The steel industry has been under pressure in recent months, thanks to a slowdown in the global economy, rising interest rates, and geopolitical tensions. Notably, China, the largest steel producer (accounting for 54% of global production), is also facing a slowdown.

Indian steel manufacturers had benefited from higher steel prices and lower exports from China over the past 18 months. …

Subscriber exclusive for you. Click here to read.This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.This is a premium article. Click here to read.

The steel industry has been under pressure in recent months, thanks to a slowdown in the global economy, rising interest rates, and geopolitical tensions. Notably, China, the largest steel producer (accounting for 54% of global production), is also facing a slowdown.

Indian steel manufacturers had benefited from higher steel prices and lower exports from China over the past 18 months. The Nifty Metal rose 33% in the past year, while the broader Nifty 50 increased by 20%. India, the second-largest steel producer with a 6.6% share of world production, is also seeing increased demand. Overall, lower fuel costs, cheap Chinese imports, the government’s infra push, and taxes on the import/export of steel determine the margins of Indian steel manufacturers.

India’s steel consumption increasing at a slower pace

India has one of the lowest per capita levels of steel consumption in the world at 81.1 kg per person, while the global average stands at 233 kg. In comparison, major exporting economies like China, Germany, Japan, and South Korea have per capita consumption above 300 kg per person.

The lower per capita steel consumption in India is due to its higher population, relatively lower spending on infrastructure development, and the limited export of machinery. As a result, the growth of steel consumption in India has been slower. The National Steel Policy 2017 plans to increase steel consumption to 160 kg per person by 2030, a growth rate of 10.5% CAGR from the current levels.

Looking at the trend since 2018, India's steel consumption has a growth of 3.5% CAGR. The recent pick-up in the manufacturing and real estate sectors has driven steel consumption in India.

Government initiatives to boost steel demand in FY24

The Indian government has taken significant steps to increase steel demand in FY24. The budgetary allocation for infrastructure rose by 33% to 10 lakh crore in FY24, with nearly 50% of the budget earmarked for road and railway projects. The new production-linked incentive scheme will further aid steel consumption in India.

Recent investments in the real estate sector, mining, and pick-up in the automotive space have provided a much-needed buffer for the steel sector in FY24. As the rural economy gradually returns to normalcy, urban consumption is expected to play a major role in driving steel demand in the retail segment.

India’s steel consumption grew by 13.3% in FY23. According to the Indian Steel Association, steel consumption is expected to grow by around 7.5% in FY24. Steel consumption is closely linked to GDP growth, and all sectors that utilize steel are expected to grow above 6% in FY24. According to the Ministry of Steel, India’s production capacity will increase to 300 million tonnes per annum from the current 150 million tonnes by 2030.

While the majority of India’s steel production is dedicated to captive consumption, around 5-10% is exported. However, the global slowdown and declining steel prices have led to lower Indian steel exports. China, with its increased exports, is also posing challenges to India’s prospects in steel export.

China’s production key to maintaining international steel prices

China commands a staggering 54% of global steel production. But its production has been facing challenges over the past five years due to changes in emission norms and the impact of Covid-19. China maintained its steel production at around 1 billion tonnes in FY23, after peaking at nearly 1.05 billion tonnes in FY20. The sector accounts for nearly 15% of China’s emissions, and the country is moving towards electric arc furnace manufacturing methods to tamp that down.

Stricter Covid regulations and production cuts have also limited China’s steel exports. The increased production is focused mainly on meeting pent-up domestic demand due to the Covid pandemic. However, as manufacturing activity slowed down and the real estate market experienced a slump in China, Chinese steel manufacturers have turned to international markets to offload their excess steel production. May 2023 saw the highest steel exports in the past 29 months.

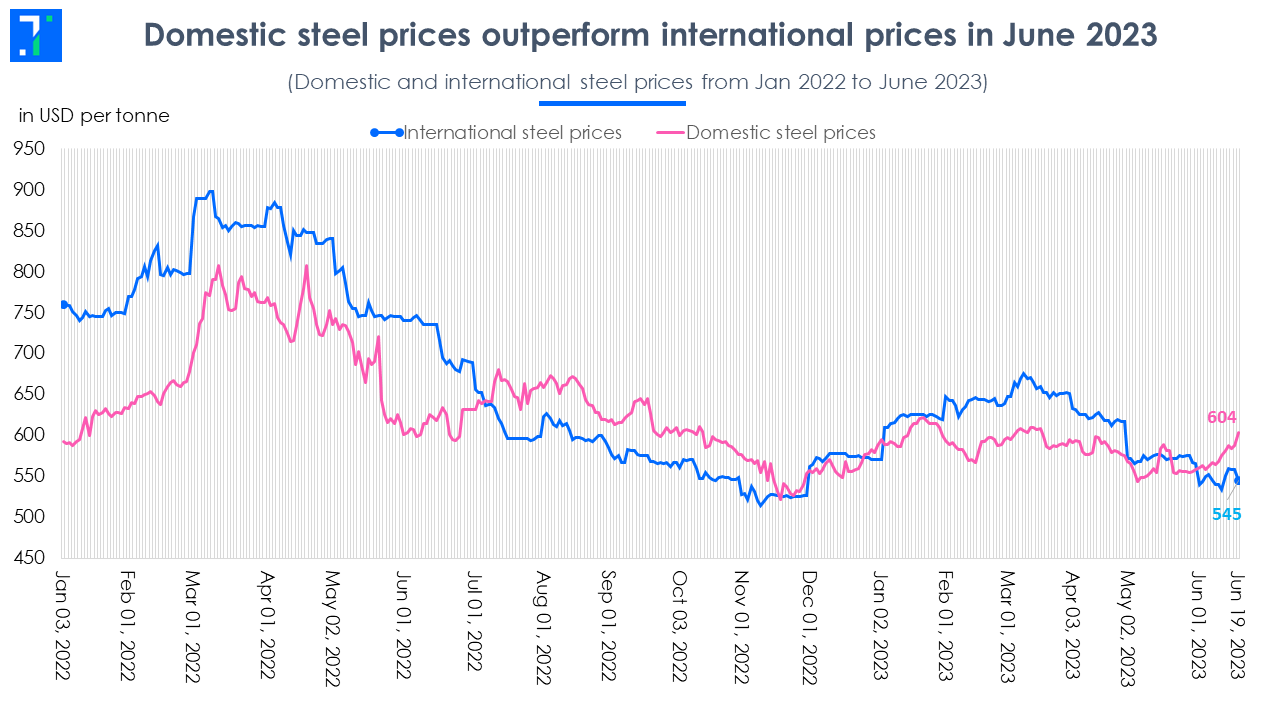

The excess influx of Chinese steel into the international market has caused international steel prices to decline from $670/tonne in March 2023 to $545/tonne in June 2023. As China ramps up its exports, steel prices are expected to fall further.

In contrast, prices in India have seen an uptick from $545/tonne in May 2023 to $604 in June 2023. The difference between international and domestic prices will make way for higher imports if the government doesn't intervene. This could impact the price realization of domestic manufacturers.

Local manufacturers are hopeful that the Chinese government’s efforts to revive the real estate and manufacturing sectors of China will aid steel consumption in the country. This, in turn, should reduce the supply to the international market and help boost international prices.

Government interventions restrict steel exports in FY23

Higher international steel prices from lower Chinese exports led Indian manufacturers to increase steel exports in FY22. As the international prices peaked in H1FY23, domestic manufacturers further ramped up their exports, causing a surge in domestic prices.

To stabilize the domestic market, the government imposed a 15% export duty from May 2022 to November 2022. As the price gap between domestic and international markets narrowed, local manufacturers once again focused on the domestic market.

To prevent the influx of cheap Chinese steel into the Indian market, the Indian Steel Association has asked the government to consider raising the basic customs duty on steel from 7.5% to 12.5%. However, the government is not keen on doing this, since this would raise prices of finished goods across several segments. Nearly 23% of India’s steel imports are dedicated to automobiles and components.

Lower exports impact profitability for Indian manufacturing

The run-up in steel prices during H2FY22 provided an opportunity for domestic manufacturers to increase their exports. At the time, the difference between international and domestic prices reached around $150/tonne. However, as the difference declined with the imposition of export tax, domestic prices shot up. Consequently, manufacturers shifted their focus to the domestic market due to higher domestic prices compared to international prices.

However, the profitability of Indian manufacturers in Q4FY23 took a hit YoY, considering that international and domestic prices peaked at $900 and $770 per tonne, respectively, in Q4FY22 and fell since then. On average, the lower pricing in Q4FY23 resulted in margin/tonne declining by 25%.

The current outlook indicates that higher domestic prices and healthy steel demand will aid the domestic steel sector. Foreign counterparts like Tata Steel UK may face difficulties, owing to lower prices and economic slowdown.

Lower fuel costs to offset lower price realizations

The recent downtrend in coking coal prices has helped steelmakers cushion the impact of lower price realizations. Fuel accounts for nearly 40% of the total production cost of steel. Coking coal prices have declined by more than 60% since its peak in September 2021.

Coking coal prices are expected to remain at their current levels due to lower demand, and stabilizing steel production globally. The reduction in fuel costs will help improve profit margins; however, this benefit will be offset by the decline in steel prices.

India's steel industry shines amid global challenges

Amid a global economic slowdown and rising interest rates, steel consumption has taken a hit. The World Steel Association predicts a 2.4% increase in steel demand in 2023 and 1.7% in 2024. However, the world's largest steel consumer, China, is expected to grow at a rate of 5.2% in 2023 due to a slowdown in its real estate and manufacturing activity.

India’s GDP growth rate for FY24 is projected to be around 6.5% by the Reserve Bank of India, with an improvement of around 7.5% in the domestic steel sector. Higher domestic steel prices and lower fuel costs will provide a buffer for the Indian steel industry against the global slowdown.

However, if China continues its steel production during the economic downturn, it will hurt the prospects of Indian steel manufacturers. The policy changes aimed at boosting steel consumption in China hold the key to global steel prices.