By Deeksha JanianiWhen it comes to wealth creation, the last 12 months have been a topsy turvy time. The sharp upward swing in stock markets last year was followed by a period of high volatilty. It wasn't just the fortunes of retail investors that were affected - Indian promoters and big business families also saw unexpected changes.

In this week’s Analyticks:

- India Inc's promoters: Big winners and losers in net worth

- Screener: Companies predicted to deliver strong QoQ revenue growth in Q2FY23

Let’s get into it.

India's promoter families: Who gained and who lost big time in the past one year?

This year has been a mixed bag for Indian markets. While some consumption-oriented sectors like hotels and restaurants, retailing, and food and beverages zoomed in value, others likeIT and Pharma got beaten down.

This created a new batch of winners and losers: some Indian promoter families saw their net worth figures reach new highs, while others saw their net worth fall from record levels between September 2021 and September 2022.

To arrive at public net worth estimates for September 2022, we have considered the stock price as on September 9, 2022 and promoter holdings in companies as of the most recently available date - end of June 2022. The previous year’s net worth estimate is based on September 2021 month end prices and shareholding.

The Winners: Some promoter families see wealth soar as consumption recovers in India

Who said fast food is bad for you? Not for the Jaipuria family. After India emerged out of the Omicron wave, outdoor leisure and travel activity rebounded strongly. Out of home consumption of food and beverages also rose, benefitting promoter Ravi Jaipuria and his family.

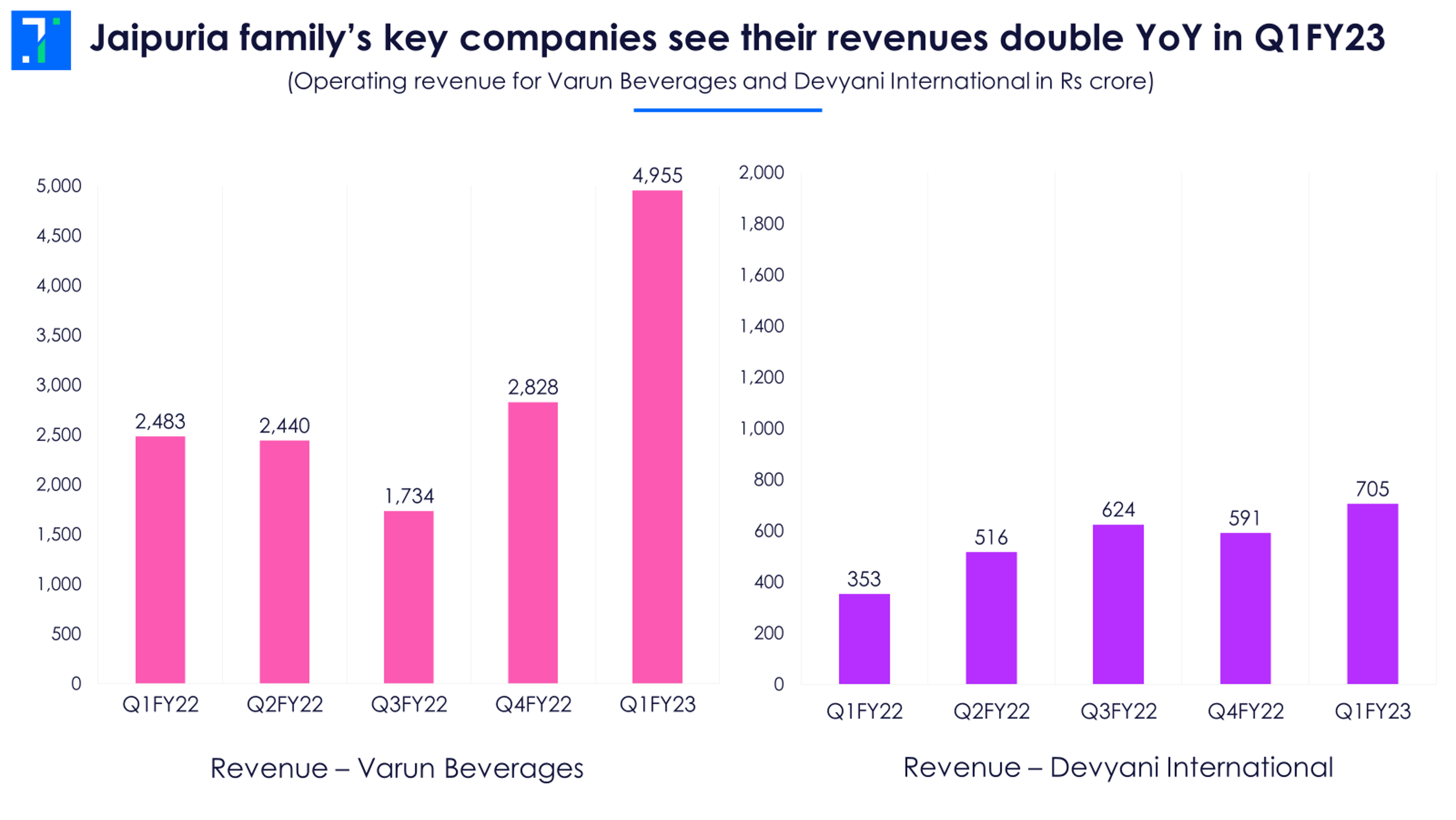

The family’s net worth touched nearly Rs 60,000 crore, up over 70% for the period in question. This stellar jump was mainly driven by their official franchisee of PepsiCo brands, which is Varun Beverages. The company doubled its sales volumes to 300 million cases in Q2-2022 backed by the intense heat wave, IPL season and higher outdoor activity.

A second notable contributor to the rise in the Jaipuria family’s net worth was the quick service restaurant player Devyani International. The franchisee of KFC and Pizza Hut grew ahead of Jubilant Foodworks in Q1FY23. Devyani’s average daily sales from KFC stores touched an all-time high and same store sales growth crossed 60% in Q1FY23.

Promoters of specialty chemical companies like Pidilite Industries and Fine Organics have also gained in the year gone by. The Parekh family’s net worth scaled the Rs 1 lakh crore mark in September 2022, led by the healthy stock price performance of Pidilite. The correction in crude oil prices from June 2022 added to the fortunes of this family. Vinyl acetate monomer is a key input used in the company’s adhesives like Fevicol and is linked to crude prices.

Rise in demand for food and beverages also aided the revenue growth of Fine Organics as it caters to the food additives market. The Shah and Kamat family saw their combined net worth double to Rs 15,000 crore as Fine Organics' share price moved steadily upward.

The Losers: Promoters of IT and Pharma companies suffer a dip in their fortunes

As the IT sector boomed, backed by new digital transformation projects, the demand for quality talent rose. The tide was in favor of the techies as companies competed to hire them by offering higher packages. As the bidding war escalated, attrition rates started to climb.

Many engineers saw a revolving door of opportunity, exiting new companies in six months or less to join the next one at even higher pay packages. Before the Ashneer Grover fiasco, BharatPe was making headlines for tempting engineering hires with BMW bikes and trips to Dubai. IT companies had to incur higher costs in form of incentives to retain talent. The effect of these costs could be clearly seen on the margins of top-tier IT companies from Q3FY22.

Soon, demand concerns also emerged. Worries of an economic slowdown in the US and Europe surfaced towards the end of March 2022. Margin pressures coupled with uncertainty on the demand front spooked foreign investors, leading to capital flight from the Indian IT sector and causing the Nifty IT index to correct over 25% from its highs.

Accordingly, the prominent promoter families of Azim Premji and Shiv Nadar saw their net worth fall by more than Rs 50,000 crore in this period. This was driven by the underlying correction in the stock prices of Wipro and HCL Technologies respectively.

Divi Satchandra Kiran and his family was another major loser in terms of net worth. The combined family’s net worth fell below Rs 50,000 crore on the poor near-term outlook for Divi’s Laboratories. As the pandemic started to recede from Q2FY22, analysts expected the company’s revenues from sale of Covid-19 drugs, especially molnupiravir, to fall in FY23. The evidence of this was clearly seen in the company’s financial performance for Q1FY23.

Ajay Piramal and family also saw their net worth fall by over Rs 15,000 crore, mainly due to the demerger of their pharmaceutical business. However, even when the business was combined with Piramal Enterprises, the pharma unit saw its revenues fall by over 30% QoQ in Q1FY23. Notably, the demerged entity will get listed on the bourses in Q3FY23, adding back to the family’s public net worth.

Outlook stays strong for specialty chemicals and consumption related sectors

In the earnings call of Q1FY23, the management of Devyani International sounded confident of the demand trends in the second half of the fiscal. This expectation is backed by India's upcoming festive and holiday season. The company is also set to expand its domestic store count by over 50% by FY24. So it's no surprise that the consensus estimates of analysts expect its net profits to double in the next two years.

The demand outlook for Varun Beverages is also strong given that its juices, energy drink and dairy segments are performing well, and it is expanding into newer markets. The Jaipuria family is riding high on upbeat sentiment in this sector.

The Speciality chemical sector is set to grow at a CAGR of 11-12% in next five years as the demand shifts to India, owing to the ‘China+1’ policy of global suppliers. The favorable demand environment augurs well for players like Pidilite Industries and Fine Organics. Analysts expect these companies to clock robust revenue growth in FY23 as well.

Among the losers, the near-term challenges for Indian IT continue to persist. High attrition rates will take a few more quarters to stabilize while a weak macroeconomic environment may impact the technology spends of these companies. Accordingly, analysts see top-tier IT firms clocking lower revenue growth in FY23.

As India continues to cope with a challenging global environment of high inflation and growth slowdown, it will be interesting to see which promoter families emerge as the big winners and losers over the next year.

Screener: Some segments set to clock strong QoQ revenue growth in Q2FY23

As we approach the end of Q2FY23, we take a look at companies which are likely to report strong topline growth in the September quarter as well as in FY23, according to Trendlyne’s Forecaster. Analysts have also recommended a Buy/Strong Buy rating for these stocks.

As we approach the end of Q2FY23, we take a look at companies which are likely to report strong topline growth in the September quarter as well as in FY23, according to Trendlyne’s Forecaster. Analysts have also recommended a Buy/Strong Buy rating for these stocks.

This screener reflects 15 companies that qualify within the Nifty 500 group. The festive season in India began with Ganesh Chaturthi and Onam in August end, and is expected to drive higher sales for home appliance and consumer durable makers in September. Companies like TTK Prestige and Crompton Greaves are predicted to clock over 20% QoQ revenue growth in Q2FY23, backed by the premium segment.

Online beauty and fashion retailer Nykaa will also see strong sales growth in Q2FY23 according to analysts, as redder lipsticks and hair treatments fly off the shelves during the festive season. Higher consumption among Indians will also drive demand for retail credit, aiding the expected double-digit revenue growth of HDFC Bank and Axis Bank.

Fertilizer maker Coromandel International is set to deliver QoQ revenue growth of nearly 60% in Q2FY23 on the positive impact of Kharif season, according to estimates.

You can find some popular screeners here.