1. AWL Agri Business:

This FMCG company, formerly known as Adani Wilmar, jumped 6% on Thursday after the Adani Group announced the sale of a 20% stake in the company to Wilmar International. With this stake purchase, Singapore-based Wilmar becomes the majority shareholder in the company. Adani Group plans to exit entirely by selling its remaining 10% stake to “a set of pre-identified” investors.

In Q1 FY26, the company reported YoY revenue growth of 20%, led by strong pricing in the edible oils segment. However, it missed Forecaster estimates by 5%, mainly due to lower volumes and exit from the government rice export business.

Higher input costs, especially for palm oil, weighed on profitability. Net profit declined 24% YoY in Q1, and EBITDA margin dropped to 2.1%. Addressing this, MD & CEO Angshu Mallick said, “We expect some improvement in demand starting July, with the onset of the festive season and easing raw material cost pressures, especially in palm.”

The company operates across three key segments—Edible Oils, Industry Essentials, and Food & FMCG. Although the edible oil segment brings in 80% of revenue, it contributed only 50% to total profit, highlighting its low-margin nature. In contrast, the Industry Essentials segment, which includes castor oil and oleochemicals, delivered 28% of profits from just 13% of sales, aided by near-full capacity utilisation. The Food & FMCG segment also added 21% to profits, despite accounting for only 8% of sales in Q1.

AWL Agri reported fairly substantial retail expansion, directly reaching customers via 8.7 lakh outlets. It saw 26% YoY growth in rural areas and 11% in urban markets. Mallick expects the Food & FMCG segment to “continue to grow in double digits given the expansion in product pipeline and distribution.” He adds that the company aims to generate Rs 10,000 crore in revenue from this segment by FY27, with rural growth playing a key role.

ICICI Securities maintains a ‘Buy’ rating on the stock with a higher target price of Rs 360. The brokerage is optimistic about the company’s transition from a commodity-driven business to a more stable and profitable FMCG model. However, it also flags volatility in raw material prices and execution risks in scaling the branded food portfolio as potential headwinds.

2. Allied Blenders & Distillers (ABD):

This breweries & distilleries company rose by 8.1% over the past week. This surge followed the Maharashtra government's July 15th announcement of plans to issue 328 new wine shop licenses, a move set to increase licensed liquor outlets by 19% (from 1,713). This policy shift, which aims to boost state revenue, is expected to generate an additional Rs 14,000 crore annually in excise revenue. Allied Blenders & Distillers (ABD), having opened its second Maharashtra distillery in January and as India's third-largest Indian made Foreign Liquor (IMFL) company, is set to significantly benefit.

Despite Maharashtra's growing population, the number of licensed liquor outlets has remained static since the 1970s, leading to just 1.5 shops per lakh people—far below the national average of six. However, implementing changes faces significant challenges due to cultural opposition and bar association protests over hiked excise duties, creating an intense situation for these policy reforms.

For FY25, the company reported a 6.2% increase in revenue, driven by growth in its Prestige & Above (luxury) portfolio. Trendlyne Forecaster projects a 12.3% revenue growth in FY26, attributing it to the company's focus on expanding reach to other countries and premiumization efforts. The stock has also appeared on a screener of stocks which have outperformed their industry over the past month.

Alok Gupta, the Managing Director of ABD, expressed confidence in the company's future, stating, "FY26 will be a year of momentum, backed by positive consumer sentiment, stable input costs, and a supportive policy landscape. Growth in the super premium to luxury segment will be driven by rising disposable incomes and demand for experience-based consumption.” The anticipated UK Free Trade Agreement (FTA) may also reduce Scotch import duties.

According to Trendlyne’s Forecaster, 5 analysts have a consensus recommendation of “Strong Buy”, with an average target price of Rs 516.6. ICICI Securities projects moderate volume growth of about 3% CAGR for the company's mass premium segment from FY26-27. Realization growth, however, is expected to come from price increases.

3. Computer Age Management Services (CAMS):

Thismutual fund services company rose 2.9% on July 15 after Motilal Oswalraised its target price to Rs 5,000 and reiterated its ‘buy’ rating. CAMS is a prominent tech services player in the finance space – it handles the back-end operations for mutual funds and also offers digital services in insurance, payments, and investor verification (KYC).

India’s mutual fund industry hasgrown rapidly, from around Rs 25 lakh crore in mid-2020 to over Rs 74 lakh crore by June 2025, and is projected to cross Rs 130 lakh crore by FY30. As the main registrar that handles about 68% of industry assets, CAMS is likely to benefit from this growth. Higher mutual fund volumes means more transactions, investor accounts, and servicing needs, which would support steady revenue growth across CAMS’ core and allied services.

InFY25, its revenue grew 25.3% to 1,475.1 crore, while its net profit surged 33% to 470.2 crore. Strong growthcame from its continued leadership in the mutual fund registrar and transfer agent (RTA) segment, a 29% rise in equity assets under management (AUM), and a 51% jump in SIP registrations. CAMS alsoadded three new AMC mandates and its first international MF client, CeyBank Asset Management Company, a Sri Lankan AMC. Non-MF businesses, which contributed 14% of revenue, grew nearly 25%, led by CAMS KRA and CAMSPay.

While the core RTA business accounts for approximately 87% of its revenue, CAMS continues todiversify into non-MF segments to mitigate concentration risk.

One of the keychallenges for CAMS is a pricing reset with a major mutual fund client. The company reduced its service fees earlier than planned, as older pricing models based on physical processes no longer made sense in the digital age. This changecaused a Rs 14 crore revenue hit in the Q4 and a 4% drop in the fees CAMS earns from servicing mutual funds.

Anuj Kumar, Managing Director and Chief Executive Officer,said, “About half the pricing impact is already in the books (Q4). The remaining will flow through Q1 and Q2. After that, we expect to return to growth.”

Motilal Oswal remains positive on the stock, citing strong positioning and steady non-MF growth, but also flagged near-term margin pressure from the repricing impact. The brokerage expects non-MF revenue to grow 21% and MF revenue 9% annually over FY25-27.

4. Tata Technologies:

This IT software firm rose over 2% on July 15 as its Q1 FY26 revenue and net profit came in well above Forecaster estimates, despite a QoQ decline. Net profit dropped 9.8% and revenue declined 2.6%, mainly due to slower activity in core services as project ramp-ups were delayed and clients held back on spending. The product segment also saw weak growth because of the typical seasonal slowdown in the first quarter.

Tata Technologies’ core auto segment was affected by delays in project ramp-ups, especially from North American carmakers. These companies held back on R&D spending after the US announced higher tariffs on auto imports in April. They are now looking at shifting manufacturing operations to the US to avoid the tariffs. Since over 60% of Tata Tech’s revenue comes from the auto sector, this had a notable impact. However, the company saw signs of recovery in the second half of the quarter by closing six new deals, four worth over $10 million (~Rs 86 crore) each and two over $5 million.

Analysts believe the management's positive outlook comes from a stronger order book at the end of Q1 compared to last year. However, slowing global demand amid rising tariffs remains a concern for the auto segment's growth. Additional pressure from export restrictions of rare earth metal by China is weighing down growth.

Warren Harris, MD & CEO, said that tariff announcements in April created uncertainty, causing many clients to pause or delay their orders. He mentioned that while customer decisions were initially expected in April, they only came through by late June. This delay makes the company more confident about better performance in Q2 and the rest of the year. However, he added, “We don't anticipate a V-shaped recovery (quick and sharp rebound), in part because of uncertainty due to trade tensions.”

ICICI Securities has a ‘Sell’ rating on Tata Technologies with a price target of Rs 510. The brokerage expects revenue to decline by 1.5% in FY26, which is in contrast to the management’s aim of double-digit growth. It also pointed out that the stock’s high valuation amid slow recovery in the auto segment remains a key concern.

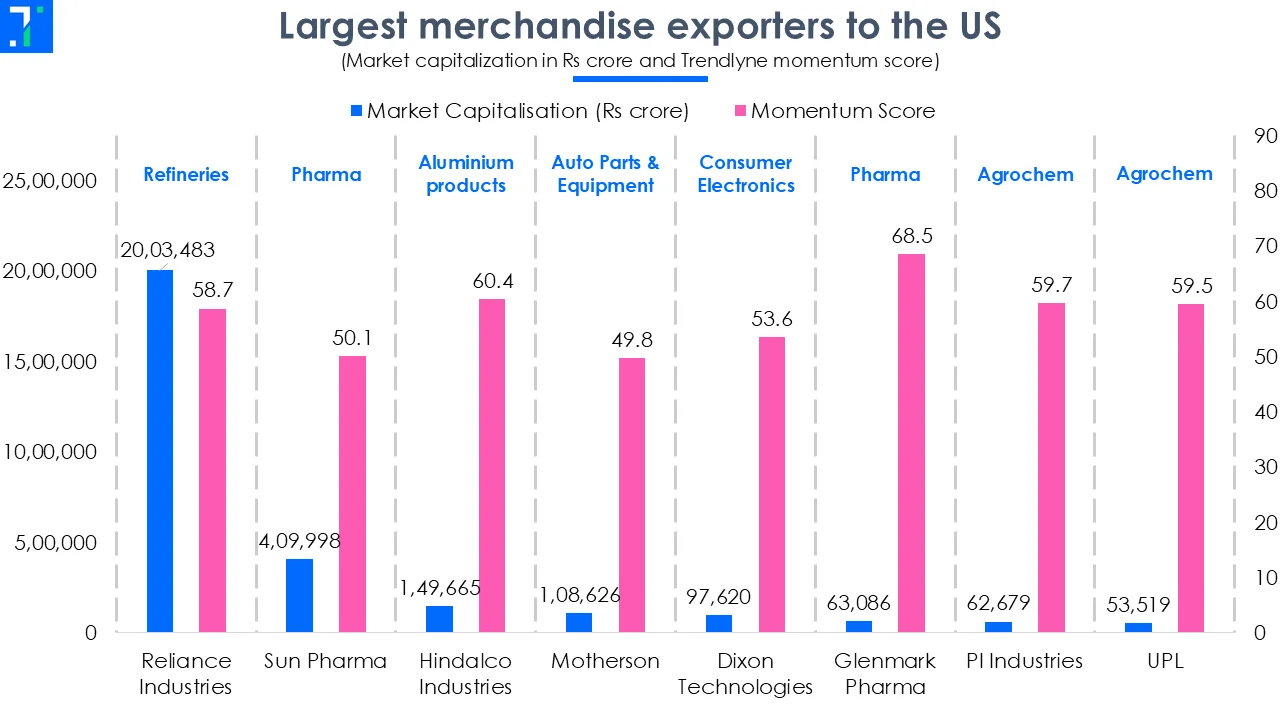

5. Glenmark Pharmaceuticals:

This pharmaceutical company rose 20% to a 52-week high of Rs 2,286.1 on July 11. The rally came after its subsidiary, Ichnos Glenmark Innovation (IGI), signed a licensing agreement with AbbVie for exclusive rights to commercialise its blood cancer drug ISB 2001 (myeloma), with a global market size of $27.5 billion in 2024.

The drug is currently in phase I trials. AbbVie will further develop, manufacture and market the drug worldwide. IGI will receive an upfront payment of $700 million (Rs 5,850 crore) from AbbVie following regulatory approvals. The company is also eligible to earn up to $1.2 billion (Rs 10,000 crore) from FY27 onwards as the drug reaches sales milestones. IGI will also receive double-digit royalties on sales generated by AbbVie.

Managing Director, Glenn Saldanha,said, “We plan to transition to an innovation-led business over the next five years in dermatology, respiratory, and oncology segments.” He emphasises that this deal with AbbVie supports the goal of increasing patented medicines revenue to 70% by 2030, up from 60%.

The company’s revenue rose 6.1% to Rs 13,435.4 crore in FY25, driven by growth in India and the European market, new product launches, and regulatory approvals. The net profit turned positive at Rs 1,047 crore, driven by lower raw material costs and a decline in tax expense, compared to a loss in the previous year.

Glenmark’s US revenue declined 5.4% in FY25 due to delays in regulatory approvals. Senior General Manager Utkarsh Gandhi expects an uptick in US sales, driven by the launch of respiratory and injectable products. The company expects revenue growth of up to 12% in FY26, supported by product rollouts in Russia, Brazil, Mexico, South Africa, and Southeast Asia regions.

Post the deal, Motilal Oswalreiterated a ‘Buy’ rating on Glenmark with a target price of Rs 2,430. The brokerage expects that the partnership with AbbVie will drive earnings for Glenmark in domestic and international markets. Over the past two years, Glenmark has strengthened its portfolio in the higher-margin oncology portfolio, which is supporting sales growth. The brokerage projects net profit to grow at a CAGR of 20% over FY26-27.

Trendlyne's analysts identify stocks that are seeing interesting price movements, analyst calls, or new developments. These are not buy recommendations