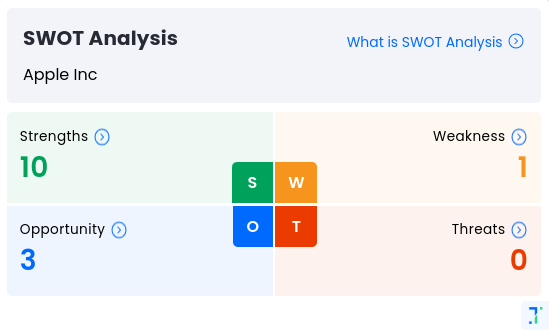

Provident Financial Services IncSWOT Analysis

What is SWOT Analysis Strengths

Strengths12 S

Weakness15 W

Opportunity0 O

Threats2 T

What is SWOT Analysis ?These are then classified as strengths, weaknesses, opportunities that investors can leverage, and threats that might impact company health.Strengths, Weaknesses, Opportunities and Threats Analysis is a real time check on stock health throughout the day. SWOT looks at financials, management quality, technical parameters and valuations to identify positives and negatives for every stock.

- Strengths

- Weakness

- Opportunity

- Threats

- Buy Zone: Stocks in the buy zone based on days traded at current PE and P/BV

- Relative Outperformance versus Industry over 1 Week

- Relative Outperformance versus Industry over 1 Month

- Rising Net Cash Flow and Cash from Operating activity

- Relative Outperformance versus Industry over 1 Year

- PEG lower than Industry PEG

- Dividend yield greater than sector dividend yield

- Good quarterly growth in the recent results

- Relative Outperformance versus Industry over 1 Week

- Relative Outperformance versus Industry over 1 Month

- Company able to generate Net Cash - Improving Net Cash Flow for last 2 years

- Increasing profits every quarter for the past 2 quarters

- Stocks with Quarter Change % less than Industry

- PE higher than Industry PE

- Momentum Trap (DVM)

- Await Turnaround (DVM)

- Risky Value (DVM)

- Low durability companies

- Inefficient use of shareholder funds - ROE declining in the last 2 years

- Inefficient use of assets to generate profits - ROA declining in the last 2 years

- Top Losers

- Low Piotroski Score : Companies with weak financials

- Annual net profit declining for last 2 years

- Weak Momentum: Price below Short, Medium and Long Term Averages

- RSI indicating price weakness

- Top Losers

- Stocks Underperforming their Industry Price Change in the Quarter

- Mutual Funds Decreased Shareholding in Past Month

- MFs decreased their shareholding last quarter

Free SWOT (Strengths, Weakness, Opportunities, Threats)widget for Every Stock

The SWOT widget is available for every stock for your website and Android app. It gives investors a quick bird's-eye view on the company's short-term and long-term financial health, technical momentum, shareholding and management health.

What is QVTQVT Stock Score

Provident Financial Services IncQuality 20 /100 Low Financial StrengthValuation 45 /100 Mid ValuationTechnicals 42 /100 Technically NeutralAwait TurnaroundGoodAverageBadWhat is QVT Stock Score ?

Provident Financial Services IncQuality 20 /100 Low Financial StrengthValuation 45 /100 Mid ValuationTechnicals 42 /100 Technically NeutralAwait TurnaroundGoodAverageBadWhat is QVT Stock Score ?

Good Average Bad Quality >55 35-55 <35 Valuation >50 30-50 <30 Technicals >60 35-60 <35 QVT stock score gives you three scores on every stock in the stock market.

A High Quality Score (above 55) indicates good and consistent financial performance: stable revenues, profits, cash flows and low debtA High Valuation Score (above 50) indicates the stock is competitively priced at current P/E, P/BV and share price.A High Technical Score (above 60) indicates the stock is seeing buyer demand, and is bullish across its technicals compared to the rest of the stock universe.