The boxer Mike Tyson once said, "Everyone has a plan, until they get punched in the mouth". The world economy gets punched in the mouth, a lot.

In the leadup to 2024, news headlines are filled with predictions for the future. Economists and analysts look at political and macro trends, as well as their financial models to forecast what the next year holds for us.

The problem is that many of these predictions end up being wrong. The future is full of punches that we don't see coming.

Consider The Economist—a starchy, well-respected magazine - which makes a set of predictions in January every year. The writer Morgan Housel points out that the Economist's predictions for 2020 said nothing about Covid, even though China had informed the World Health Organization in December 2019 about "cases of pneumonia in Wuhan of unknown origin".

In 2022, the Economist did not mention a chance that Russia would invade Ukraine, even though by then, Putin had been assembling a huge military force along the Ukraine border for months.

But that’s the point: the biggest risks, which turn our markets and politics upside down, are often underestimated, and obvious to us only in hindsight. People thought Covid was a regional flu; few believed Putin would actually attack.

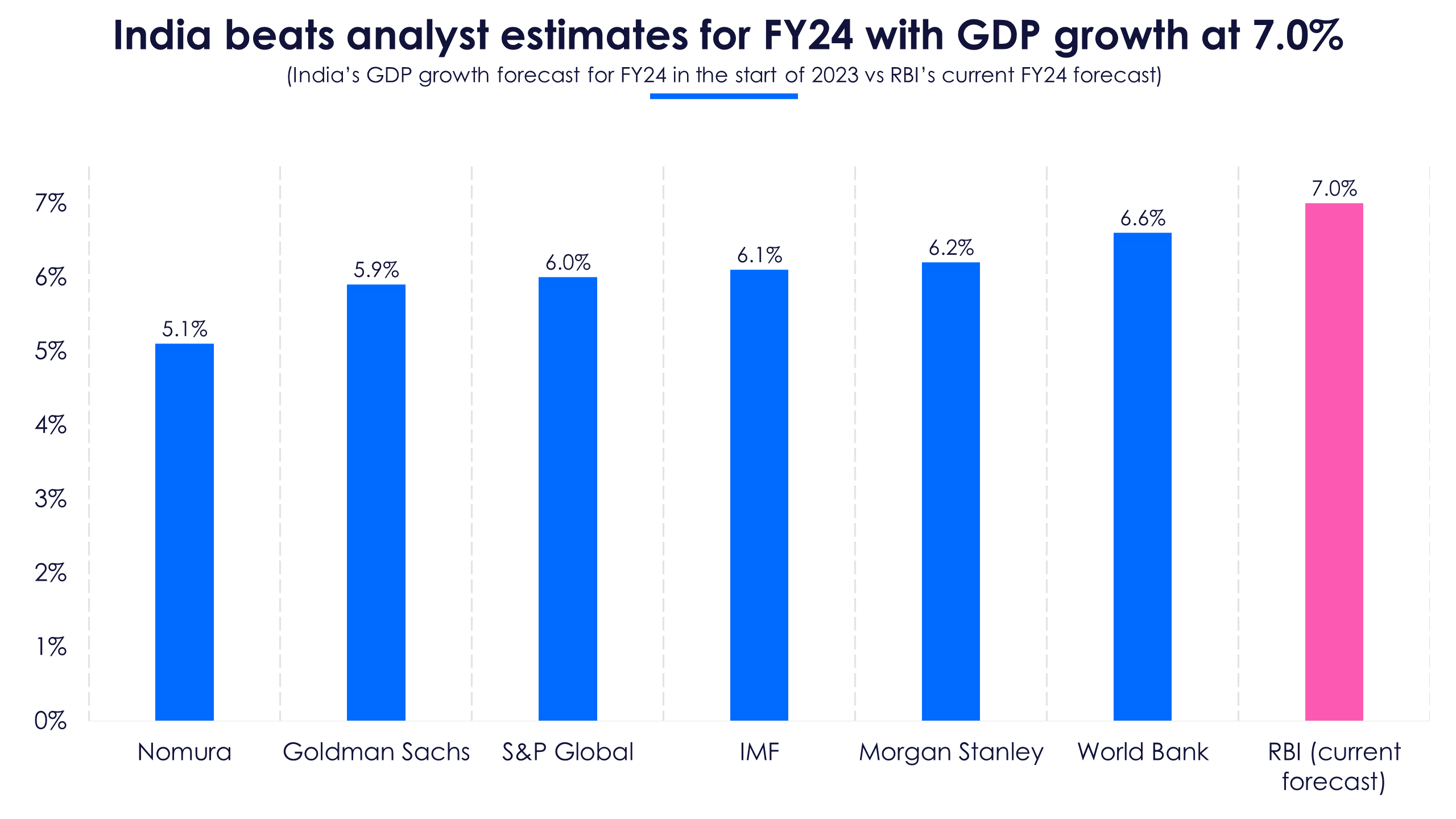

Even smaller predictions analysts regularly make and have good models to fall back on - like GDP growth and stock market levels - are rarely accurate. At the start of 2023, analysts were all over the place in their estimates for India's GDP growth and likely Nifty levels. India grew faster thanks to a spending boost from the Indian government, a healthy financial sector, and China's unexpected slowdown, which drove down oil prices.

Goldman Sachs came the closest when it came to predicting the levels Nifty would hit in 2023.

What are the risks that we are currently under-estimating, and not paying enough attention to? This week, we look at:

- Three risks that may affect 2024, as we head into the new year

- Screener: Stocks and industries that outperformed the index in 2023

Let's dive in.

1) The Red Sea turns red: Rising tensions in the Suez Canal can hit oil prices

The 192-km long Suez canal is the fastest sea route between Europe and Asia, andh transports 10% of the world's oil - around 92 billion barrels every year. With the Israel-Gaza war, the canal and the Red Sea have become conflict zones, as Iran-backed rebels, the Houthis in Yemen, have started attacking transport ships and oil tankers.

The tensions in the Suez have driven Brent crude oil prices up from a low of $73 per barrel earlier this month to over $80. If tensions worsen, it could spill over into a regional war that drags additional players like Iran into the mix. And of course, with a war cheap oil would go out of the window, hitting importers like India hard.

The other flashpoint is China and Taiwan. China has long claimed Taiwan as its own, and the US has pledged to defend it from any attack. Analysts have been saying that Chinese Premier Xi Jinping is more risk-averse than Putin, and unlikely to invade. But they have been wrong before.

Taiwan has its elections in January, and a win for the China-unfriendly Democratic Progressive Party may force Xi's hand. China is also in a bad spot economically. Exports have shrunk in 11 out of 13 months, and consumers are not spending. Leaders in a bad spot like Xi usually tend to look for a distraction.

2) Unexpected results: A Trump win in the US, a mixed election result in India

The 2024 US election will likely be between two senior citizens: a 76 year old Donald Trump versus a 80 year old Joe Biden. This rerun of the 2020 election has many American voters disappointed about the choices available.

Trump is fighting a raft of legal cases, and running on a platform of revenge against his enemies and closing down the US economy. Despite all that, he is neck-and-neck in the polls with current President Biden. Some even show Trump leading. Many American analysts still think that the election is a likely Biden win. A win for Trump on the other hand, threatens many global efforts the Biden administration has signed onto, including the climate agreement and funding for the Ukraine war.

Back home in India, Modi remains a popular leader as we approach the Lok Sabha elections. But a spike in inflation, or rising worries around issues like unemployment, could dent the BJP's vote bank. Opposition parties have mainly focused on freebies instead of laying out an economic vision. A coalition or opposition win could threaten India's ambitious economic program.

3) Lies, lies and more lies: AI driving scams and misinformation

A fake video that triggers a riot in Tamil Nadu. A scam call to your parents asking for an OTP, telling them that their bank needs to verify their identity. A link in your gmail that when you click on, steals your passwords. There has been a 200% spike in cybercrime in India this year, and 54% of urban Indians say that they have been targeted by scammers. Disinformation and scams have become a problem for the internet and digital payments like UPI.

The rise of AI can can potentially make this even worse. Already, spoofing the voice of a family member using AI has become noticeable in phone scams. OpenAI CEO Sam Altman talked about this last week: “A thing that I’m concerned about is what happens if an AI reads everything you’ve ever written online … and then right at the exact moment, sends you one message customized for you.” If scams and attacks become more high-volume, automated and personalized, frauds can become an even more significant problem for India in the coming year.

Finally, there is of course 4) the placeholder risk. The one that we don’t know about yet. The future is a place full of sharp turns and blind corners. Hopefully 2024 will be less surprising than the past three years. We could all use a break.

Screener: Stocks from industries beating Nifty 50 in year change %, outperforming their industries in 1-year change %

Shipping industry leads in Nifty 50 outperformance in year change %

This screener shows stocks from industries that have beaten the Nifty 50 index in terms of one-year change %. These stocks have also outperformed their industries in 1-year change, return on capital employed (RoCE) and return on equity (RoE).

Industries outperforming the Nifty 50 index include shipping, electrical equipment and construction & engineering industries. These industries outperformed the Nifty 50 index by 91.2, 86.8 and 66.1 percentage points over the past year respectively. Two stocks each represent the other electrical equipment and construction & engineering industries.

Major stocks that appear in this screener are Power Finance Corp, Apar Industries, The Fertilisers and Chemicals Travancore, Rail Vikas Nigam, Mazagon Dock Shipbuilders, Olectra Greentech and Polycab India.

Among the stocks in the screener, Power Finance Corp has risen the most over the past year by 261.7%. This has helped the stock outperform its finance industry by 175 percentage points. The company has also outperformed its industry in terms of return on capital employed (RoCE) and return on equity (RoE). Strong power demand and government PLI schemes have helped power sector financing companies.

Apar Industries has outperformed the other electrical equipment industry in year change % by 114.2 percentage points owing to a 218.1% surge in its stock price over the past year. The stock has been on the rise for the past year thanks to premium product launches and growth in exports. This has helped the company to register a net profit CAGR of 35% over the previous five years.

You can find more popular screenershere.