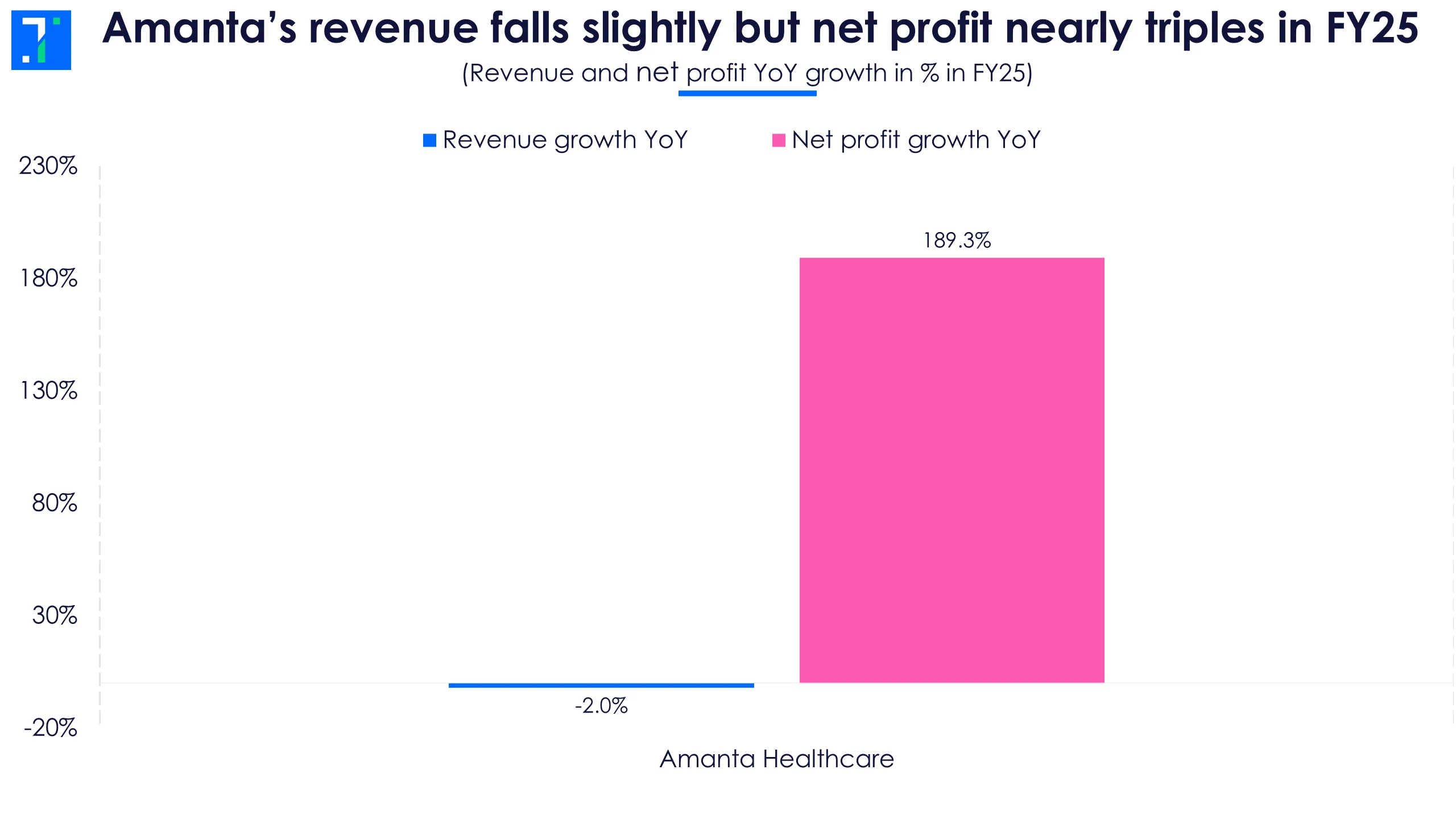

Amanta’s revenue falls slightly but net profit nearly triples in FY25

The company plans to use the IPO funds for capital expenditure, including civil construction, equipment, plant, and machinery to set up two new manufacturing lines—SteriPort and SVP—at Kheda, Gujarat. A portion will also go towards general corporate purposes.

In FY25, the company’s revenue declined 2%, but net profit rose 189%, helped by inventory destocking and lower finance and depreciation costs.

Along with Amanta Healthcare, seven SME IPOs are also lined up this week.

- Rachit Prints opened its IPO on September 1, will close on September 3, and list on September 8. It aims to raise Rs 19.5 crore in a price band of Rs 140–149 per share.

- Optivalue Tek Consulting and Goel Construction will open on September 2, close on September 4, and list on September 10. Optivalue Tek aims to raise Rs 51.8 crore with a price band of Rs 80–84, while Goel Construction plans to raise Rs 99.8 crore with a price band of Rs 250–263.

- Austere Systems will open for subscription on September 3, close on September 8, and list on September 11, planning to raise Rs 15.6 crore in a price range of Rs 52–55 per share.

- Vigor Plast Indiaand Sharvaya Metals are scheduled to open on September 4, close on September 9, and debut on September 12. Sharvaya Metals plans to raise Rs 58.8 crore with a price band of Rs 192–196, and Vigor Plast aims to raise Rs 25.1 crore at Rs 77–81 per share.

- Vashishtha Luxury Fashion will open on September 5, close on September 10, and list on September 15. It plans to raise Rs 8.9 crore, with a price band of Rs 109-111 per share.

Ten fresh IPO listings are scheduled this week

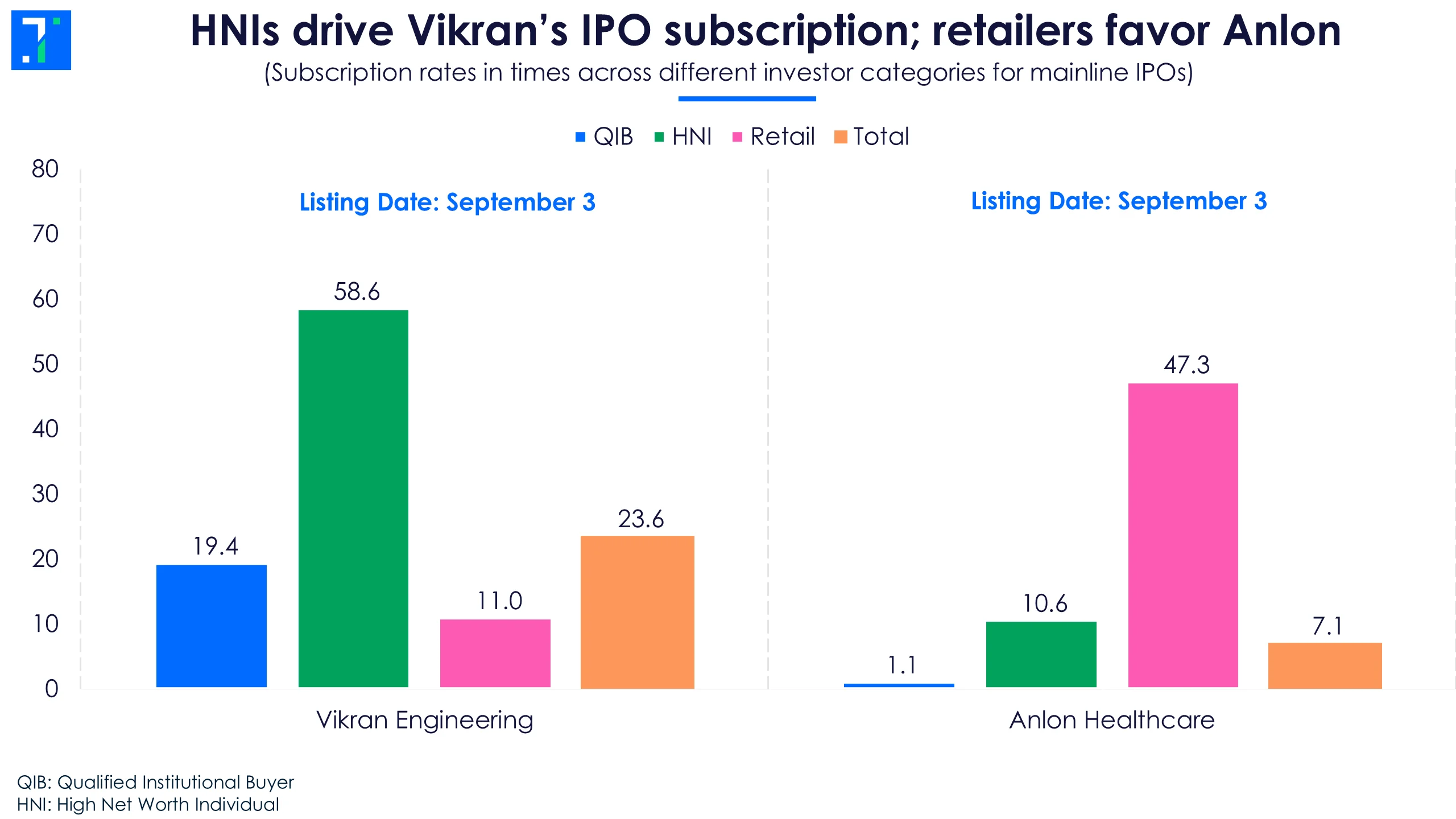

Vikran Engineering received bids for 23.6X the shares on offer. The HNI category showed the strongest demand at 58.6X, while QIBs subscribed 19.4X. The company will list on September 3. This heavy electrical equipment maker focuses on energy and water infrastructure and provides end-to-end services including design, installation, and commissioning for the power, water, and railway sectors.

HNIs drive Vikran’s IPO subscription; retailers favor Anlon

Anlon Healthcare was subscribed 7.1X overall, held back by a weak QIB response at 1.1X. Retail investors, however, bid strongly at 47.3X. The pharma company makes intermediates and active pharmaceutical ingredients (APIs) used in medicines, nutraceuticals, personal care, and veterinary products. It will also list on September 3.

Eight SMEs are lined up for listing this week: