Omega Healthcare Investors, Inc.SWOT Analysis

What is SWOT Analysis Strengths

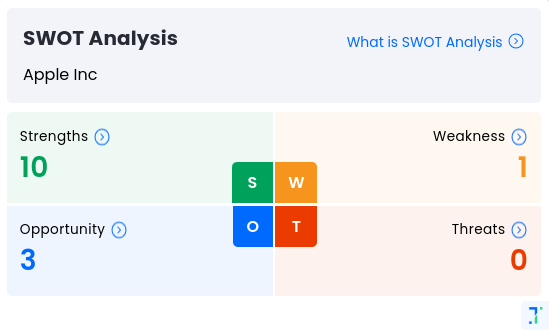

Strengths15 S

Weakness8 W

Opportunity5 O

Threats0 T

What is SWOT Analysis ?These are then classified as strengths, weaknesses, opportunities that investors can leverage, and threats that might impact company health.Strengths, Weaknesses, Opportunities and Threats Analysis is a real time check on stock health throughout the day. SWOT looks at financials, management quality, technical parameters and valuations to identify positives and negatives for every stock.

- Strengths

- Weakness

- Opportunity

- Threats

- Stocks in Buy Zone with High Momentum Score Last Month

- Companies with current TTM PE Ratio less than 3 Year, 5 Year and 10 Year PE

- Relative Outperformance versus Industry over 1 Week

- Mid-range Performer (DVM)

- PE less than Industry PE

- Relative Outperformance versus Industry over 1 Month

- Relative Outperformance versus Industry over the Quarter (3 Months)

- Relative Outperformance versus Industry over 1 Year

- Annual Profit Growth higher than Sector Profit Growth

- PEG lower than Industry PEG

- Dividend yield greater than sector dividend yield

- Relative Outperformance versus Industry over 1 Week

- Relative Outperformance versus Industry over 1 Month

- Increasing Revenue every Quarter for the past 4 Quarters

- Stocks Outperforming their Industry Price Change in the Quarter

- Bearish Stocks - Stocks with Medium to Low Trendlyne Momentum Score

- Stocks with Expensive Valuations according to the Trendlyne Valuation Score

- MACD crossed below zero line previous end of day

- Top Losers

- Declining Net Cash Flow : Companies not able to generate net cash

- Weak Momentum: Price below Short, Medium and Long Term Averages

- RSI indicating price weakness

- Top Losers

- Mutual Funds Increased Shareholding in Past Month

- Institutions increasing their shareholding

- Mutual Funds Increased Shareholding over the Past Two Months

- MFs increased their shareholding last quarter

- Mf buying for 2 months

Free SWOT (Strengths, Weakness, Opportunities, Threats)widget for Every Stock

The SWOT widget is available for every stock for your website and Android app. It gives investors a quick bird's-eye view on the company's short-term and long-term financial health, technical momentum, shareholding and management health.

What is QVTQVT Stock Score

Omega Healthcare Investors, Inc.Quality 87 /100 High Financial StrengthValuation 30 /100 Expensive ValuationTechnicals 33 /100 Technically BearishFalling CometGoodAverageBadWhat is QVT Stock Score ?

Omega Healthcare Investors, Inc.Quality 87 /100 High Financial StrengthValuation 30 /100 Expensive ValuationTechnicals 33 /100 Technically BearishFalling CometGoodAverageBadWhat is QVT Stock Score ?

Good Average Bad Quality >55 35-55 <35 Valuation >50 30-50 <30 Technicals >60 35-60 <35 QVT stock score gives you three scores on every stock in the stock market.

A High Quality Score (above 55) indicates good and consistent financial performance: stable revenues, profits, cash flows and low debtA High Valuation Score (above 50) indicates the stock is competitively priced at current P/E, P/BV and share price.A High Technical Score (above 60) indicates the stock is seeing buyer demand, and is bullish across its technicals compared to the rest of the stock universe.